To say current financial economic conditions are unprecedented understates things: The United States, the world’s largest economy, by far, is transitioning economically from a once in a hundred-year public health crisis. Americans are also experiencing personal financial transitions, magnified by valleys and spikes in the economy as it recovers from the Coronavirus crisis. The economy is in transition and causing difficult personal financial transitions.

An economy in transition. The unemployment rate, at 6.1% in April, is far from the 3.5% achieved for months during the peak of the 2019 expansion. Meanwhile, the worst inflation threat in four decades is causing uncertainty in the stock market. In addition, the federal government spent about $5.5 trillion to inject cash into the pandemic-stricken economy and keep Americans in need from starving or financial ruin. Moreover, it is almost certain that another multi-trillion dollars in debt will be added to the balance sheet of the United States by the end of 2021 to fund much-needed infrastructure improvements.

People in transition. The unprecedented macroeconomic transition is causing unprecedented microeconomic transitions, personal upheaval. Companies are offering buyouts to employees. Home prices in suburbia have increased significantly, causing many to reconsider buying or selling homes. As the outsized boom resonates, some entrepreneurs are making fortunes, while others are losing everything.

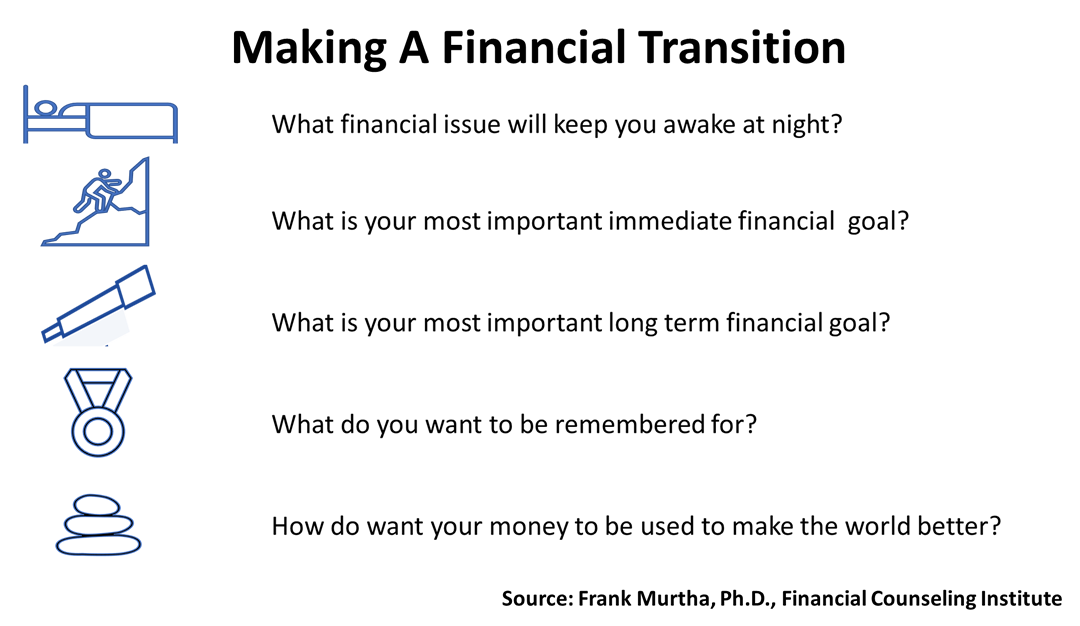

If you or members of your family are buying or selling a home, planning to retire, taking a buyout, or making a financial transition, ask yourself these five questions:

1, What financial issues could keep you awake at night?

2. What is your most important immediate financial goal?

3. What is your most important long-term financial goal?

4. What do you want to be remembered for?

5. How do you want your money to be used to make the world better?

Feel free to contact us about your personal situation.