Economist Fritz Meyer yesterday said inflation is slowing rapidly and warned of a period of deflation.

At his monthly webinar for CFP, CPA, CIMA, CFA professionals, Mr. Meyer showed several charts tracking inflation expectations, including the two shown below.

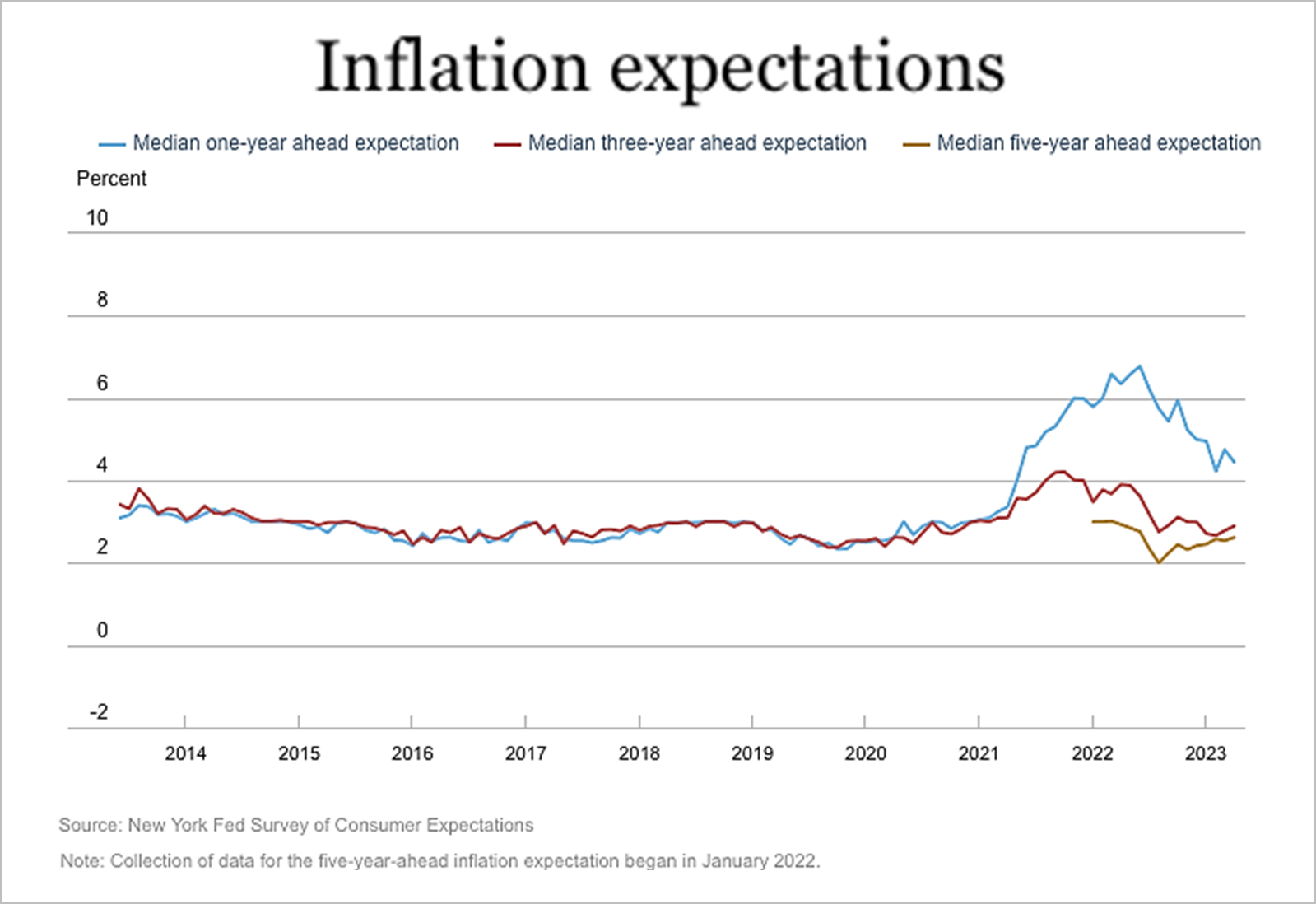

The rate of Inflation expected by consumers for the next 12 months, three years, and five years are shown in the chart above. The data are based on a survey of consumers conducted by The New York District Branch of the U.S. Federal Reserve Bank. Over the year, inflation is expected to average about 4.1%. Over the next three- and five-year periods, the inflation rate is expected by consumers to come closer to the Federal Reserve’s target of 2%.

The average expected inflation rate over the next 10 years is shown in this chart above. At 2.21%, it’s very close to the Fed’s target rate. The 10-year inflation rate in this chart is based on the recent yield on a 10-year U.S. Treasury bond versus the yield on 10-year Treasury Inflation Protected Securities. Inflation is under control, according to these metrics of inflation expectations.

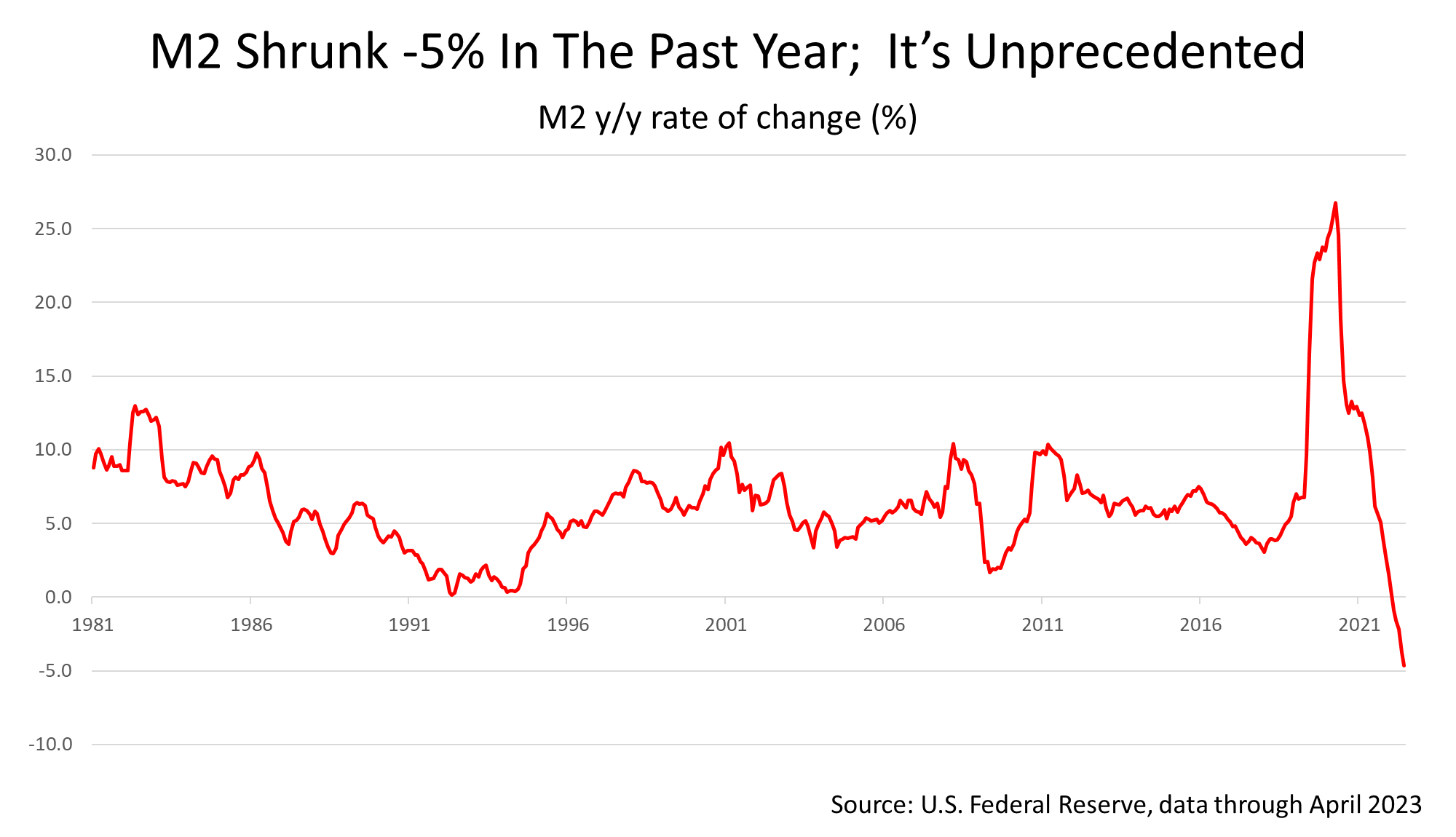

Mr. Meyer, whose one-hour webinars are conducted monthly and averaged a 4.8-star rating from professionals for over a decade, warns that an unprecedented drop in the money supply could result in a period of deflation. Mr. Meyer cited a May 24, 2023, op-ed article by economist Donald Luskin in The Wall Street Journal, which said this is the only contraction in money supply in U.S. history and that it “would be extraordinary if such a contraction didn’t result in deflation.”

Since March 2022, the Fed raised rates 10 times in the boldest tightening policy campaign in U.S. history. The inflation crisis may be over now, and the regional banking crisis was not much of a crisis. The Standard & Poor’s 500 stock index trades at 18 times net profits expected by Wall Street in the next 12 months, which is a reasonable valuation. Considering that artificial intelligence technology, which is led by American companies, is about to usher in an era like the introduction of the Web to consumers in the mid-1990s, the stock market could surprise investors on the upside in the years ahead.