The window of opportunity to act before taxes are hiked is about to close.

At Tuesday’s State of the Union message, President Biden will likely talk about his plan for higher taxes, which he campaigned on. The details of the President’s plan to end the step-up basis on inheritances is perhaps the most significant change.

Other tax proposals Mr. Biden campaigned on include a sharp reduction in the favorable treatment on profits from investments, a new top tax rate of 39.6%, and expansion of the 12.4% Social Security tax if you earn more than $400,000 in adjusted gross income annually..

It’s possible the tax hikes about to be negotiated in Congress could be retroactive, which would make planning maneuvers fruitless. That’s unlikely, however, but the window of opportunity to act is about to be closed.

If your annual income is higher than $400,000 or your family has an estate worth more than $3.5 million, please let us know if you have questions.

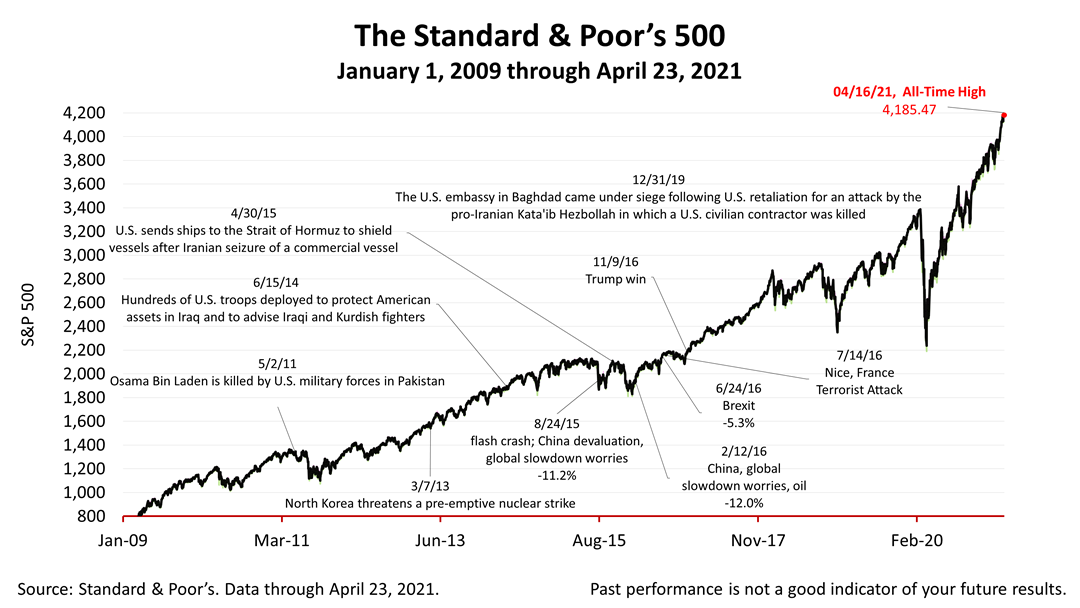

Despite details of the coming tax hikes on wealth and investments emerging in press reports this past week, the Standard & Poor’s 500 stock index closed Friday at 4,180.17 – a gain of +1.09% from Thursday and down -0.12% from last week, ending a four-week winning streak. The index is up +60.54% from the March 23rd bear market low.