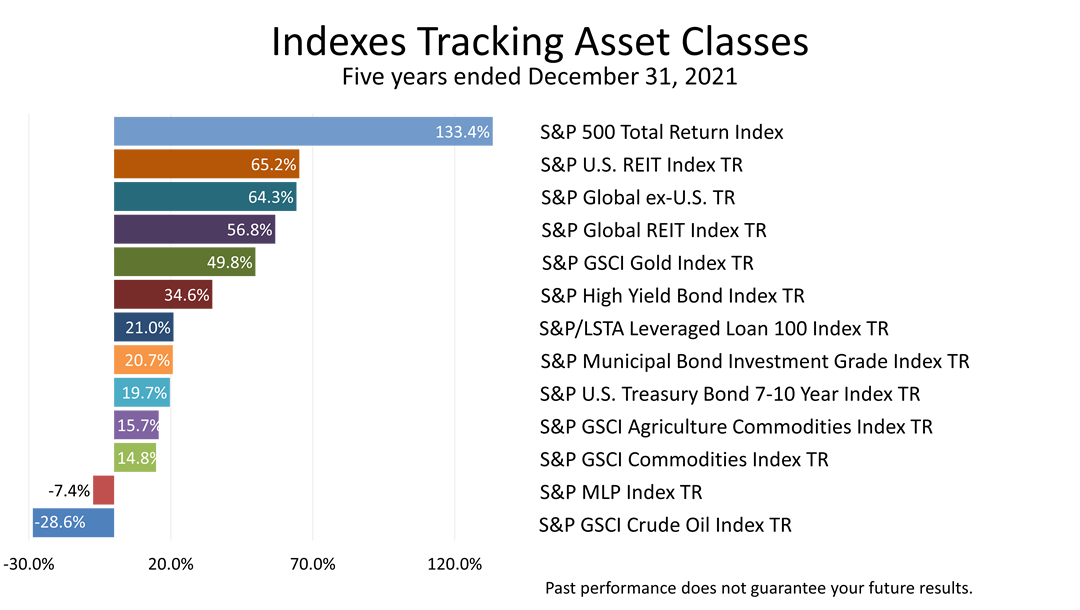

The U.S. stock market’s 133% five-year return dominated this diverse group of 13 securities investments. None of the other asset classes came even close to the total return of the Standard & Poor’s 500 stock index.

With another year passing, the financial media is naturally talking a lot about the spectacular returns on stocks and real estate, and there’s a smattering of coverage about the big losers – investments in energy and commodities. The coverage will get talked about at business luncheons, cocktail parties, and investment seminars. We suggest resolving not to get caught up in the talk in 2022.

The spectacular returns of stocks are causing speculation -- not just speculation in risky investments but speculation in the media that the stock market is in for a lackluster year in 2022 or even a loss. For example, The Wall Street Journal’s, January 3, 2022, print edition, led with a story entitled, “Stocks Confront Rockier Course In 2022.” Similarly, The New York Times, led its business section on Jan. 1, 2022, with the headline,” The Big Uneasy.” “Shares soared as interest rates stayed low and stimulus programs helped the economy,” The Times reported. “But expected changes could make investors wary.”

We suggest ignoring the speculation. The stock market is unpredictable. Covid, too, has been unpredictable. Inflation is higher than in decades. Federal Reserve policy just changed from dovish to hawkish on inflation, but interest rates have never been so low in U.S. history.

Despite the unprecedented crosscurrents, the stock market could go much higher in 2022. It also could go down. However, the economy is roaring and there is certainly no sign of a recession on the horizon.

If you rely on our advice, resolve in 2022 not to get caught up in the financial zeitgeist.