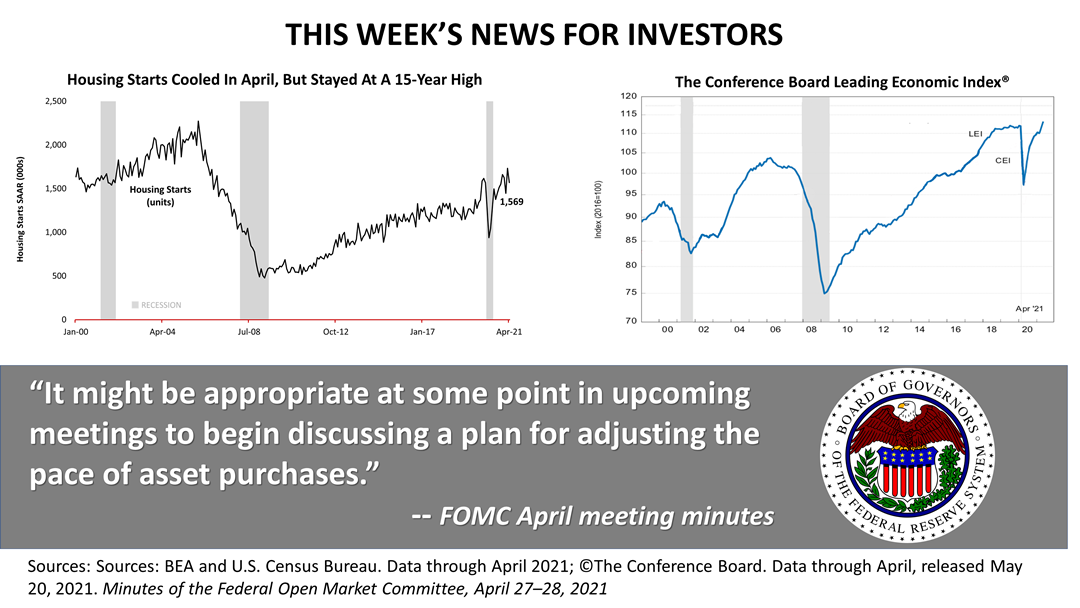

The U.S. Index of Leading Economic Indicators hit an all-time high and housing starts weakened but were still at a 15-year high. Amid the booming April data released this past week, the big news for investors was in the release of the minutes from the Federal Reserve’s monetary policy meeting on April 27 and 28, revealing that some members of the Federal Open Market Committee (FOMC) want to begin talking about cooling down the fast growth of the economy.

On page 10 of the 11-pages of minutes published by the Fed three weeks after every FOMC’s meeting, the Fed gently signaled to investors that it was thinking about starting to talk about a plan to taper purchases of bonds, a liquidity measure likely to precede a hike in the Fed’s lending rate to banks. While tapering is likely not to begin until 2022, the Fed is sending an early warning signal to investors.

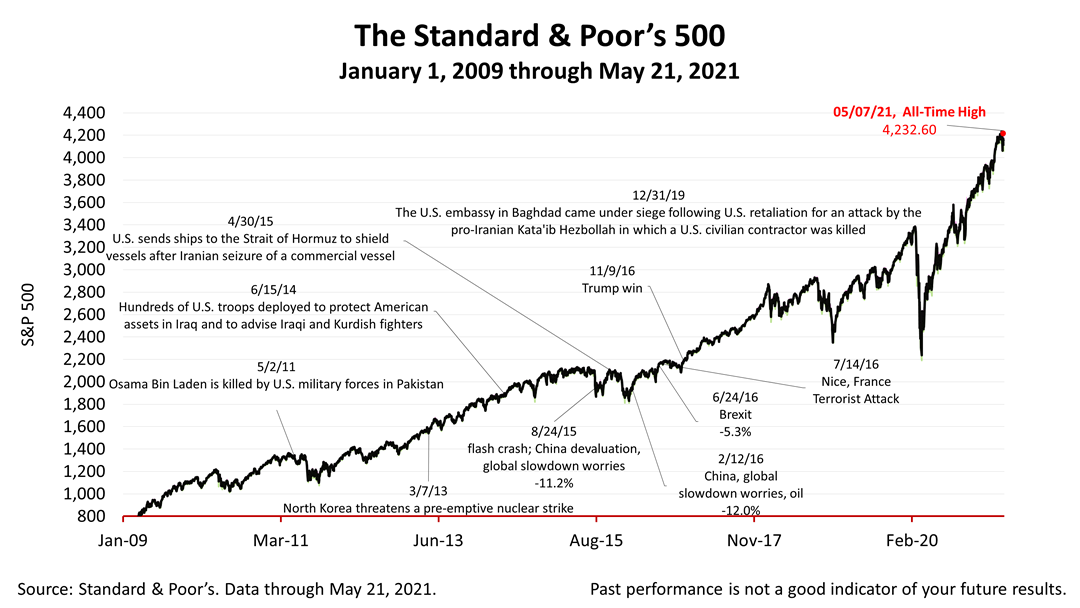

The Standard & Poor’s 500 stock index closed Friday at 4,155.86, about 2.5% from its all-time high. The index lost -0.08% from Thursday and -0.43% from last week. The index is up +60.01% from the March 23rd bear market low.

It was the second week in a row that the S&P 500 declined amid nervousness about inflation and Fed policy.