There’s a new paradigm in valuing stocks and bonds. The change in the relative value of stocks versus bonds – the two primary investments in a diversified portfolio -- has major implications for strategic retirement investors. Here’s what’s happening.

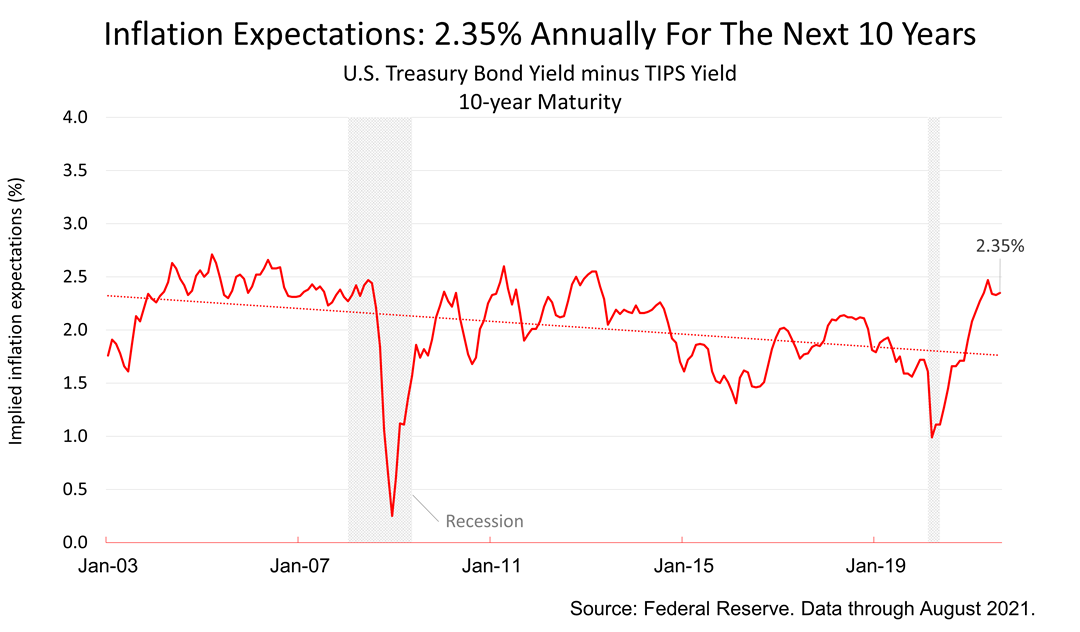

The bond market expects inflation for the next decade to annually average 2.35%, according to a market-based measure of expected inflation known as the Breakeven Inflation Rate. The BIR is derived from subtracting the current yield on 10-Year Treasury Inflation Protected Securities from the current yield on a 10-year Treasury bond.

With 10-year Treasury bonds currently yielding about 1.30%, and the breakeven inflation rate at 2.35%, the real return on a 10-year Treasury Bond is -1.5%! A negative expected return on a 10-year Treasury bond is unprecedented in modern history! It’s also unlikely to change anytime soon.

What’s it mean to you? It means that, even though stocks prices have been hitting new highs for many months, and even though stocks are trading at high price-to-earnings multiples compared to history, stocks are much more attractive than bonds. The rules of asset allocation don’t generally change much over the years, but a negative real return on long-term bonds is a major change to the asset valuation paradigm in place for decades. It’s wise for investors to adjust their long-term portfolio for the new asset valuation paradigm.