Federal Reserve Chairman Jerome Powell today said the United States has made progress in managing inflation as well as employment, marking the start of a new phase in the central bank’s policy for achieving its dual mandate of full employment and price stability.

“We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance,” Mr. Powell said. “My view is that the ‘substantial further progress’ test has been met for inflation.”

Before today’s speech, Mr. Powell had said the Fed had made progress with the employment situation in the aftermath of the Covid-induced shortest, steepest recession in history. Adding that substantial progress was made on inflation was news.

Mr. Powell’s speech was delivered virtually at a gathering of central bankers, finance ministers, academics, and financial market participants from around the world. The symposium which is hosted by the Kansas City Federal Reserve Bank in Jackson Hole, Wyoming, was originally planned as a live event, but was canceled at the last moment and streamed online because of growing fears of the spread of the Delta Variant.

Media coverage of the speech focused on how Mr. Powell’s remarks made it almost certain that the Fed would curb its “quantitative easing” policy of purchasing long-term bonds before the end of this year. But after reading a transcript of Mr. Powell’s remarks, the more important takeaways were the details, clarity, and transparency of the Fed chairman’s remarks.

Here’s are highlights of Mr. Powell’s remarks, which were well-received in the stock market.

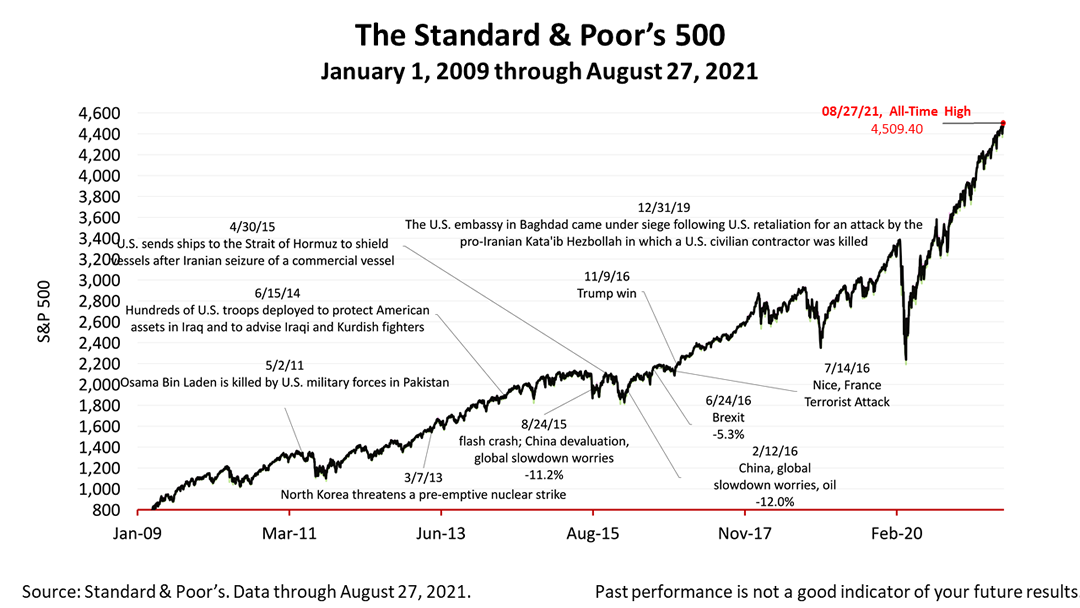

The Standard & Poor’s 500 stock index closed this Friday at an all time high of 4,509.40. The index gained +0.88% from Thursday and closed +1.51% in value from last Friday. The S&P 500, on a total-return basis, is up +67.35% from the March 23, 2020, bear market low.