State of the Markets

Covid continues to be the largest threat to our economic growth, especially as the differing variants progress through the population. Last quarter, we were negatively impacted by the Delta variant, and now we are reckoning with the effects of Omicron. While this variant is much more contagious, it seems to be less virulent. Some medical experts agree this is how a viral pandemic ends – millions get infected by a much less dangerous variant resulting in herd immunity. The seasonal flu we have today is evidence of a similar effect which began with the Spanish flu pandemic 100 years ago. Our expectation is the economy will remain open with this milder variant causing less of a need for drastic social constraints to be implemented once again.

Looking at economic growth for 2022, it’s important to realize we are ending 2021 on a very strong note. Final revised GDP in the 4th quarter could measure as high as 7.5%. The outlook for the 1st quarter of 2022 is also robust averaging 4.0%. Supply constraints remain evident, limiting near-term growth potential but offering the reverse as remedies emerge in the future quarters. Businesses are still having difficulty getting the necessary items they need to run their business. The auto industry is a great example, as manufacturers can’t get enough computer chips to match production with demand. In 2019, the U.S. had 17 million units in auto sales. That figure declined to 13 million units in 2021, marking a nearly 25% drop. Finding workers is another area of consternation for business owners. There are 4 million fewer people working today than at the end of 2019. While that figure has been dropping steadily, it remains an issue in the effort of maximizing growth. The hospitality industry has been impacted the hardest in the Covid era. The result is that restaurants operate with limited hours, some hotels offer limited floors to guests, and car lots maintain a very reduced selection. This provides many opportunities to spur growth as supply chain issues potentially get resolved in 2022.

The other major concern for economic growth is tighter monetary policy. The market now expects three rate hikes this year. Pressure on interest rates seems to be almost a given, especially if inflation remains well above the Fed’s 2.0% target which is very possible as goods inflation has been reinforced by wage inflation. Wage inflation has traditionally been slow to reverse. Interest rates have risen sharply in early January as the 10-year Treasury yield went from 1.51% to 1.85%. The 3-year Treasury note was 0.40% in September and recently traded at 1.35%. While three rate hikes of 25 basis points each doesn’t seem like something to worry about, markets are not accustomed to tighter monetary policy. Equities are very sensitive to rising interest rates and a correction in the stock market would likely lead to reduced consumer spending ultimately resulting in lower economic growth.

Pension Plan Index Update

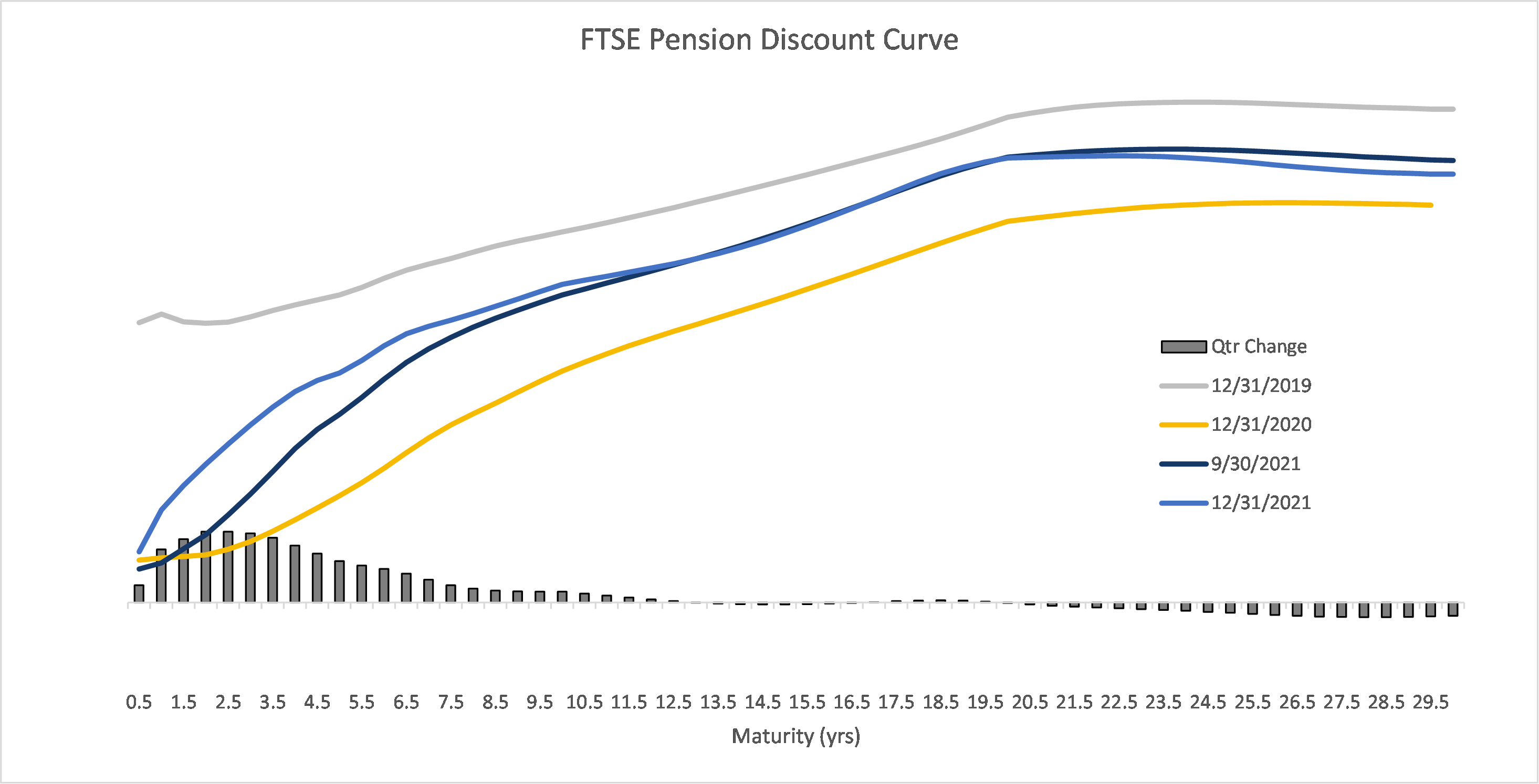

In parallel with US Treasury movements, the pension discount curve flattened over the fourth quarter of 2021, a result of twisting interest rates along the maturity spectrum. Shorter maturities exhibited the largest movements with incremental changes measuring nearly +0.5%, while the longest maturities declined on average -0.1%. As we mentioned last quarter, rising interest rates, all else equal, have the effect of improving the funded status for the average plan. In aggregate, calendar year 2021 produced rising discount rates over the entire yield curve with the average individual year rate expanding by 0.48%. Combining the effects of rising discount rates with positive capital market performance, the average plan improved their funding level between 8 and 9%. Many pension funding indices now measure the average plan’s funded status in the area of 95-100% funded, levels not seen since before the 2008 financial crisis.

In parallel with US Treasury movements, the pension discount curve flattened over the fourth quarter of 2021, a result of twisting interest rates along the maturity spectrum. Shorter maturities exhibited the largest movements with incremental changes measuring nearly +0.5%, while the longest maturities declined on average -0.1%. As we mentioned last quarter, rising interest rates, all else equal, have the effect of improving the funded status for the average plan. In aggregate, calendar year 2021 produced rising discount rates over the entire yield curve with the average individual year rate expanding by 0.48%. Combining the effects of rising discount rates with positive capital market performance, the average plan improved their funding level between 8 and 9%. Many pension funding indices now measure the average plan’s funded status in the area of 95-100% funded, levels not seen since before the 2008 financial crisis.

If we boil down the curve rates into a single discount rate, we can see a similar effect over a longer period of time. In fact, over the past year, the single rate increased 0.31%, assisting with improving pension funding levels (although in comparison with prior year end values, the rate remains near the low end of the spectrum). An expectation of continued Fed rate increases would cause the value to move higher, producing declining future values of pension liabilities, and coinciding with our expectation for a reversal of the recent year-end single-rate trend of declining rates.

If we boil down the curve rates into a single discount rate, we can see a similar effect over a longer period of time. In fact, over the past year, the single rate increased 0.31%, assisting with improving pension funding levels (although in comparison with prior year end values, the rate remains near the low end of the spectrum). An expectation of continued Fed rate increases would cause the value to move higher, producing declining future values of pension liabilities, and coinciding with our expectation for a reversal of the recent year-end single-rate trend of declining rates.

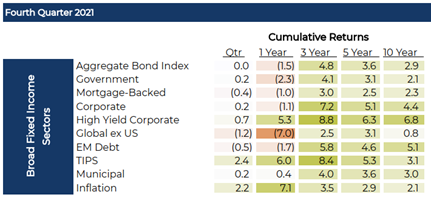

Fixed-Income returns were mostly positive over the quarter, except for the Global, EM, and Mortgage-Backed sectors. Throughout the fourth quarter, debt markets began to price in the notation of inflation becoming less transitory which allowed for TIPS to perform above that of other sectors, an effect that also held true on a YTD basis.

Fixed-Income returns were mostly positive over the quarter, except for the Global, EM, and Mortgage-Backed sectors. Throughout the fourth quarter, debt markets began to price in the notation of inflation becoming less transitory which allowed for TIPS to perform above that of other sectors, an effect that also held true on a YTD basis.

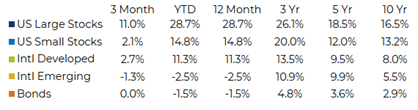

Equity returns for the quarter exhibited mostly positive performance. On a year-to-date basis, domestic large stocks generated another staggering year of returns, measuring 28.7%. The 5-year average is now at 18.5%, which has exceeded many market prognosticators’ long-term forecasts. Cyclical sectors produced the highest performance over the year, although defensive sectors had a strong fourth quarter as the domestic economy dealt with supply chain issues and the aforementioned Omicron Covid variant. Domestic Large-cap growth companies continued their trend of outperforming value over the year, while small and mid-cap companies broke their long-term trend with value stocks outperforming growth in 2021.

Equity returns for the quarter exhibited mostly positive performance. On a year-to-date basis, domestic large stocks generated another staggering year of returns, measuring 28.7%. The 5-year average is now at 18.5%, which has exceeded many market prognosticators’ long-term forecasts. Cyclical sectors produced the highest performance over the year, although defensive sectors had a strong fourth quarter as the domestic economy dealt with supply chain issues and the aforementioned Omicron Covid variant. Domestic Large-cap growth companies continued their trend of outperforming value over the year, while small and mid-cap companies broke their long-term trend with value stocks outperforming growth in 2021.

Economic Outlook

The non-transitory nature of inflation was the backbone for many aspects of life in the 4th quarter. Politically, it was a significant contributor to the uncertain status of the Biden administration’s signature legislative program (the social infrastructure package). Although negotiations between moderate Democrats and the White House have stalled, there is a political need to deliver for constituents ahead of midterm elections, so we continue to expect a bill that is north of $1.5 trillion will eventually pass.

The pain of inflation has hurt many people as wage growth has not outpaced the cost increases in some unavoidable areas such as energy, food, and shelter. Many economists look at “core” inflation numbers, which strips out food and energy costs, due to their occasional volatility. The concern is that food, energy, and shelter costs absorb about half of the disposable income for many households (Source: USDA and Investopedia). In concert with rising inflation measures annual wage growth has spiked to 4.3% (Atlanta Fed Wage Growth Tracker, November 2021). Although this sounds great, the annual rate of inflation in November, as measured by the consumer price index (CPI) increased a whopping 6.8%. The net effect is that many people just earned a pay cut of 2.5% (on a real basis).

At the Fed meeting in mid-December, the Federal Reserve made a rapid policy shift, “the Powell Pivot,” to combat levels of inflation not seen in a generation. Even though the Fed expects inflation to naturally decelerate to 2.6% in 2022 and settle just over 2% in 2023, they retired the term “transitory” to describe inflation. Of note, the Federal Reserve expects unemployment to drop to 3.5% in 2022, below the long-term neutral rate of 4%. Just recently, the rate fell to 3.9%. Although allowing the employment market to “run hot” may push up wages for low and moderately skilled workers, it will very likely stoke the inflation fire. The Powell Pivot may go through a policy meatgrinder as a tight employment environment feeds into price pressures. Keep in mind, the Fed’s dual mandate is full employment and price stability, which will require a delicate balancing act to serve both in 2022.

"It isn’t until roughly 2024 that the Fed expects they will be approaching a neutral rate..."

The Powell Pivot occurred in at least a couple of ways. First, the Fed announced that they were reducing the pace of mortgage purchases by $30 billion a month. Additionally, they will cease purchases by March of 2022 where it was previously planned to end mid-year. Second, the Fed telegraphed to the market, through the “Dot Plot” which now suggests that the short-term rate will be raised three times in 2022, to roughly 0.75%, followed by another two or three hikes in 2023 to a level that may exceed 1.50% in 2023. It isn’t until roughly 2024 that the Fed expects they will be approaching a neutral rate (where the Fed Funds Rate is in line with the rate of inflation). Perhaps a third way the pivot occurred was in the messaging following the Fed’s most recent meeting. They appeared to leave a window of opportunity to be more hawkish to fight inflation than what the market was expecting by announcing they could hike before reaching full employment.

The Fed’s guidance offers a high degree of certainty that rates will rise. The Fed Funds Rate has anchored the short part of the yield curve near zero for nearly two years. A change in policy and increase in the Fed Funds Rate means short rates will rise, an effect that was already evident in the 4th quarter. On the longer end of the yield curve, the largest balance sheet on planet Earth (the Fed) is stepping away from massive Treasury and agency-backed mortgage-backed security purchases, putting temporary upward pressure on yields. To elaborate, the Fed had been purchasing $120 billion per month of US Treasury and mortgage-backed securities. The need for the purchases came during the liquidity freeze that occurred in the bond market in March of 2020 (the start of the pandemic). Liquidity has returned to the fixed-income markets and yield spreads have narrowed dramatically (spread is the incremental yield earned for holding bonds with some degree of credit risk as compared to similar-term US Treasuries). Broadly, the quantitative easing program has outlived its usefulness, but we remained concerned that volatility will return to the bond market as the largest buyer quickly leaves the market. That is certainly not to say that free markets shouldn’t operate without training wheels at some point, but investors who have benefited from well-behaved (managed) markets will need to gain comfort operating in a more volatile market as volatility often offers opportunity.

As mentioned last quarter, convexity hedging may cause a feedback loop that following a spat of rising rates, will act to push yields even higher. Between the Fed walking away from the bond market, technical influences, and behavioral flaws, we anticipate that there is tinder to drive yields higher in 2022. ACG expects that when the concerns about Fed tightening are expressed, long yields will fall, and the Fed may find itself in the unenviable position of trying to raise rates against the headwinds of a flattening yield curve. The Fed will be hesitant to push short rates to the point where fixed-income investors start to worry about a yield curve inversion (where short-term rates are higher than longer-term yields). This challenge for the Fed is likely more of a 2023 issue than a 2022 concern, and it is worth mentioning that asset sales by the Fed may be able to influence the longer end of the yield curve for a time.

"Another near-term headwind is the removal of fiscal stimulus from many world economies."

Near term, base effects, and the removal of unprecedented levels of fiscal stimulus are the greatest threat to an orderly path to the Fed’s current expected policy path. With such outsized price increases as of late, subsequent periods are not expected to maintain the pace of increases or put another way, the base effects will limit the rate of growth in future periods. Another near-term headwind is the removal of fiscal stimulus from many world economies. UBS estimates that that the removal of fiscal stimulus in 2022 will cause a drag of up to 2.5% from global GDP. That is five times greater than the austerity measures that followed the 2008 financial crisis. These influences may provide the delicate mechanism that the Fed is banking on to glide inflation back to manageable and healthier levels.

A wildcard that many people are talking about is the state of the employment environment. The good news for many U.S. workers is that compensation grew by the largest amount on record in the third quarter. The bad news, as we detailed earlier, is the increase didn’t keep pace with headline CPI. Data from the ADP Research Institute show that U.S. companies added the most jobs in seven months this past December. On that basis, it appears that Americans are returning to the workforce. While it is possible that the jump in wages has coaxed some people back to work, it may also simply be the case that more people decided that it was time to earn an income. According to the BLS, in November the number of jobs seeking people was over 10 million and the number of people looking for jobs (people who are unemployed) totaled just under 7 million. It suggests that wage inflation may have room to run for 2022. The degree to which this dynamic results in wage inflation, and broader inflationary updraft, may be the source of risk that could cause the Fed to act in a way that surprises the markets. If the Fed has to slam on the brakes to moderate inflation, it may increase the risk of a recession. If labor force participation does not pick up, we may have another vexing issue (if people simply decide that they don’t want to work but they really want others to support them). Such a bifurcated employment market, those who work and those who are unwilling to work, could result in a head-spinning future with pockets of inflation and an economic drag on broader GDP at the same time. A more sustainable path is an educated workforce and encouraging industries that can use moderately skilled workers. Workers who experienced both the Great Recession and the pandemic during their formative and adult years understandably value a satisfying work/life balance, and employers who want to attract talent will have to address these needs to retain the best employees for the long run. A very real collaboration needs to occur between employers and employees about how to run a profitable and competitive corporation that is made up of satisfied and motivated people. Something must reverse the course of devalued human capital.

"Currently, the growth of the labor force is roughly in line with the pace of new job openings."

Currently, the growth of the labor force is roughly in line with the pace of new job openings. The continuation of this delicate dance may be crucial to the Fed being able to proceed with its orderly plan. Too many new jobs being created, relative to the number of people entering the workforce, will likely result in inflation. A collapse in the number of new jobs relative to the number of job seekers risks a deflationary wage environment, which could precipitate a downward economic spiral, as people aggressively compete for jobs while experiencing the 2.5% “pay cut” that inflation has effectively handed them. If inflation is too many dollars chasing too few goods, the “job scarcity” environment scenario would be a version of too few dollars pursuing too many goods.

This is a difficult environment in which to make an interest rate forecast. Since we began writing this quarterly strategy, 10-year Treasury yields have ranged from 1.50% to 1.85%. We expect the Fed’s tapering program will end in March and immediately they will posture themselves to raise the Fed Funds Rate at the May meeting, but the market is calling for a 90% chance of a March hike. We would be onboard with that, but there is a bit of a challenge that the Fed may have created for themselves when they identified equitable wage growth as an expanded tangent to their “full employment” mandate. In the recent jobs report, black American unemployment ticked higher to above 7%, while white American unemployment declined further to roughly 3.2% (Source: CNBC). Given the broadened mandate and the political pressure to incorporate an equitable component into the role of the central bank, it would seem like the bias for the Fed would be to let the employment environment run hotter than the market would prefer. We expect that all of this will result in a mid-year hike with rates broadly rising ahead of the hikes, and possibly into the first hike, with growing market concern that a program of several hikes will “kill the recovery.” In 2022 we could see 10-year Treasury yields exceed 2.0%, which may be coupled with spread widening in corporate bonds, especially as the training wheels (Fed bond purchases) are removed from the market. Longer-term, we expect that the U.S. will mimic aspects of Japan’s experience with debt, deficits, the need for cheap money being thrown at a population that may start saving more, and low yields for a long time.

Disclosures:

This Newsletter is impersonal and does not provide individual advice or recommendations for any specific subscriber, reader or portfolio. This Newsletter is not and should not be construed by any user and/or prospective user as, 1) a solicitation or 2) provision of investment related advice or services tailored to any particular individual’s or entity’s financial situation or investment objective(s). Investment involves substantial risk. Neither the Author, nor Advanced Capital Group, Inc. makes any guarantee or other promise as to any results that may be obtained from using the Newsletter. No reader should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, the Author and Advanced Capital Group, Inc., disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations in the Newsletter prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. The Newsletter’s commentary, analysis, options, advice and recommendations present the personal and subjective views of the Author and are subject to change at any time without notice. The information provided in this Newsletter is obtained from sources which the Author and Advanced Capital Group, Inc. believe to be reliable. However, neither the Author nor Advanced Capital Group, Inc. has independently verified or otherwise investigated all such information. Neither the Author nor Advanced Capital Group, Inc. guarantee the accuracy or completeness of any such information.