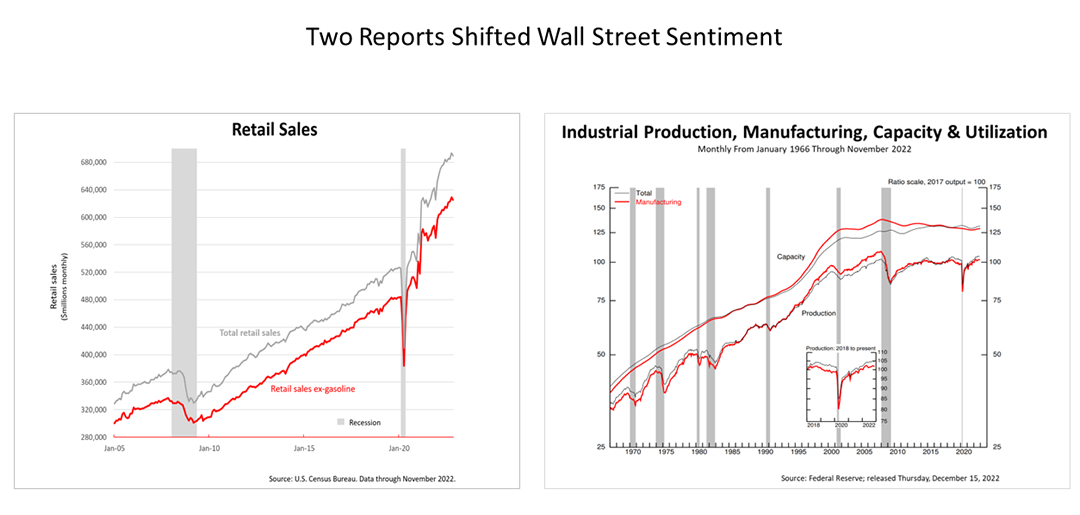

Wall Street sentiment quickly shifted Thursday and Friday. After November retail sales data from the U.S. Census Bureau and a Federal Reserve System report on industrial production were released Thursday morning, a two-day stock market plunge ensued.

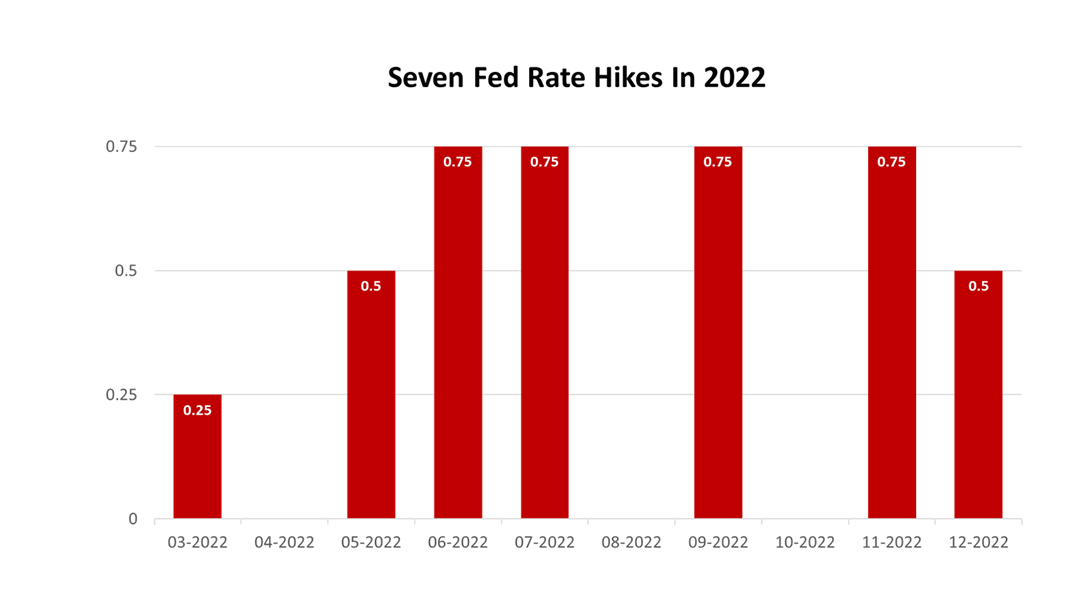

The two bad economic data surprises came after the Federal Reserve Board chair, Jerome Powell, said at a press conference on Wednesday that policymakers had voted at their December 13-14 meeting to raise the central bank’s lending rate by a half-point.

It was the Federal Reserve Bank seventh interest rate hikes in the last 10 months. “We think that we'll have to maintain a restrictive stance of policy for some time,” Mr. Powell said at the 45-minute press conference. “Historical experience cautions strongly against prematurely loosening policy.”

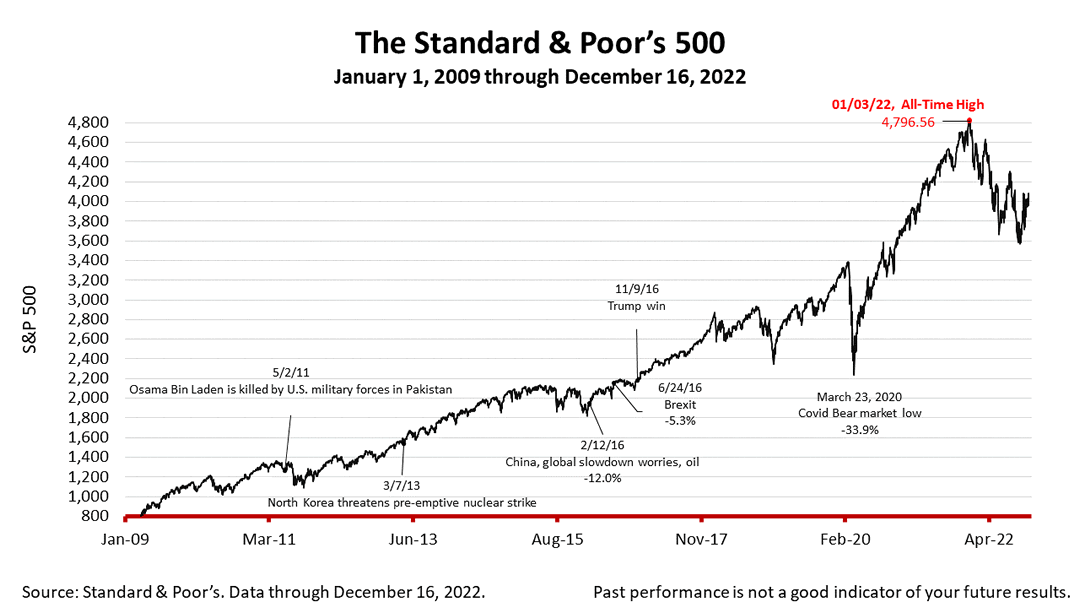

Wall Street initially reacted positively Wednesday after the Fed chair’s remarks. That changed on Thursday.

November retail sales, excluding gasoline, increased by +6.4% in the 12 months through November. However, after inflation, as measured by the consumer price increase index, retail sales were only up four-tenths of 1%. Eighty-eight percent of retail sales are goods, as opposed to services, and retail sales drive 30% of total U.S. gross domestic product. Meanwhile, U.S. industrial production declined by two-tenths of 1% in November, and manufacturing output decreased six-tenths of 1%.

The bad data reports were the proximate cause of the shift in sentiment. They made more Wall Street investors doubt whether the Federal Reserve could engineer a soft landing – tightening monetary policy while causing only a slight recession in 2023 or, possibly, no recession at all.

After falling -2.5% on Thursday, the S&P 500 stock index lost another -1.1% on Friday, closing the week at 3,852.36. Down -2.08% from a week ago, the index is up +72.18% from the March 23, 2020, bear market low and 19.68% lower than its January 3rd all-time high.