Crushing expectations, the Bureau of Labor Statistics (BLS) reported Friday morning that employers created 476,000 new jobs in January. The unemployment rate ticked up slightly, to 4%, still very low by historical measure.

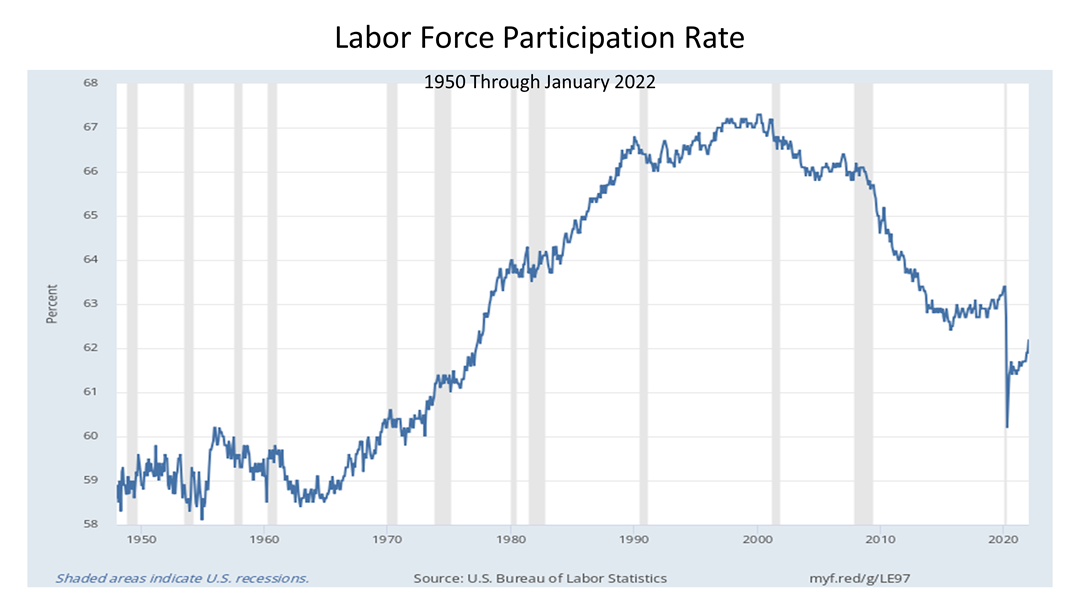

The number to watch, however, is the labor participation rate, which edged upward by three-tenths of 1% last month, according to BLS. Since the pandemic hit, the labor force of the U.S. has shrunk more than expected. It’s simply not rebounded to its pre-pandemic level.

It’s a cultural event known as The Great Resignation. Contributing to this historic shift in attitudes, more Americans in their 60s have chosen to retire, rather than work and risk exposure to the virus. The unexpected shift is making the labor market tight, and that means higher wages and more inflation.

With the Omicron variant threatening to derail a hot economy in January, Wall Street was reportedly expecting 125,000 net new jobs to be created. However, the strength of the U.S. expansion has repeatedly exceeded expectations since the partial shutdown of the economy in February and March 2020. Friday’s jobs report not only exceeded expectations for January, but BLS also revised sharply upward previously announced job-creation figures for November and December 2021.

And the news gets even better: Of the 12 BLS industry sectors tracked monthly, the biggest job gains in January were in leisure and hospitality companies -- the sector hit hardest by the pandemic. Since February 2020, employment in leisure and hospitality is down by 1.8 million, or 10.3%.

A comeback in restaurants and bars is good news but highlights the Federal Reserve’s challenge to raise lending rates to quell inflation without killing the expansion. Assuming the service sector job comeback continues, the tight labor market will force higher wages higher in the lowest paid jobs, waiters, dishwashers, and other leisure and hospitality jobs. The 2021 inflation of prices due to supply chain problems in 2022 is poised to become a wage inflation problem.

The number of employees in the U.S. has increased by 19.1 million since April 2020 but is down by 2.9 million, or 1.9%, from its pre-pandemic level.

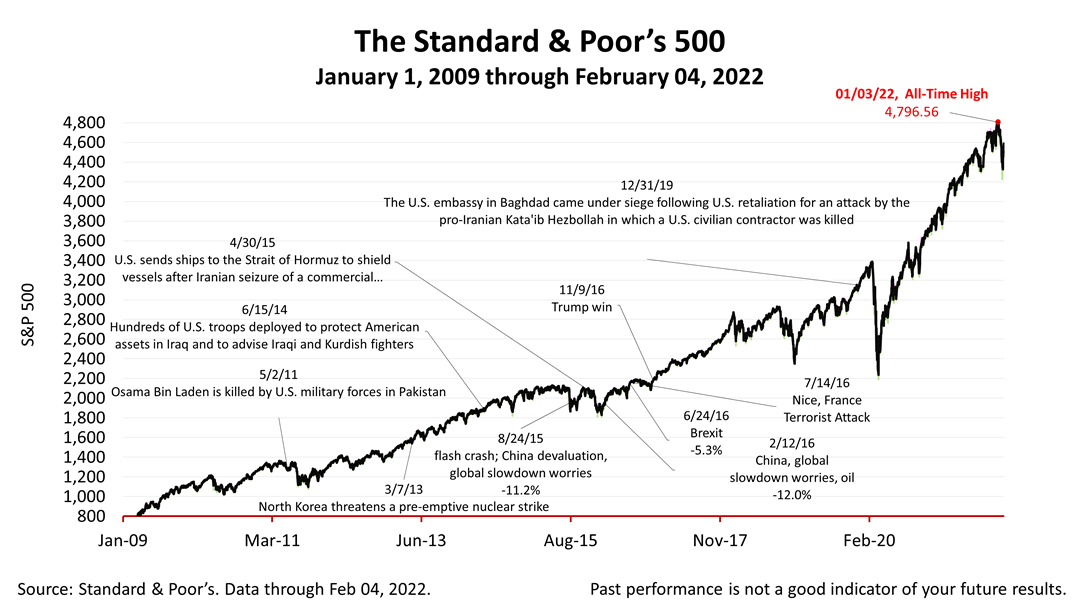

The Standard & Poor’s 500 stock index closed this Friday at 4,500.53. The index gained +0.52% from Thursday and +1.54% from last week. The S&P 500 is up +67.18% from the March 23, 2020, bear market low.