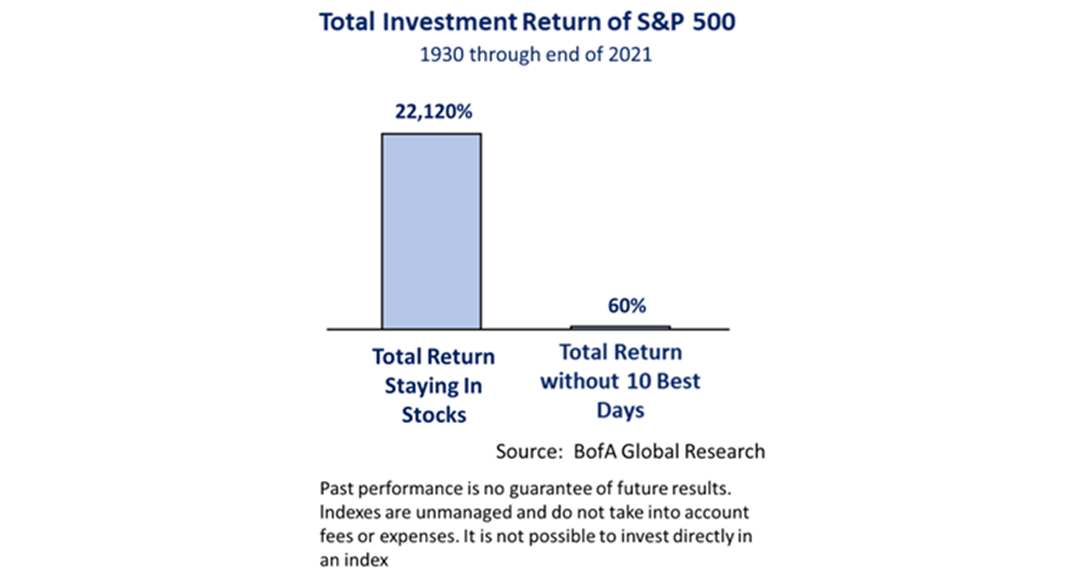

Everyone says trying to get in and out of the stock market is unwise, but this bar chart makes clear why.

Missing the 10 best days in of every decade since 1930 through the end of 2021 would have resulted in a total return of 60%, while staying in the Standard & Poor’s 500 index for the entire 91 years would have resulted in a total return of 21,120%.

To be clear, missing the 10 best days in the stock market every decade in the 91-year period ended in 2021 resulted in a fraction of the return of staying in stocks, as measured by the S&P 500.

“Markets can snap down or snap back so fast and so unpredictably, that even if you have a good sense of where the market is going, it is extraordinarily difficult to get the timing right,” says financial historian Mark J. Higgins. “And, you have to get it right twice, once on the way out and once on the way in.”

At this moment in financial history, with stocks in a bear market and widely expected to drop further in the months ahead, this is a reminder that trying to time stock market peaks and troughs is unwise.