Executive Summary:

- Pension discount rates continue to move higher following the movement in US Treasury bonds resulting in pension plans obtaining higher funding ratios.

- The economy may well be in the midst of a recessionary session, independent of the definition used to determine its official existence.

- Capital markets have responded by exhibiting mostly negative returns for the first half of 2022.

State of the Markets

Over the second quarter, the capital markets have migrated from a focus on the pandemic and geopolitical risks to an assessment of how aggressively the Fed will be forced to move in an effort to advert even higher inflation. Having raised rates three times over the past six months, with many more hikes expected later this year, it seems the Fed may be required to take on greater risk of incurring a recession to tame the unsustainable level of current inflation. Often this sort of Fed action results in negative market returns and precedes a defined recession. Both equity and fixed income markets have already generated some of the worst first half performances in history. For example, long treasuries have posted a negative 21.8% return, the S&P 500 has declined 16.1%, intermediate Treasuries are 8.3% lower, and the U.S. Aggregate Bond Index is 10.4% lower on a year-to-date basis. Chairman Powell has been amplifying his rhetoric regarding inflation and the markets have reacted in a predictable manner. A recession may soon follow if we’re not already in the midst of one now.

Our expectation is that inflation will peak sometime between now and the end of the year. At which time, rates will have increased significantly on everything from mortgages to car loans, creating an increased toll on consumers’ finances resulting in lower aggregate demand. As demand falls, so should inflation. Improvement in many supply chain mechanics will assist with reduced demand and subsequent lower inflation. Although for the decline to occur, it won’t require a completely “healed” supply chain. In fact, that may take several years. Only incremental improvement in certain key sectors of the economy will suffice to take some of the stress off the pricing of certain goods. Consumers have already modified their behavior (lower demand, substitutes, etc.) to reduce expenses, and we believe they will continue to do so. The combination of reduced demand and improving supply will result in inflation peaking over the near term. In contrast, if our expectation doesn’t materialize, the Fed will be forced to consider initiating even larger rate moves which will continue to diminish the equity markets and risk a potentially more severe recession.

Pension Plan Index Update

Pension funding levels are a crucial figure, used to determine the financial requirements of a pension plan which can be dissected broadly into asset values and liability values. Asset values can be thought of as a culmination of an equity component and often to larger extent, a fixed income component. The portion that’s attributable to bond values is driven by the level of interest rates which is a component that relates strongly to the valuation of the liabilities. In both the numerator and denominator, interest rate movements will dictate a majority of the funded status volatility. It’s for this very reason that we focus on the level and movement of interest rates so intently within this document.

Pension funding levels are a crucial figure, used to determine the financial requirements of a pension plan which can be dissected broadly into asset values and liability values. Asset values can be thought of as a culmination of an equity component and often to larger extent, a fixed income component. The portion that’s attributable to bond values is driven by the level of interest rates which is a component that relates strongly to the valuation of the liabilities. In both the numerator and denominator, interest rate movements will dictate a majority of the funded status volatility. It’s for this very reason that we focus on the level and movement of interest rates so intently within this document.

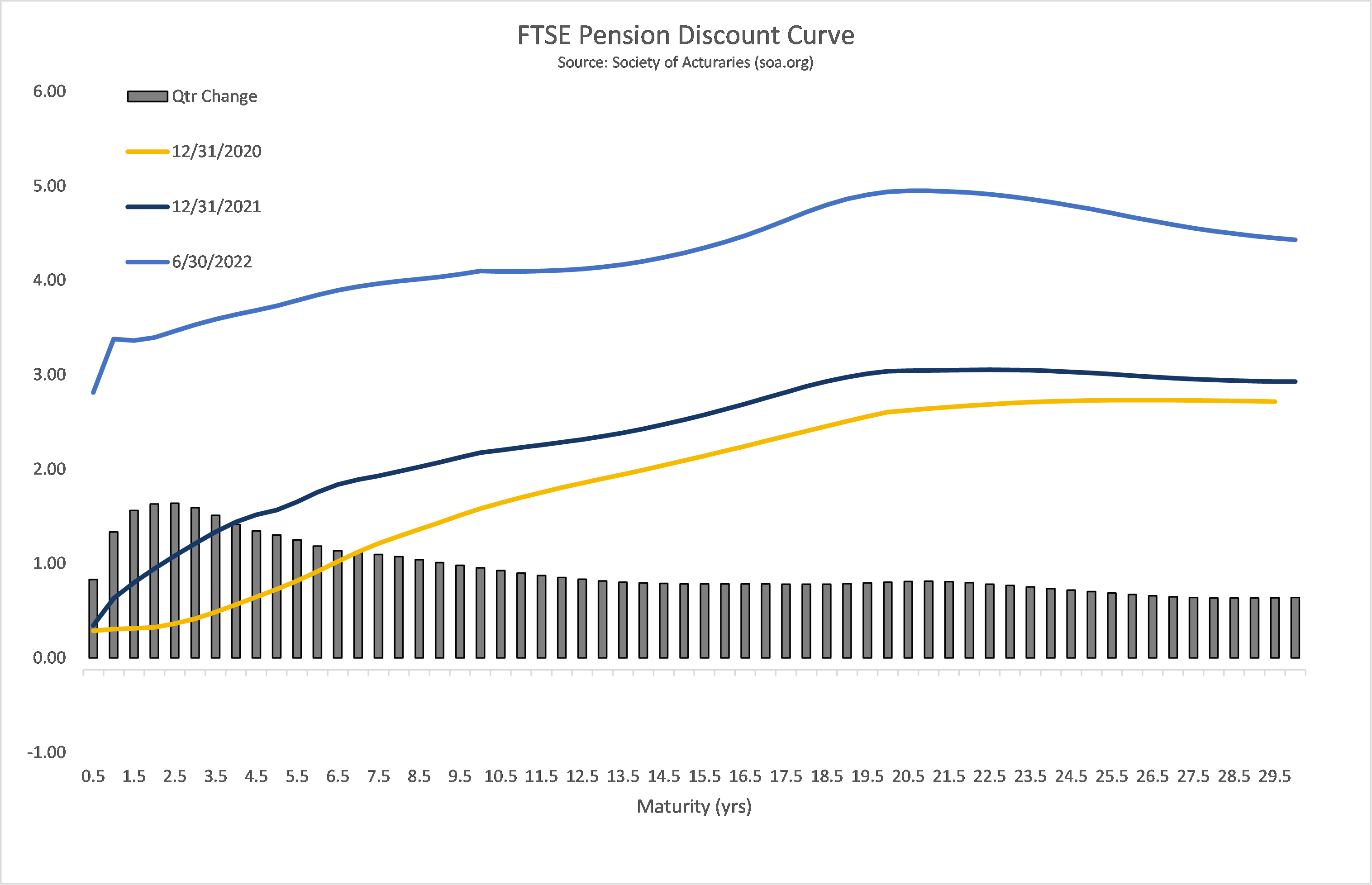

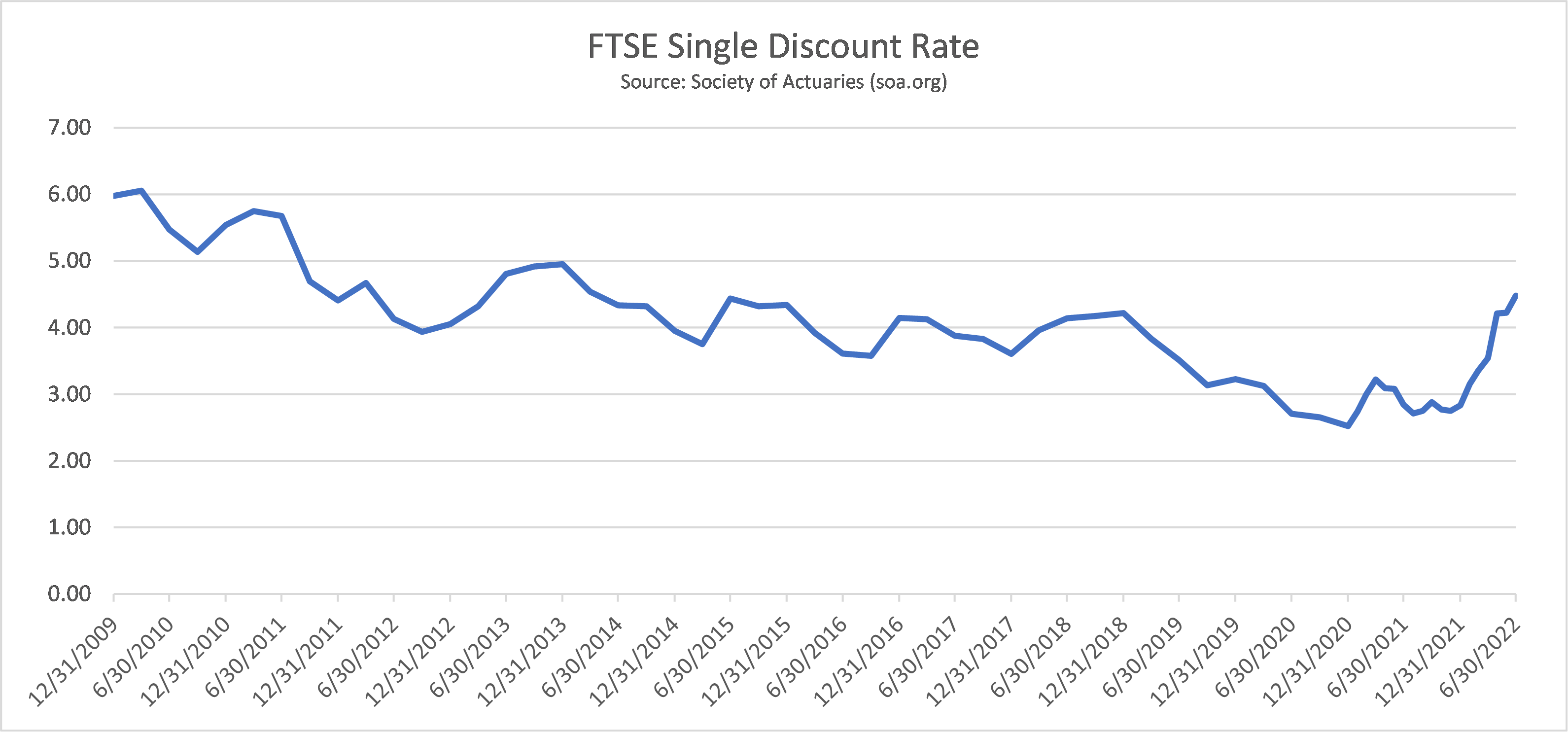

Previously we pointed out that rates had moved significantly higher during the first quarter, thereby decreasing the value of both fixed income assets and the value of liabilities. It’s this matching principal which we strive to achieve with our Asset Liability Immunization Strategy (ALIS). On average, that movement (using the FTSE discount curve) amounted to 99 bps. Over the second quarter, the trend continued albeit to an average which amounted to 92 bps. In total the year-to-date 6/30 movement of any maturity year on the FTSE curve totaled 191 bps. This is significant because the YTD change has now nearly doubled the value of any single rate, which began the year at 237 bps. As a result of this impact, we are now seeing many plans with gains in their funding ratio on the order of nearly 10% through the first half of the year. In contrast to this rate dynamic is that of public pension plans which often discount their liabilities by a long-term rate of return. Their rate is not as volatile as either the treasury curve or common discount curves such as the FTSE because they are derived from an expected average rate of return rather than current levels that move over time. We have recently noticed several articles where public plan pension funding levels are being examined for having some of the worst progress in funding since the great depression. What’s interesting is the focus on asset returns to the exclusion of how the liabilities are being valued. Examining poor asset returns, especially with the returns we’ve weathered in 2022, while keeping the single discount rate constant needs to be understood without exclusion and has essentially lowered the numerator in the equation and kept the denominator stable resulting in a steep reduction in the ratio. We are not saying this calculation is incorrect but rather that the dynamics need to be understood. The results shouldn’t be used to compare to private plan funding performance without understanding the mechanics of each entities calculation.

Previously we pointed out that rates had moved significantly higher during the first quarter, thereby decreasing the value of both fixed income assets and the value of liabilities. It’s this matching principal which we strive to achieve with our Asset Liability Immunization Strategy (ALIS). On average, that movement (using the FTSE discount curve) amounted to 99 bps. Over the second quarter, the trend continued albeit to an average which amounted to 92 bps. In total the year-to-date 6/30 movement of any maturity year on the FTSE curve totaled 191 bps. This is significant because the YTD change has now nearly doubled the value of any single rate, which began the year at 237 bps. As a result of this impact, we are now seeing many plans with gains in their funding ratio on the order of nearly 10% through the first half of the year. In contrast to this rate dynamic is that of public pension plans which often discount their liabilities by a long-term rate of return. Their rate is not as volatile as either the treasury curve or common discount curves such as the FTSE because they are derived from an expected average rate of return rather than current levels that move over time. We have recently noticed several articles where public plan pension funding levels are being examined for having some of the worst progress in funding since the great depression. What’s interesting is the focus on asset returns to the exclusion of how the liabilities are being valued. Examining poor asset returns, especially with the returns we’ve weathered in 2022, while keeping the single discount rate constant needs to be understood without exclusion and has essentially lowered the numerator in the equation and kept the denominator stable resulting in a steep reduction in the ratio. We are not saying this calculation is incorrect but rather that the dynamics need to be understood. The results shouldn’t be used to compare to private plan funding performance without understanding the mechanics of each entities calculation.

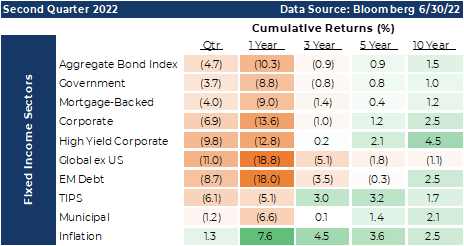

Speaking of the asset returns, let’s take a closer look at some keys sectors of the capital markets over the recent past. Over the quarter, and for that matter YTD, sectors of the bond market which underperformed were those which contained heightened levels of risk. High-yield corporate, Emerging Market Debt and even Corporate Investment Grade, both domestic and international, saw headwinds because of market participants repricing credit risk to accommodate for future uncertainty. Corporate credit spreads as measured by the ICE US Corporate Index OAS have experienced 66 bps of widening in the first half. Over the same time period, inflation considerations have caused the treasury yield curve to flatten. The spread between the 5-year treasury and the 30-year treasury measured only 5 bps at quarter end. This is evidence of a market that is questioning future economic growth.

Speaking of the asset returns, let’s take a closer look at some keys sectors of the capital markets over the recent past. Over the quarter, and for that matter YTD, sectors of the bond market which underperformed were those which contained heightened levels of risk. High-yield corporate, Emerging Market Debt and even Corporate Investment Grade, both domestic and international, saw headwinds because of market participants repricing credit risk to accommodate for future uncertainty. Corporate credit spreads as measured by the ICE US Corporate Index OAS have experienced 66 bps of widening in the first half. Over the same time period, inflation considerations have caused the treasury yield curve to flatten. The spread between the 5-year treasury and the 30-year treasury measured only 5 bps at quarter end. This is evidence of a market that is questioning future economic growth.

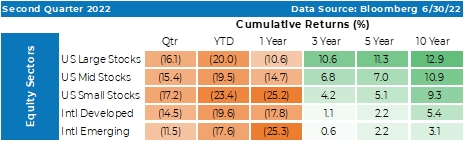

Equity returns exhibited the same apprehension with negative absolute returns across the various sectors. Consistent with the bond market, areas of greater risk produced larger negative returns. Fears of the possibility that the FOMC won’t be able to control inflation, a change in consumer demand (which we’ll cover in more detail in later sections) and pricing in a higher probability of a recession are all valid reasons for the market losses. The sectors with higher valuations such as consumer discretionary, information technology, and communication services lost more ground as growth estimates were lowered. At the same time, value outperformed growth across both domestic and international markets.

Equity returns exhibited the same apprehension with negative absolute returns across the various sectors. Consistent with the bond market, areas of greater risk produced larger negative returns. Fears of the possibility that the FOMC won’t be able to control inflation, a change in consumer demand (which we’ll cover in more detail in later sections) and pricing in a higher probability of a recession are all valid reasons for the market losses. The sectors with higher valuations such as consumer discretionary, information technology, and communication services lost more ground as growth estimates were lowered. At the same time, value outperformed growth across both domestic and international markets.

Economic Outlook

We believe the current job environment will be less impactful on inflation than would normally be considered. According to the Bureau of Labor Statistics, in April, the largest contributor to inflation was made up of services. Services can often be substituted, or they can simply be delayed. Dining out is good example of a service where if the cost increases too much, or the quality of the experience declines too far, the consumer can choose alternatives like deciding to make their meals at home. Most of the recent wage inflation has been focused on lower-quartile earners, largely in the service sector of the economy. If economic sentiment softens and consumers change behaviors, the recent advancement in wage inflation may quickly reverse.

Even though the layoff rate in May was near a historical low of 0.9% (Source: US Labor Department), industries most closely impacted by rising interest rates and subsequent higher costs are starting to announce plans to cut staff. Among the early sectors to feel the pinch are mortgage lenders, home builders, financial institutions, and some commodity-centered companies. A few recently released data points exhibit how the nearly two jobs per job seeker could quickly become one job or less per job seeker. Job placement firm Challenger, Gray, & Christmas indicated that as of June, planned layoffs increased to 32,517, a 57% jump from the month prior, and the highest number since February of 2021. Manufacturers’ overtime hours have declined in the past three months, the longest downward streak since 2015. Perhaps more telling is the sentiment of both workers and employers. In June, a survey of more than 1,000 workers performed by staffing company Insight Global, found that nearly 80 percent of US employees fear losing their job during a potential recession. The same survey validated those fears by reporting that 90% of the managers surveyed said they would likely have to lay off employees during a recession. Firms like Netflix, Tesla, and Meta have announced plans to trim their workforce, and these announcements are happening before the official declaration that the U.S. is in a recession.

"Away from the employment environment, there are many influences which can push the economy into a stalled state..."

Away from the employment environment, there are many influences which can push the economy into a stalled state such as corporate and consumer sentiment which has lately collapsed. The June University of Michigan Conference Board survey of consumer sentiment fell to a record low, and their gauge of expected business conditions is at one of the lowest readings going back to 1978. It’s widely believed that declines of 10 percentage points or more in either of the University of Michigan Conference Board surveys are predictors of recessions with evidence of that fact going back to the 1980s. The headline number is down by 30 percentage points this year. And so, it’s no surprise that near the end of the quarter, Goldman Sachs economists put the probability of a recession in the next year at 30% while a Bloomberg model placed the probability at 38%. In the near term, the Atlanta Fed’s GDPNow indicator may hold the most creditability. Despite its volatility, it has been an accurate predictor of GDP growth during a current quarter. At the moment, GDPNow sees the second quarter running at a contraction of 2.1%. Since the model’s inception in 2011, its average error has been just 0.3%. In concert with the first quarter’s contraction of 1.6%, the current GDPNow measure suggests that we are currently in a recession if we define a recession as two consecutive quarters of GDP contraction.

Sentiment is down, workers are questioning the employment landscape, and it appears that we are in a recession, but the economic headwinds don’t stop there. Although elevated fuel costs are weighing down both consumers and corporations alike, other operating challenges may start to impact corporate profitability which we expect will pull down earnings, resulting in even more negative investment performance. Specifically, the strong US Dollar is being mentioned by companies including Costco, Microsoft, Salesforce, and Hewlett-Packard as an operating challenge and another reason for reduced profitability. For companies with overseas sales, a strong dollar makes US products more expensive to foreign buyers, requiring more of their foreign currency to buy US goods. As we surmised earlier, when demand sours, look for abrupt production, cost containment, and investment changes on the part of corporations.

"It appears that the housing market is set for a meaningful pause in activity."

We also expect turmoil in most sectors that are exposed to rising borrowing costs. It appears that the housing market is set for a meaningful pause in activity. According to Redfin, in June nearly 60,000 home sales fell through, which was roughly 15% of the transactions for the month. The primary factors impacting affordability and transaction trends has to do with the fact that mortgage rates are nearly double what they were at the start of the year, and according to an S&P CoreLogic Case-Shiller housing price index, prices are up approximately 20% as compared to last year. Sales of new homes fell in April by the most in nine years, decreasing by 16.6%. A lot of economic activity is generated by new home construction and sales of homes, so marginally this will act as a weight on domestic growth.

Retailers are also feeling the pinch of higher energy prices, elevated staffing costs, and changing consumer behavior. In May, both Walmart and Target guided earnings estimates lower. Walmart said that rising food prices were forcing consumers to spend more on essentials than expected. Walmart’s inventories of $61.2 billion at the end of the first quarter were about a third higher than a year prior and as of April 30, Target was carrying $15.1 billion of inventory, about 43% more than a year earlier. It seems retail is poised to be a sector that could add to the economic drag from both the perspective of profitability and contribution to the job market.

"Our expectation is that a recession is in the cards..."

Our expectation is that a recession is in the cards, but the same nimble Fed that ended Quantitative Easing and then tightened and announced Quantitative Tightening (QT) in a matter of weeks could cease aspects of the tightening programs if market liquidity, risk spreads, or elements of the Fed’s dual mandate dictate. As the Fed continues to raise short-term rates, the yield curve will remain flat, although depending on the degree of recessionary fears, we wouldn’t be surprised to see a substantial inversion. As the probability of a recession and its magnitude are thought to be understood by the market, we expect a downward trend in the less manipulated segments of the bond market to follow. 10-year Treasury yields should continue to flutter around 3.0% before drifting lower at the end of the year.

Fiscal spending seems to be shrinking, especially following the mid-term elections where a form of gridlock will be the base case. Business and consumer sentiment is in collapse. Major industries are facing numerous headwinds and turning an eye toward cost savings. The Fed’s fear of not breaking inflation is palpable. How does this not translate into a recession and eventually lower bond yields? In our estimation, the idea of achieving full-employment while at the same time experiencing a pain-free end to our inflation situation is all but wishful thinking.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.

.png)