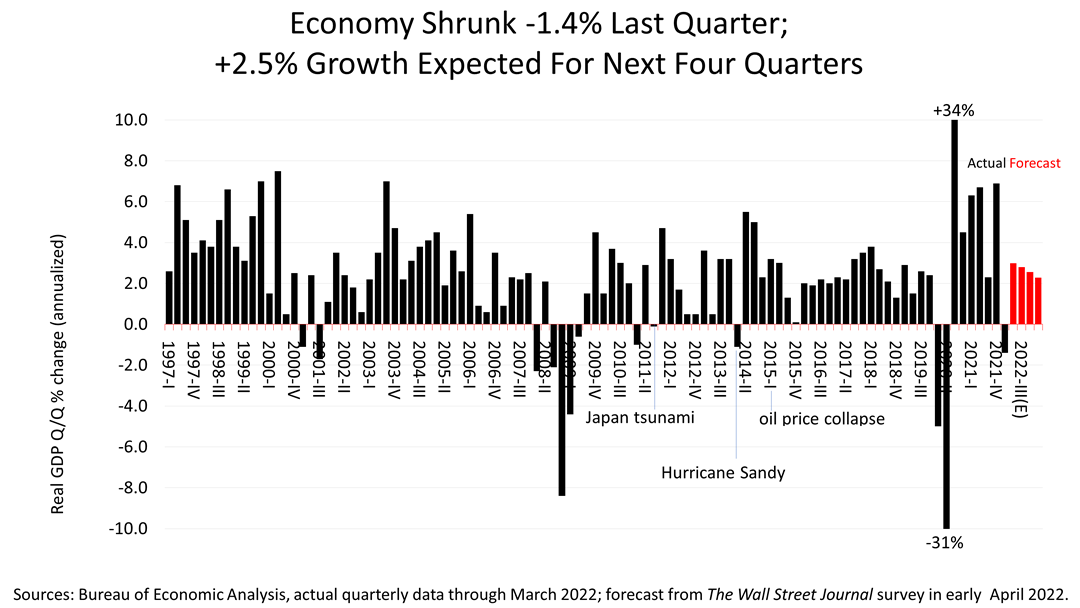

The U.S. economy shrunk -1.4% last quarter, but a +2.7% average growth rate is expected for the next four quarters.

In the first quarter of 2022, Covid 19 disruptions to the supply chain stunted growth.

“A slower pace of inventory investment by business in the first quarter -- compared with a rapid buildup in inventories at the end of last year -- also pushed growth down,” according to a front-page story in Friday’s Wall Street Journal.

However, 60 economists surveyed in early April are expecting the expansion to continue for the four quarters ahead.

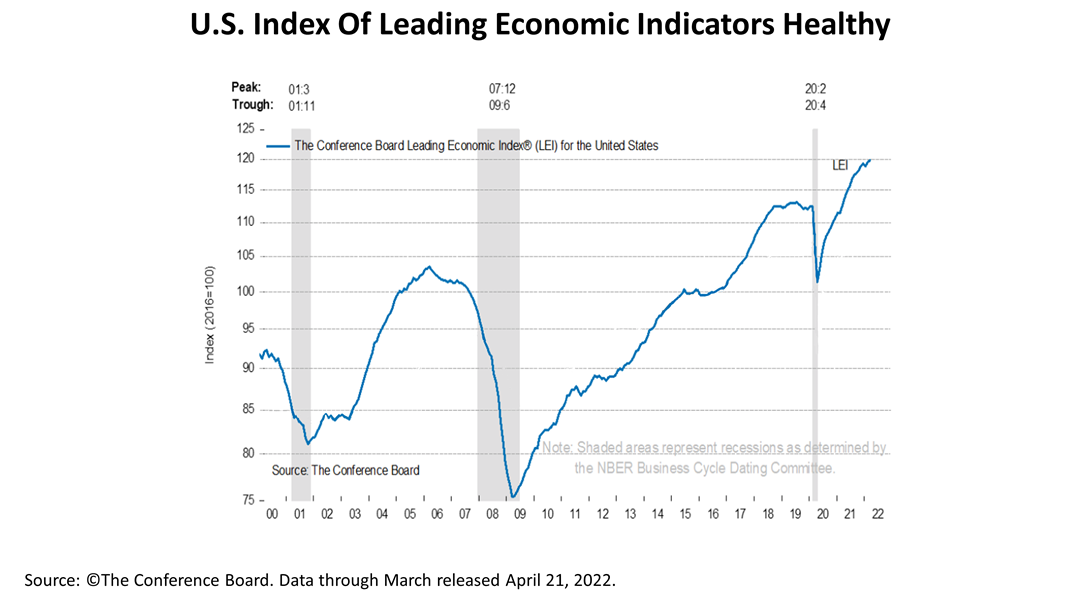

The Index of Leading Economic Indicators (LEI) for the U.S. collapsed months in advance of every recession since World War II, with the exception of the pandemic recession, a 100-year risk event.

The LEI was up +0.3% in March, following a rise of +0.6% in February, a -0.5% drop in January, and a +0.8% surge in December 2021.

“The US LEI rose again in March despite headwinds from the war in Ukraine,” said The Conference Board, which maintains the index globally and for major economies as well as for the United States. “This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations.”

The Conference Board projects +3% US economic growth in 2022. This is much slower than the +5.6% pace of 2021, but still a much higher rate of growth than just before the pandemic.

The 10 components of the Conference Board’s Leading Economic Index® are:

1. average weekly hours worked, manufacturing

2. average weekly initial unemployment claims

3. manufacturers’ new orders – consumer goods and materials

4. ISM index of new orders

5. manufacturers’ new orders, nondefense capital goods

6. building permits – new private housing units

7. stock prices, S&P 500

8. Leading Credit Index™

9. interest rate spread of 10-year Treasury and fed funds

10. index of consumer expectations.

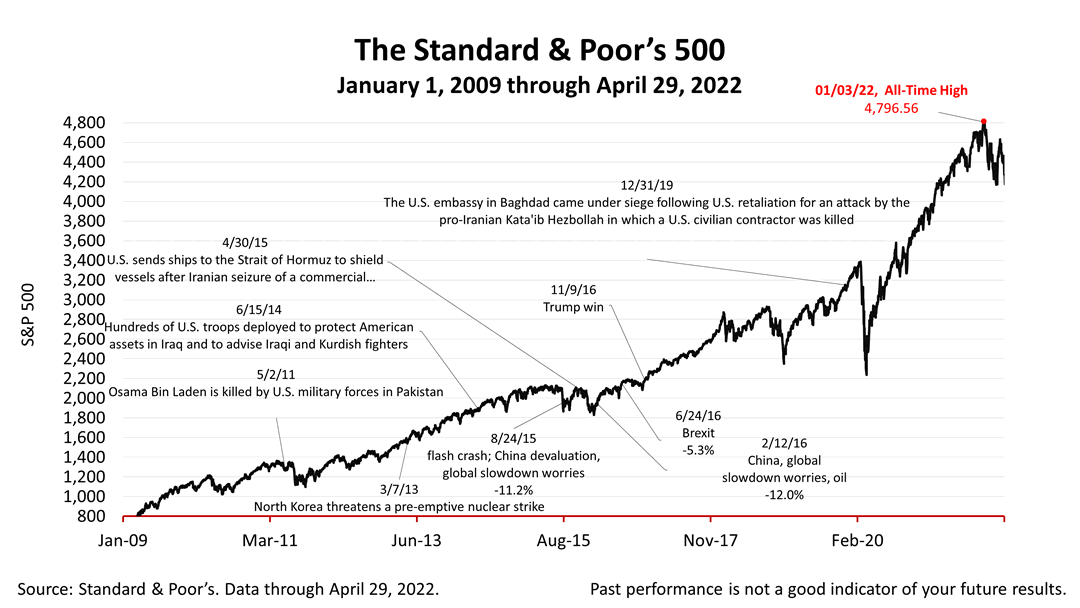

The Standard & Poor’s 500 stock index closed this Friday at 4,131.93. The index lost -3.63% from Thursday and is down -3.32% from last week.

Since the all-time closing high on January 3, the S&P 500 is down -14.8%. However, stocks are up +59.48% from the March 23, 2020, bear market low, an extraordinary run.

A recession – two-quarters of economic shrinkage -- is not in the forecast. A small minority of economists, however, are predicting the Federal Reserve will hike rates too fast and tip the economy into a recession in 2022. The chances this minority forecast will be correct is why stocks have dropped sharply.

From the dark days of the pandemic, a much brighter economy is expected to emerge in the 12 months through March 2023. However, the Federal Reserve could raise rates too fast and slam the door on growth in its effort to snuff out inflation. No one knows if the Fed will be able to eliminate raging inflation without causing a recession. That’s the risk of stocks.

The equity risk premium -- a key concept in modern portfolio theory – is worth remembering now: Stocks averaged +8.1% more appreciation annually than a risk-free 90-day U.S. Treasury Bill for the 20 years through December 2021.