With a recession more likely following the banking crisis in March, small business owners and those starting new businesses receive some relief from this new tax break that became effective in 2023.

The labor market remains strong, and the number of individuals looking for jobs still outnumber job openings, according to the latest government data. However, the pace of job creation is expected to slow, and layoffs are expected to increase through the end of 2023.

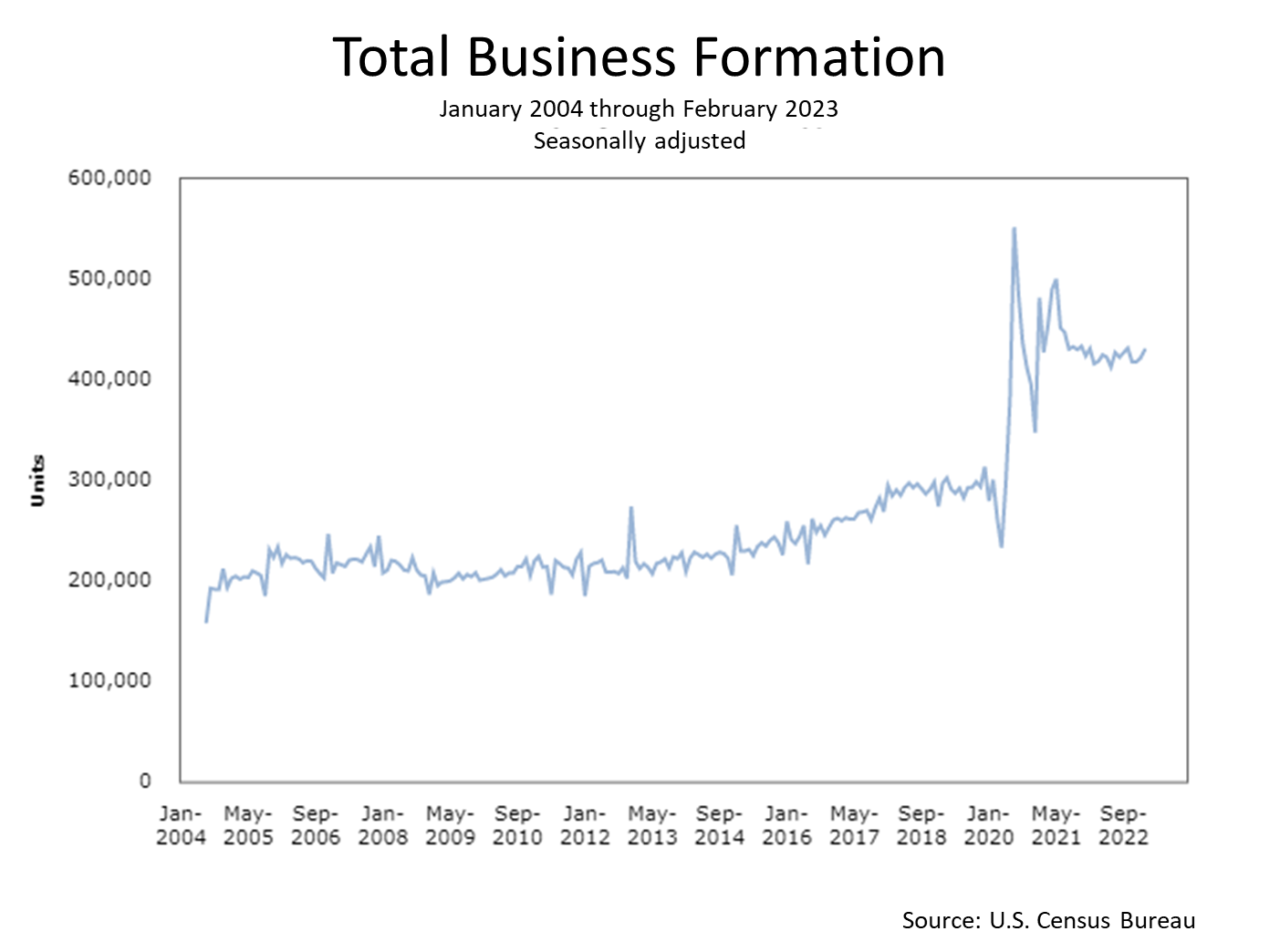

Labor market turmoil that followed the pandemic motivated more individuals to start businesses and enter the “gig economy,” and that trend could be repeated in the months ahead. A big benefit of starting a business is that you can establish your own 401(k) retirement plan, which enables tax-advantaged investment benefits. In addition to providing new business owners a way to save for retirement, a 401(k) provides a way of retaining and attracting employees.

In 2023, small businesses are eligible for a credit on 100% of the cost of starting a qualified retirement plan, up from a 2022 credit of up to 50%. The increased credit does not apply to defined benefit plans.

Setting up an employer plan makes your company a fiduciary, which involves risk and responsibilities that must be considered. Unless you know a lot about retirement plans or are committed to spending hours researching the tax, legal and fiduciary issues involved, finding a low-expense plan provider with a broad array of investment choices may require professional guidance.