Tax hikes are an accident waiting to happen.

The likelihood of higher tax rates suddenly makes converting traditional IRA investments into Roth IRAs more important.

Higher taxes are widely anticipated, and our job as financial professionals is to alert you to what’s ahead. Before the tax wreck of 2021, please brace yourself by planning now.

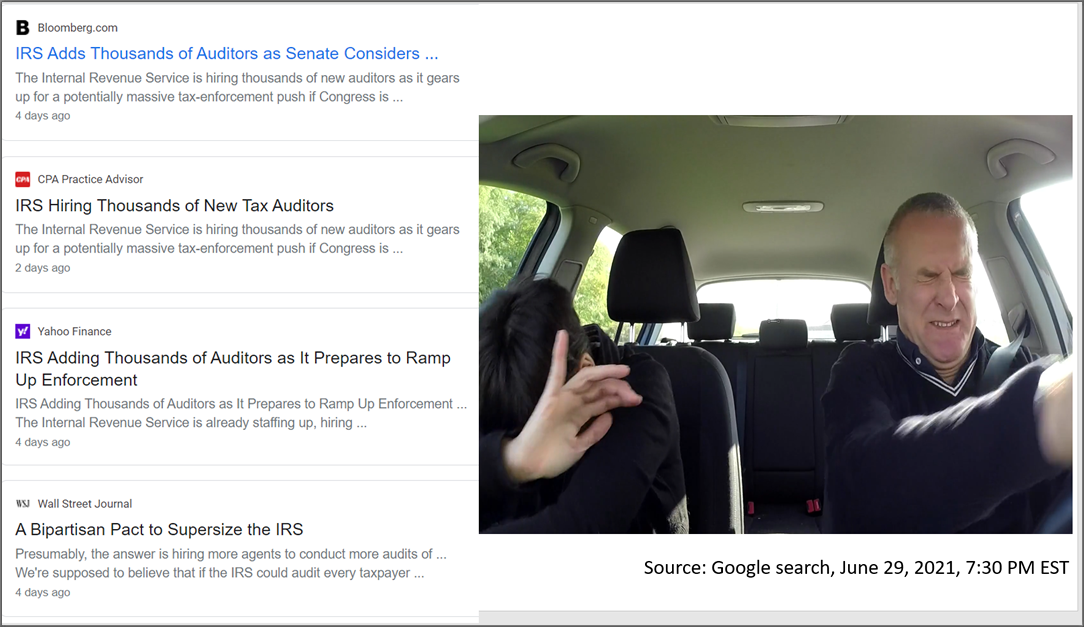

The IRS is hiring more tax auditors and President Biden has proposed tax hikes on high income and high net-worth individuals. Avoid the worst effects of the shift in federal tax policy by planning. Keep your eyes wide open and be prepared for what’s about to hit.

If your retirement assets are in IRA accounts, in the event of a stock market selloff, the drop could present a tax-saving opportunity. The likelihood of higher tax rates may make converting traditional IRA investments into Roth IRAs suddenly more important.