Executive Summary:

- Pension discount rates continue to move higher, expanding funding ratios to improved levels and offering an opportunity to stabilize future financial requirements through a hedging strategy such as ALIS.

- Capital markets have exhibited one of the worst 9-month performance periods in history as measured on a year-to-date basis through the third quarter.

- The FOMC will continue to aggressively force inflation out of the economy causing some job losses, a slowdown in economic activity, and a change in expectations before they reverse course.

State of the Markets

The Fed continued its aggressive policy of raising short-term rates, becoming still more restrictive during the third quarter, in an effort to overcome their previously identified transitory inflation and the potential of even higher future inflation. There have been 300 basis points of rate increases in the last five FOMC meetings with another 125 basis points expected before year end. By some measures, the combination of Fed Funds rate hikes and Quantitative Tightening has been the most rapid tightening cycle ever as measured on a percentage basis.

The market’s reaction to higher Fed Funds rates in the quarter was a resounding negative response marking one of the worst 9-month periods in history. The NASDAQ has posted a -32% return, the S&P 500 declined 24%, intermediate Treasuries are 8% - 10% lower and the U.S. Aggregate Bond Index is 15% lower year to date thru September. Some market participants say that due to higher yields on Treasuries, stock prices took a valuation hit because the “risk-free” rate used to discount the future cashflows was greater. More likely, the equity market is becoming increasingly pessimistic about the prospects for future earnings of companies of all types. As it relates to both stocks and bonds, a “risk off” mindset has permeated the market, generating losses on both sides of the performance ledger. The yield curve has also flattened, and in some places, it inverted, perhaps evidencing the market’s expectation of future rate increases, as seen in rising short maturity rates, which ultimately results in reduced economic output and the taming of inflation, thereby decreasing long rates.

This Fed is clearly channeling the ghost of inflation past, referencing its policy mistakes of the 1970s, when the Fed ceased tightening too soon and inflation returned, causing the Fed to drive the economy into a severe recession to break the back of inflation. As the Fed turns the screws on the economy and reduces market liquidity, we expect pressure to occur on rates, resulting in an inflation rate that declines more slowly than we would like.

The shock of higher bond yields and borrowing costs is having a near immediate impact on the economy, including the housing market, while the effect of higher rates may take time to be felt in other sectors. Mortgage rates have more than doubled, refinancings are down 90% from a year ago, and home prices have started to fall. Job openings are falling but the unemployment rate remains very low at 3.7%. Low unemployment means consumers have greater incomes to spend which increases aggregate demand. One sign to notice regarding the Fed making progress toward their inflation goal will be an increase in weekly jobless claims as well as an increase in the unemployment rate. Our expectation is that third quarter GDP will measure above zero, although time will tell if we’ve had a recession in the first half of the year.

Pension Plan Index Update

European pension plans made front-page news over the quarter with headlines stating that “Liability-Driven Funds Triggered a UK Bond Panic.” While that statement is true, it’s worth noting that culprit wasn’t the liability focused strategy, but rather the tendency for European plans to engage managers who employ the use of derivatives within their pension strategy. It was the leverage effect, inherent in the derivatives, that exacerbated the bond panic, not the underlying asset-liability matching strategy. A sharp rise in rates, partially caused by the Bank of England’s (BOE) efforts to slow their economy and limit inflation by tightening monetary policy, resulted in excess selling of UK sovereign bonds (gilts). This action created a waterfall effect of even more selling to suffice collateral calls thereby causing a downward spiral in the value of gilts at which point, the BOE was forced to step into the market to prevent a systemic crash. In a rare set of circumstances, the BOE was in effect, simultaneously raising rates, decreasing the value of the gilt, while trying to stem the sell-off by adding to the demand for gilts in their buying actions. It is in extreme times of volatility where the use of leverage can be a double-edged sword.

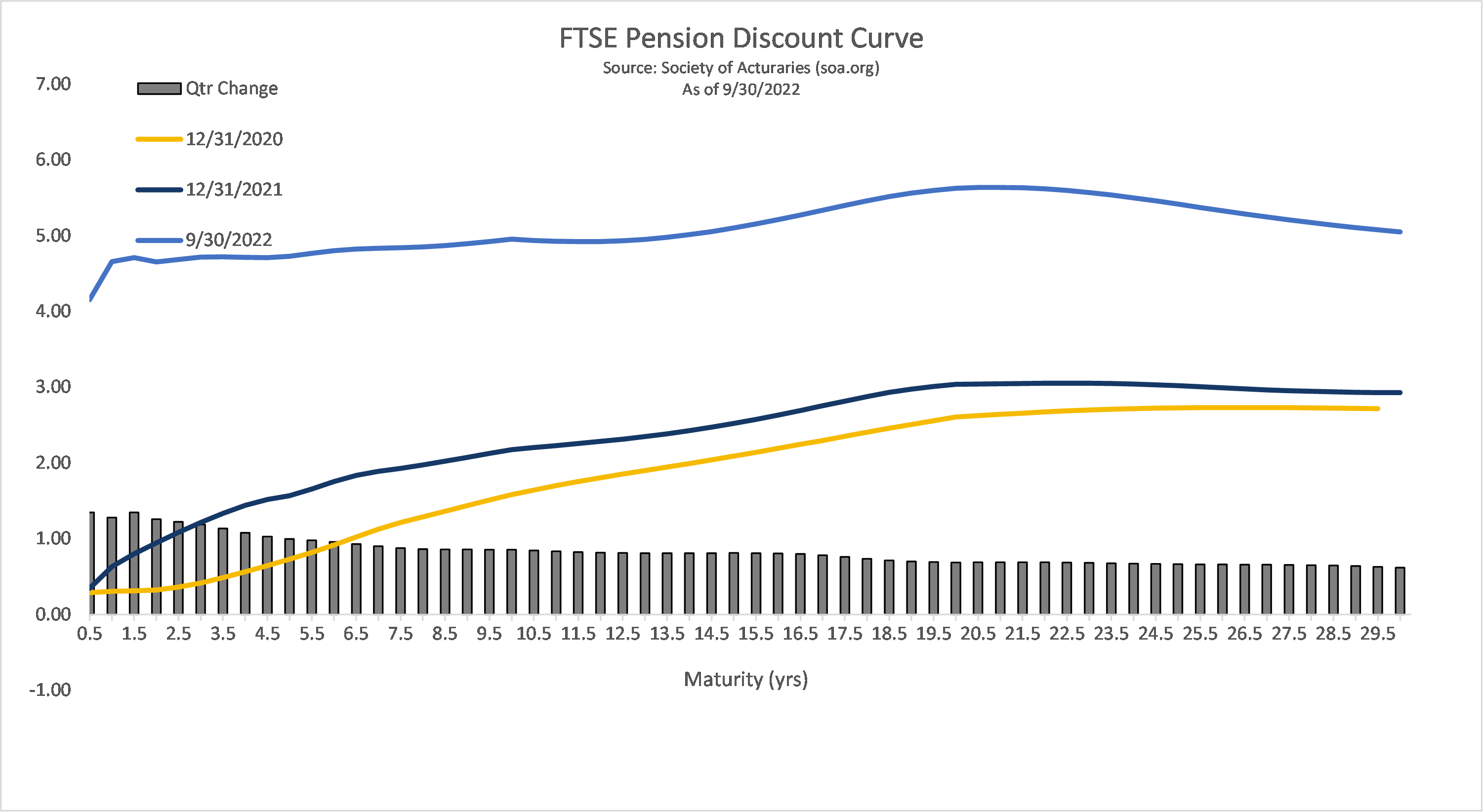

Rates not only rose in the UK over the quarter but also in the US as evidence by the FTSE Pension Discount Curve. The average single point increase was 83 basis points in the quarter with a range of 62 – 135 basis points over the various individual maturities. Since the end of the 2021 the movement is even more pronounced with the average change measuring 274 basis points and a range of 212 – 403 basis points. Continued curve flattening has also progressed into the second half of the year. As a whole, most plans have seen nearly a 10% improvement in their year-to-date funding levels. What has transpired this year is not only negative asset returns, which we will examine more closely in the next section, but a much worse return on the value of liabilities which has fueled the improved funding levels. It’s for this reason that so many plans are embracing a de-risking transaction such as pension risk transfer. 2022 is expected to close with an estimated record setting +$40 billion in risk transfer transactions, as plan sponsors embrace the positive effects of rising interest rates. Some of the expanded activity should be attributed to the continued development of the annuity market where the number of active insurers has now grown to 18 market participants. Expanded liquidity through more competitive pricing in the current rate environment will fuel transactions in the 4th quarter. We believe that pension benefits provide employers with an important offering to attract top talent in this current tight labor market. Adding stability to the financial requirements of a pension through the use of a liability focused strategy can be an appropriate first step in the de-risking process

Rates not only rose in the UK over the quarter but also in the US as evidence by the FTSE Pension Discount Curve. The average single point increase was 83 basis points in the quarter with a range of 62 – 135 basis points over the various individual maturities. Since the end of the 2021 the movement is even more pronounced with the average change measuring 274 basis points and a range of 212 – 403 basis points. Continued curve flattening has also progressed into the second half of the year. As a whole, most plans have seen nearly a 10% improvement in their year-to-date funding levels. What has transpired this year is not only negative asset returns, which we will examine more closely in the next section, but a much worse return on the value of liabilities which has fueled the improved funding levels. It’s for this reason that so many plans are embracing a de-risking transaction such as pension risk transfer. 2022 is expected to close with an estimated record setting +$40 billion in risk transfer transactions, as plan sponsors embrace the positive effects of rising interest rates. Some of the expanded activity should be attributed to the continued development of the annuity market where the number of active insurers has now grown to 18 market participants. Expanded liquidity through more competitive pricing in the current rate environment will fuel transactions in the 4th quarter. We believe that pension benefits provide employers with an important offering to attract top talent in this current tight labor market. Adding stability to the financial requirements of a pension through the use of a liability focused strategy can be an appropriate first step in the de-risking process  for many plan sponsors.

for many plan sponsors.

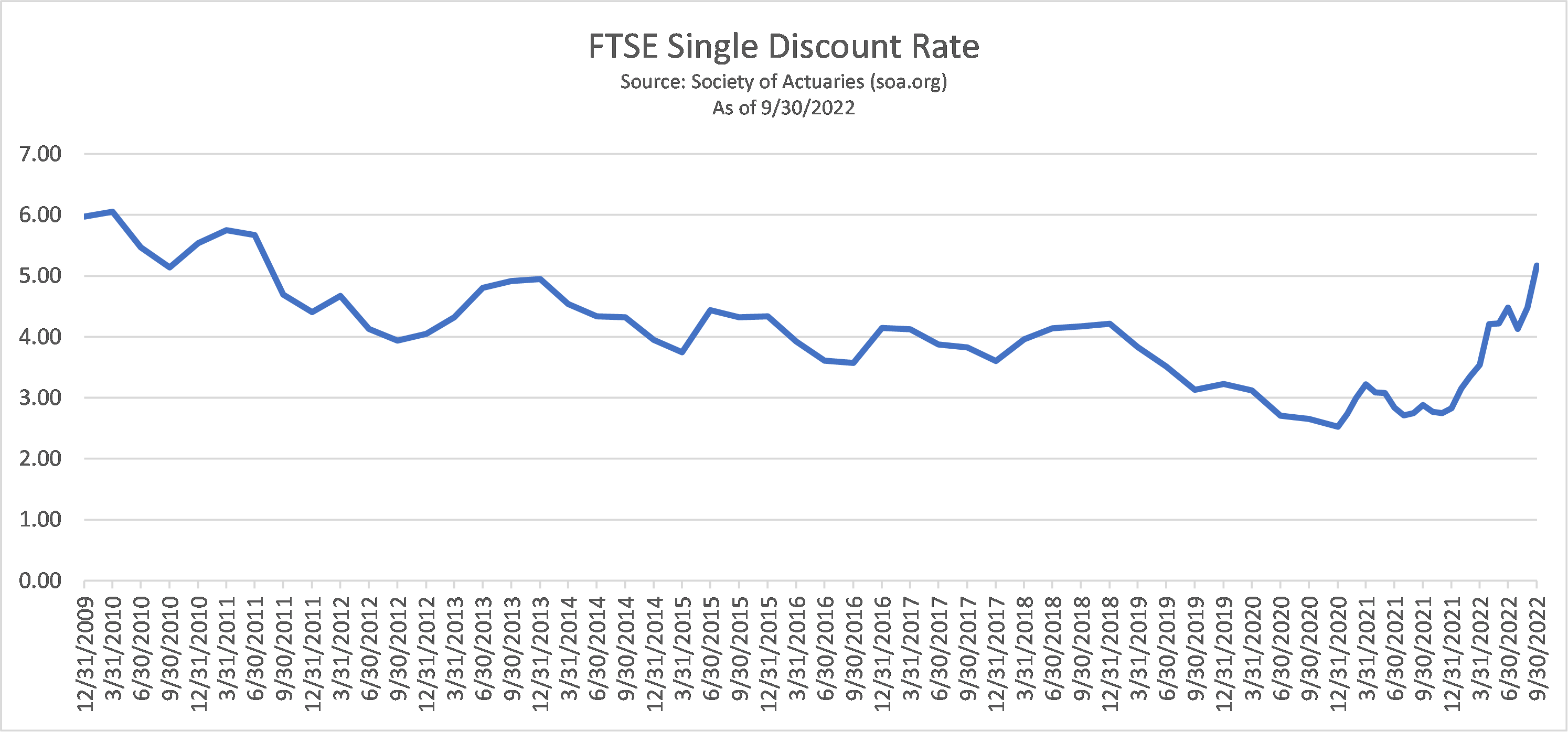

The FTSE single discount rate has seen the same swift improvement with a quarter over quarter increase of 69 bps and a year-to-date improvement of 265 basis points.

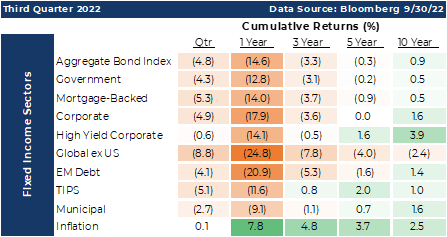

We alluded to the poor asset returns earlier and we weren’t joking since the prior year end, asset returns have been exceptionally poor with all sectors experiencing negative results. Domestic debt fared better than foreign, although all bond sectors have amassed double-digit negative returns except for municipal debt.

We alluded to the poor asset returns earlier and we weren’t joking since the prior year end, asset returns have been exceptionally poor with all sectors experiencing negative results. Domestic debt fared better than foreign, although all bond sectors have amassed double-digit negative returns except for municipal debt.

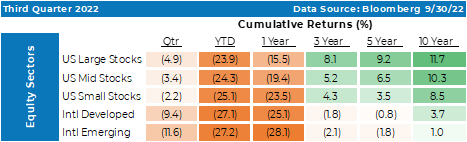

Equity returns exhibited the same lackluster negative absolute returns across the various sectors. Continuing the theme of the bond market, domestic sectors outperformed international and possibly not a surprise to those who have followed the continuing strength of the US Dollar. Long-term returns remain positive for the 3-, 5-, and 10-year tenures. Growth-oriented sectors began to show improvement over the Value-oriented sectors, a trend that contrasts with the prior 12-month returns. The S&P 500 Price-to-Earnings ratio now measures below its long-term average, a potentially positive sign for investors looking to put additional capital to work.

Equity returns exhibited the same lackluster negative absolute returns across the various sectors. Continuing the theme of the bond market, domestic sectors outperformed international and possibly not a surprise to those who have followed the continuing strength of the US Dollar. Long-term returns remain positive for the 3-, 5-, and 10-year tenures. Growth-oriented sectors began to show improvement over the Value-oriented sectors, a trend that contrasts with the prior 12-month returns. The S&P 500 Price-to-Earnings ratio now measures below its long-term average, a potentially positive sign for investors looking to put additional capital to work.

Economic Outlook

The Fed has begun messaging an apology, saying that by tightening the economy, there will be the pain of displaced workers and challenges that will occur with subdued economic activity. The Fed knows that to wring inflation expectations out of the economy, “below trend” growth is needed for a “sustained period of time” as said by Fed Chairman Powell. We interpret that to mean GDP growth of between 0% and 2%. Job losses are a certainty to achieve below trend growth. The simple truth is that people need to feel bad and worried to strip inflation out of expectations. To this point, the reduction in jobs available per seeker has dwindled from two jobs per seeker to 1.7 jobs per seeker, mostly through employers reducing the number of posted positions. Layoffs have started, but the pain in the job market has been minimal. To manage wage inflation and correct the imbalance in labor markets, the Fed will demand some degree of job losses, bringing about a fear of job loss to tamp-down the portion of overall inflation that is born out of labor costs. The probability of massive layoffs experienced in past recessions, is not our outlook since few employers are operating with bloated staffing levels. Based on our assessment of the current job market, wages should stagnate, rather than fall dramatically.

We believe that the Fed is correct to start the apology tour. It serves the double duty of possibly bringing down economic expectations for both Wall Street and Main Street, while in a compassionate way, it may cause those who are overextended the most an opportunity to get their house in order, so the pain of a recession is unpleasant, but not tragic. The Fed has indicated that they don’t plan to make the mistakes of the past, by taking their foot off the economic brake pedal too soon, as was the case in the 1970’s inflation episode. In our opinion, the Fed will raise rates to a point that either inflation is beaten out of market expectations, or some systemically important aspect of the global economy breaks.

"We have a hunch that the housing market and related economic activity is in a fragile state."

We have identified some developments that could rapidly cause havoc with the economy. Companies’ access to capital market may freeze. Current liquidity measures are back down to where they were at the start of the pandemic. Junk bond issuers, who couldn’t afford their interest costs 400 basis points ago may become officially deceased or absorbed into stronger entities. Debt risk spreads could be at risk of a dramatic widening. As a result, corporations would have to pay much more to borrow money. In the U.S., every 100-basis point increase in borrowing costs results in approximately an additional $300 billion needed to service the debt, annually. That is a lot of future productivity or intelligent social spending that may not happen. The housing market is poised for stagnation or decline since the affordability has plummeted. Mortgage rates have hit a 14-year high. In 2021 you could get a 30-year mortgage for 3%, now that number is roughly 7%, so a $2,500 monthly house payment that bought a $758,000 house in 2021 currently gets you a $476,000 home. We have a hunch that the housing market and related economic activity is in a fragile state. Corporate profits may be seeing some cracks. Higher labor costs, inflation in input costs, an extremely strong dollar, tighter monetary and fiscal policy, and the impact it may have on consumer demand seems poised to put a damper on analyst profit forecasts and stock share prices. Finally, the consumer overall may be broken. Cost increases are hitting them from all sides and wages are not keeping up. Credit card balances are near record levels, the interest cost on that credit has increased, saving rates are down, consumer sentiment measures are generally depressed, and if the Fed has its way, they have an increased risk of losing their income. Utility bills globally may grab headlines this year as heating costs may be dramatically higher. According to the National Energy Assistance Directors Association, roughly 20 million households, about one out of six, are late on their utility bills. Consumers are using a lot more debt and the debt is more expensive to carry. Although the Fed’s goals seem focused on applying pressure to consumers, there are several areas that appear to be poised to crack. What happens if several of them break at the same time?

Short term, the largest economic risk to decreasing inflation involves the uncertainty caused by Fed policy moves, imbedded lags in economic indicators, OPEC actions, suspended disbelief, and political policies that marginally mitigate the Fed’s goals. Some inflation indicators are real and others may be unhelpful head fakes. For example, the widely watched Consumer Price Index (CPI) is largely influenced by rent prices. The headline number is approximately 30% determined by rent prices, where the Core CPI is roughly 40% influenced by rent prices. Since rents are not often reset, typically at the conclusion of a lease, this component of CPI may put upward pressure on the CPI through 2023 and possibly into 2024. As a result of a shift in global alliances, or possibly just some foreign policy missteps, OPEC cutting production should put upward pressure on gas prices, creating a challenging development for many households. Finally, it seems the most meaningful inflationary risk involves politics. As the pandemic has largely subsided, politicians have attempted to spend nearly $4 trillion (includes: $900 billion in the Stimulus and Relief Bill of December 2020, $1.9 trillion from the American Rescue Plan in March of 2021, $740 billion in the Inflation Reduction Act in August of 2022 and the $400 billion student loan debt forgiveness announced in September of 2022). Very little of that spending was related to address the pandemic or revive the still ailing aspects of the economy.

"We had been encouraging spending and now we are enticing saving over consumption, but many consumers haven’t figured that out yet."

Since the Fed is just now entering restrictive territory with the Fed Funds Rate, we are likely near peak volatility over the next few quarters. Additional hikes in November and December, totaling roughly another 125 basis points should start to weigh heavily on the economy. The November hike, and more probably the December hike may invert the 3-month Treasury yield as compared to the 10-year Treasury. We had been encouraging spending and now we are enticing saving over consumption, but many consumers haven’t figured that out yet. Slowly but surely, they will see what the monthly payment in the new car is, and they will unceremoniously choose to fix the old car, and possibly feel good about the fact that they are earning something on unspent money. In the next six months, chances are, more people will start to feel discouraged about the economy. The Fed needs people to feel discouraged and expect to feel that way for the foreseeable future to win the battle with inflation.

Bond yields are as high as they have been in 14 years (meaning prices are low). We expect it gets a bit worse before it gets better, but after suffering the worst losses in roughly 40 years, betting against bonds over the next handful of years seems like a bad wager. For illustration, if the stock market was at the lowest P/E ratio in 40 years and you had an investment horizon of more than 10 years, wouldn’t you start to buy into that market?

At the start of 2022, the Fed thought they would raise rates by approximately 75 basis points in 2022. With their massive budget, huge balance sheet, market influence, and their army of PHDs and analysts, they were wrong by 400%, and at the end of the year, they may have missed it by nearly 600%. We thought at times during 2022 that the 10-year Treasury yield would hit 2.50% and flirt with 3.0%. We currently sit close to 4.0%. All of this may be a good example of decision anchoring, basing your forecast on past estimates. To break away from our anchors, we need to understand that in 1980, the Fed Funds Rate topped out at 20%. That is the unimaginable level of pain, inefficiency, and economic destruction the Fed is trying to avoid. They are going to slow this economy down and when things break, we expect that the fixes will be technical in nature and possibly not widely advertised or understood. The reason being, they cannot perpetuate the expectation of the Fed put as they are trying to make the economy feel bad, and the sad truth is they must squeeze hope out of the market psyche.

Our expectations are based on poor market liquidity, historical experience, and our outlook for economic growth and interest rates. Market liquidity at the time of writing this piece is as poor as it was during the worst time of March of 2020. Cash is king. In short, at the current time and with the near-term economic environment we anticipate, liquid investors hold all the cards and may get compensated for being able to buy bonds when nobody else recognizes their value.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.

.png)