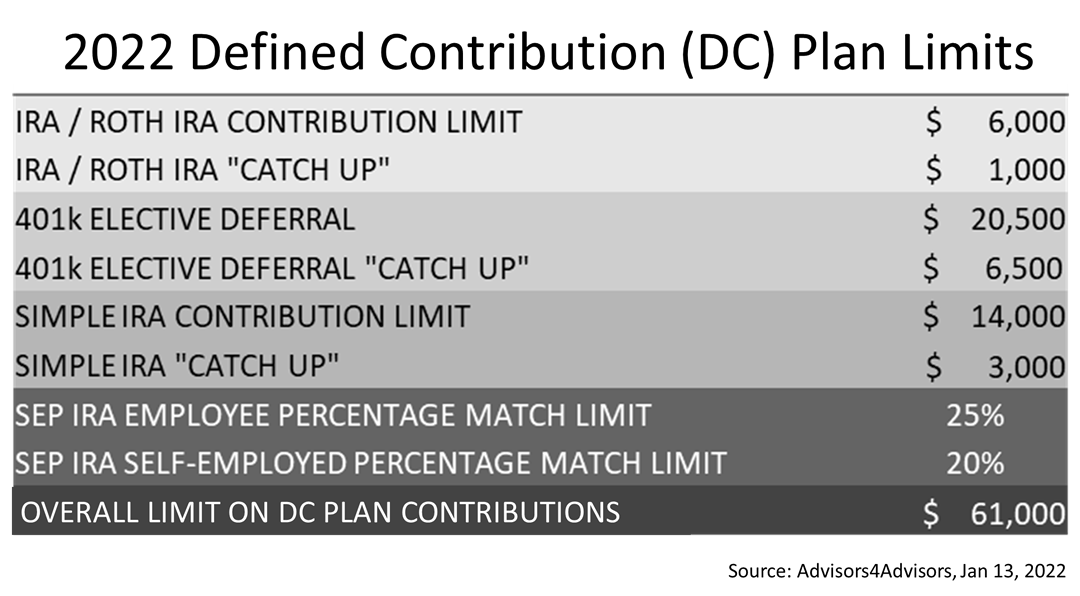

If you’re a pre-retiree who needs to catch up on retirement saving, or if you don’t need the income from some of your IRA or 401(k) accounts and want to leave them for your children, here are the limits on contributions to federally qualified defined contribution retirement plans for 2022.

The overall limit on contributions to defined contributions plans in 2022 is $61,000. That’s up $3000 from 2021. For baby boomers in the workforce trying to a create a larger nest egg, DC plans are a key option for accelerating savings in federally qualified retirement accounts.

You can contribute up to $20,500 to a 401(k) plan now, $1000 more than in 2021. The contribution limit on SIMPLE IRAs is $500 higher than in 2021, rising to $14,000 in 2022.

Architects, engineers, physicians, lawyers, dentists, and other professionals all live in this world with professional liability. An LLC or corporate entity does not limit their exposure. But federally qualified DC plans do protect those assets from creditors, including lawsuit judgments resulting from a malpractice lawsuit. The protection from liability lawsuits and other creditors generally begins a year after you make a contribution to the plan. Thus, it is best to make DC plan contributions as early in the year as is feasible.