Executive Summary:

- Many recessionary signals are present in the economy, including an inverted yield curve, restrictive monetary policy, falling leading economic indicators, and a decline in year-over-year Gross Domestic Income (GDI).

- Gross Domestic Product (GDP) has yet to indicate negative growth although it tends to track GDI, which has never declined year-over-year without a preceding or coincident recession.

- The third quarter of 2023 could see tight monetary policy colliding with loose fiscal policy in the midst of nonuniform economic results which could make a soft landing difficult to achieve.

State of the Markets

Interest rates have continued along the rising path which they began to exhibit in early 2022, with the yield on the 2-year Treasury note having increased by over 0.45% in 2023 to nearly 5.0% as of recent measurement. Similar changes have occurred across the yield curve with differing tenures moving anywhere from +0.30 - 1.35%, despite the continued inverted curve shape. As an example, the year-to-date movement in the 2-year Treasury reflects the steady increase in the fed funds rate as well as expectations of additional rate hikes. At the same time, the increased yield in the long end of the curve has been priced to reflect long-lasting expectations for inflation and economic growth. Simultaneously, inflation measures have fallen steadily while economic growth figures have remained subdued at around 2.3%. The long end of the curve tends to have a strong correlation to future inflation and domestic growth expectations. Recall headline CPI has fallen from its long-term high of 9.1% in June of 2022 to 3% as of this June. We expect that large monthly inflation prints will soon come to an end and that future incremental declines will be harder to produce as expectations adjust.

Near term, we assume base effects will produce a market sentiment that suggests inflation is behaving, followed by a reversal that head-fakes the market into thinking that the Fed is insufficiently fighting inflation. Fiscal policy may also soil our thought process, especially if student loan efforts turn into forbearance that would equate into a stimulus of between $144 and $400 billion of debt forgiveness. The second half of this year seems to be the timeframe where liquidity and financing become scarce, risk spreads widen, and broad risk appetites are recalibrated. Leading up to the stress, we have a bias toward higher quality and increased liquidity. 2023 is shaping up to be the year of planning, adjusting, and constructing the portfolio into a higher yielding environment which we expect will continue for the intermediate term.

ACG’s research suggests that owning higher quality bonds with longer duration near the conclusion of a Fed tightening cycle historically has produced some of the more compelling forward returns as compared to other return factors. Offsetting this opportunity is the fact that risk spreads are currently diminished. We think spreads will adjust higher from their current state which is approximately a full standard deviation low as compared to the relationship over the past decade by using an index of “A” rated corporates with 10-year maturities. If this correction occurs, we will likely be enthusiastic about fully expressing our bias for high-quality long-duration assets. In the meantime, a barbell strategy of some short, liquid holdings combined with longer duration positions should provide investors with a portfolio that has strong earnings power and the ability to be opportunistically nimble over the remainder of 2023.

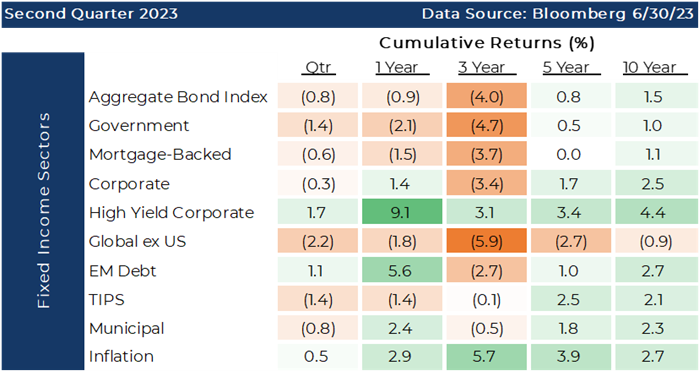

The Federal Open Market Committee (FOMC) paused in June with their succession of ten rate hikes, only to increase again at the first meeting in July which we feel is further evidence to validate that we’re nearing the end of their rate hiking cycle. Over the second quarter, bonds produced mostly negative returns except for the riskiest of bond sectors, as rates rose, and credit spreads compressed leading to spread assets outperforming government securities. Over the Covid era, including the prior three years, bond indices have produced similar negative returns. As inflation continues to retreat from its highs, cumulative performance measures maintain positive growth rather than exhibiting any sign of a deflationary environment. Akin to the performance of equity assets, risky sectors of the bond market such as high yield and emerging markets have performed extremely well on a rolling 1-year basis.

The Federal Open Market Committee (FOMC) paused in June with their succession of ten rate hikes, only to increase again at the first meeting in July which we feel is further evidence to validate that we’re nearing the end of their rate hiking cycle. Over the second quarter, bonds produced mostly negative returns except for the riskiest of bond sectors, as rates rose, and credit spreads compressed leading to spread assets outperforming government securities. Over the Covid era, including the prior three years, bond indices have produced similar negative returns. As inflation continues to retreat from its highs, cumulative performance measures maintain positive growth rather than exhibiting any sign of a deflationary environment. Akin to the performance of equity assets, risky sectors of the bond market such as high yield and emerging markets have performed extremely well on a rolling 1-year basis.

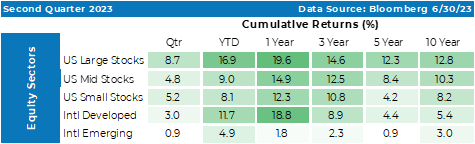

Equity indices continued to evidence their strength of performance since the end of last year. The S&P 500, as an example, rose nearly 9% in the quarter achieving a YTD return of almost 17%. A significant portion of the return was concentrated to only a handful of sectors which included information technology, consumer discretionary and communication services which further points towards a consumer that is beginning to recognize a recovery. Additionally, the trend of value stocks outperforming growth has been broken in 2023. International stocks showed signs of a reversal over the first half, including both developed and emerging markets, although emerging economies to a lesser extent as supply chain shifts began to be configured to a more on-shore approach rather than off-shore construction.

Equity indices continued to evidence their strength of performance since the end of last year. The S&P 500, as an example, rose nearly 9% in the quarter achieving a YTD return of almost 17%. A significant portion of the return was concentrated to only a handful of sectors which included information technology, consumer discretionary and communication services which further points towards a consumer that is beginning to recognize a recovery. Additionally, the trend of value stocks outperforming growth has been broken in 2023. International stocks showed signs of a reversal over the first half, including both developed and emerging markets, although emerging economies to a lesser extent as supply chain shifts began to be configured to a more on-shore approach rather than off-shore construction.

Pension Market Update

Interest rates used to discount future liability cashflows modestly increased over the second quarter allowing for further declines in the present value of pension liabilities. The net effect when measured relative to asset returns was a slight increase in the second quarter of pension funding levels to 102.2% as measured by the Milliman 100 Pension Funding Index. The average plan in the index experienced asset growth of 0.97%, offset by liability declines of 2.0% which resulted in an increase in funded status of 2.1% on a quarter-to-date basis and 0.3% on a year-to-date basis.

Cash balance plans, dependent on their mix of equities and fixed income, continued to move ahead with overcoming the negative performance experienced in calendar year 2022. Plans that have embraced individual short bonds continue to perform well as their purchased yields have provided positive effects which when combined with 2023 equity returns, allow for positive outcomes to their interest crediting rates and implications on the funding levels.

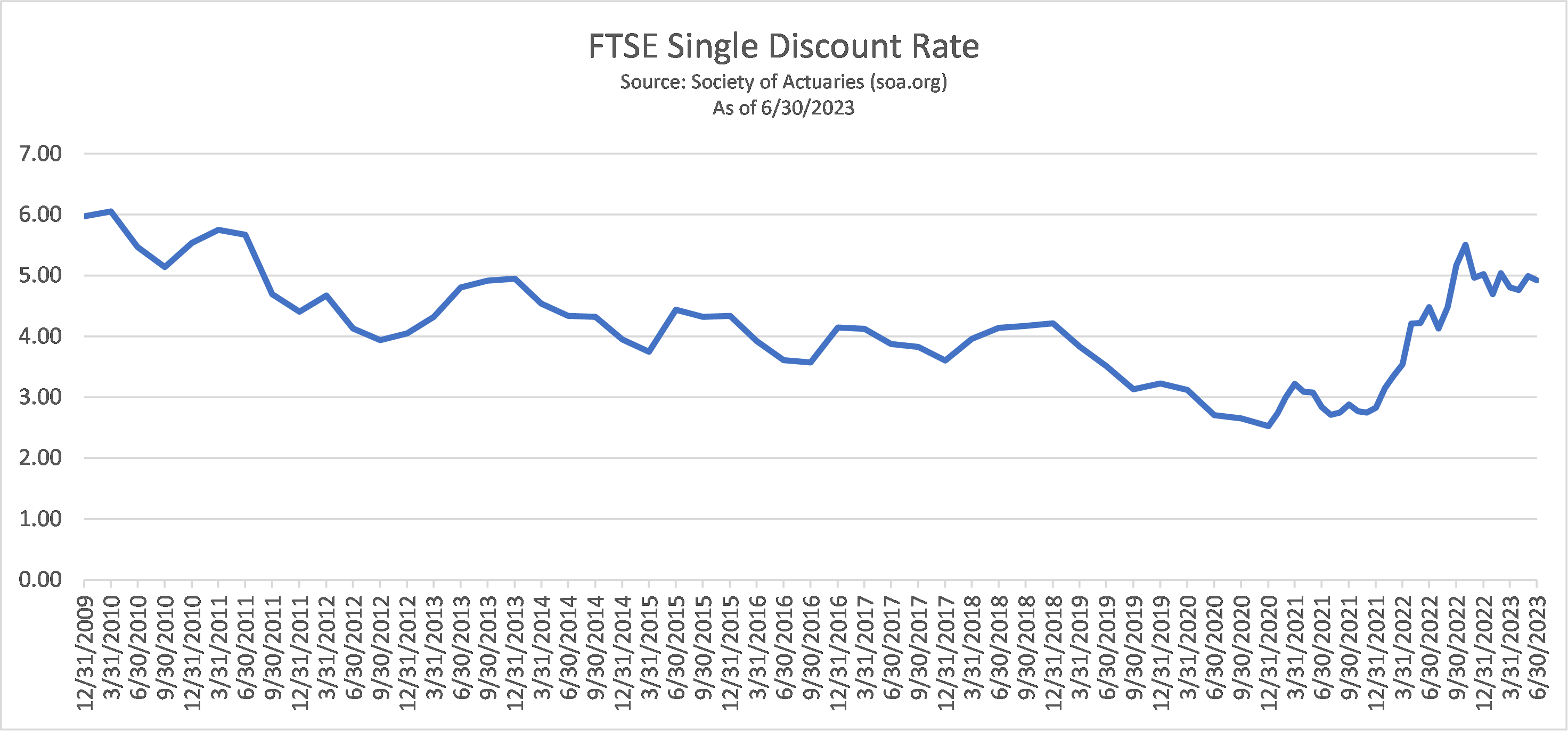

Evidenced by the enclosed graph, the significant rise in interest rates experienced in 2022 has had a tremendous impact on the value of pension liabilities with the average plan experiencing a decline of 22.6% in the prior year, as opposed to 2023 where discount rates have remained stable, albeit extremely short, interest rates have risen as much as 0.87%. The offset to discount rate movements is the return on pension assets, and while 2022 was a disastrous year for asset returns, 2023 has been complementary at least through the first half. It’s in these volatile times of asset performance and interest rate risk that a liability driven strategy such as our Asset Liability Immunization Strategy (ALIS) becomes vital. The ability to match risks between both sides of the pension ledger offers a degree of financial stability to both plan sponsors and participants.

Evidenced by the enclosed graph, the significant rise in interest rates experienced in 2022 has had a tremendous impact on the value of pension liabilities with the average plan experiencing a decline of 22.6% in the prior year, as opposed to 2023 where discount rates have remained stable, albeit extremely short, interest rates have risen as much as 0.87%. The offset to discount rate movements is the return on pension assets, and while 2022 was a disastrous year for asset returns, 2023 has been complementary at least through the first half. It’s in these volatile times of asset performance and interest rate risk that a liability driven strategy such as our Asset Liability Immunization Strategy (ALIS) becomes vital. The ability to match risks between both sides of the pension ledger offers a degree of financial stability to both plan sponsors and participants.

Likewise, the FTSE Single Discount Rate can be utilized to understand rate movements more fully. At any one point in time, the level is measured as the average rate across the entire maturity curve. Not since 2013 has this rate been higher, which translates into an opportunity for plan sponsors and advisors to retain the decrease in liability values by matching the interest rate risk in both the assets and liabilities to a precise degree. On a rolling one-year basis the rate has increased 0.44% while on a two-year rolling basis it has increased 2.08%. Implementing the first phase of de-risking by utilizing a strategy such as ALIS is paramount at this stage in the business cycle as the FOMC begins to wind down their rate hiking exercise. Commonly the second phase is thought of as a Lump Sum Offering to participants as the cost of paying out a particular subsection of the participants can be less expensive than the final phase of annuitization with an insurance company. Regardless of the phase, we suggest implementing a highly customized investment strategy which can alleviate financial risks.

Likewise, the FTSE Single Discount Rate can be utilized to understand rate movements more fully. At any one point in time, the level is measured as the average rate across the entire maturity curve. Not since 2013 has this rate been higher, which translates into an opportunity for plan sponsors and advisors to retain the decrease in liability values by matching the interest rate risk in both the assets and liabilities to a precise degree. On a rolling one-year basis the rate has increased 0.44% while on a two-year rolling basis it has increased 2.08%. Implementing the first phase of de-risking by utilizing a strategy such as ALIS is paramount at this stage in the business cycle as the FOMC begins to wind down their rate hiking exercise. Commonly the second phase is thought of as a Lump Sum Offering to participants as the cost of paying out a particular subsection of the participants can be less expensive than the final phase of annuitization with an insurance company. Regardless of the phase, we suggest implementing a highly customized investment strategy which can alleviate financial risks.

Economic Outlook

Recessionary signals continue to persist despite the lack of a negative Gross Domestic Product (GDP) growth measurement. Examples of these signals include an inverted yield curve, restrictive monetary policy, declining leading economic indicators, and a drop in year-over-year Gross Domestic Income (GDI) – a first without a coincident recession. Slowing inflationary trends, including wage inflation, may hinder a soft landing.

As of the most recent revision, 1Q GDP growth was 2.0%, with an expectation for 2Q to measure 2.0%-2.4%. A strong labor market supports consumer spending which impacts nearly 70% of GDP. Evidence of this strength is the over 9 million unfilled jobs which suggest a low likelihood of imminent labor market slowdown. Resuming student loan payments may impact GDP, but the Administration is trying to delay it further which will be stimulative.

"The issue isn’t the directional movement but rather the speed at which inflation is falling..."

Inflation continues to fall despite the Fed’s indication of potentially one to two more rate hikes this year. As we discussed earlier, inflation measures peaked at 9.1% in June of 2022 and have since declined to 3.0%. The money supply has also declined, which tends to foretell a decline in inflation by 13 months. U.S. M2 money supply is shrinking at the fastest pace since the 1930s. Most market participants agree that inflation is falling while the Fed is focused on “supercore” inflation which removes food, energy, and housing from the calculation. The issue isn’t the directional movement but rather the speed at which inflation is falling which, in the eyes of the Fed, isn’t fast enough. Contributing to stubborn inflation, specifically headline inflation, are the effects of a housing shortage that have been precipitated by the lack of residential investment beginning in 2022.In conjunction, institutional buyers of residential homes have been on the sidelines for much of this year as price increases and financing costs have resulted in institutional buyers acquiring 90% fewer homes in the first couple months of 2023 as compared to the same period in 2022. If rates or prices fall, look for institutional buyers to jump back into the market, which would create even more demand to support persistent inflation to a larger extent.

To continue fighting inflation, the Fed may abandon half of its dual mandate, price stability and full employment, as unemployment is at 3.6%, wage growth is at 4.4% and the job market shows mixed results. As a result, monetary policy will remain restrictive, with a potential shrinkage of the Fed’s balance sheet as their rate remains in restrictive territory affecting borrowing costs that are having an impact on consumers and corporations.

Another theme we have expressed for several quarters is that the zombie companies, and as a result, zombie consumers, are both working against positive economic growth. As proof, 55% of the smallest quintile companies in the Russell 2000 small cap index are unprofitable. In the top quintile of the same index, a surprising 20% of companies are unprofitable. It makes us wonder if those companies will ever materialize their assumed future growth to validate paying current high multiples when many of them are not presently profitable. As sources of stimulus and liquidity are drained from the economy, it feels like zombie corporate borrowers, and stocks of unprofitable companies are poised for difficult times. Zombie consumers may be moving in step with these struggling corporations.Consumer behavior will continue to change amid rising or sustained inflation. Commonly savings decline, credit card balances rise, and people trade down on basic goods. When polls show negative economic sentiment, luxury spending declines and casual dining traffic drops. Middle-class assets are decreasing due to inflation. Under this forecast, corporate profits will suffer, and declining growth appears likely to be the most reasonable outcome.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.