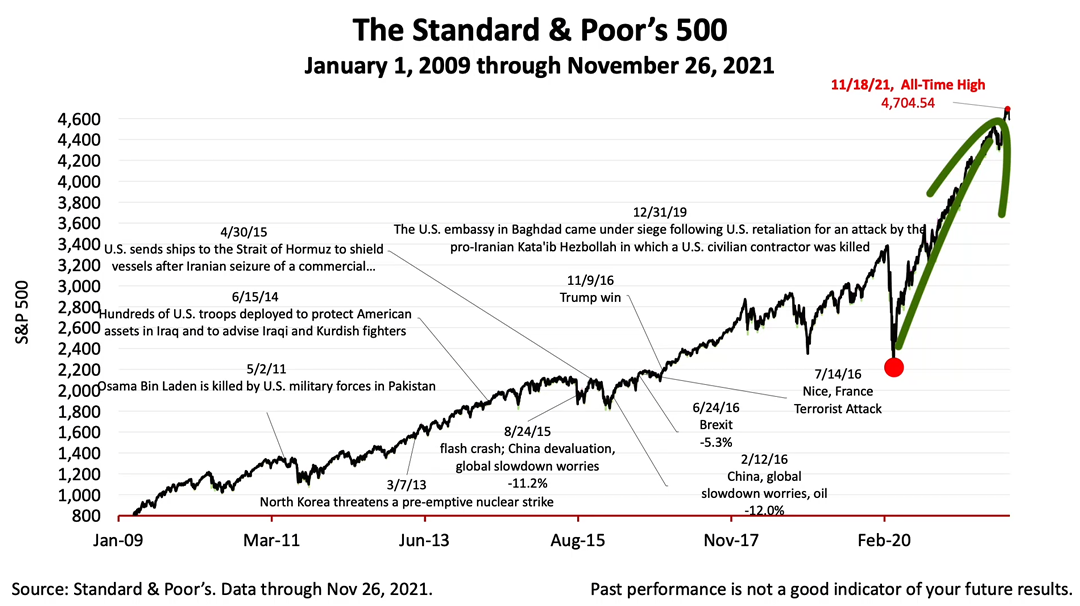

Since the Omicron variant was cited last Friday by the World Health Organization as a “virus of concern,” stock prices for the last three stock-trading days have gyrated.

The Standard & Poor’s 500 plunged -2.3% last Friday, and then rose +2% on Monday, before plunging again today by -1.9%. Tuesday’s plunge came after Federal Reserve Board Chairman Jerome Powell said Omicron posed new risks to the expansion.

The variant’s characteristics – its transmissibility, resistance to vaccines, and treatability -- are likely to continue to dominate the headlines over the next two weeks, which means even more volatility should be expected. But that doesn’t mean the bull market is over.

Since the Covid bear-market bottomed in late March 2020, stock prices have soared. And they continued soaring after the Delta variant in May unexpectedly stalled U.S. economic growth. Why?

It’s because yields on bonds are lower than ever before in U.S. history. This significantly changes the valuation investors historically attributed to stocks relative to bonds. This new valuation paradigm of stocks versus bonds is now in place and it must be understood before making investment decisions in this period of wild swings in stocks prices.

More bad news about the Omicron variant should be expected over the next two or, possibly, three weeks. The financial press is making the variant’s effects melodramatic and sensationalizing the situation.

“I think it’s a major moment,” The New York Times today quoted a hedge fund manager saying. “The Fed is finally sort of putting their stake in the ground and saying that the bubble has gone on long enough.” The financial press, even the best outlets, has a long history of sensationalizing major news events, like the Omicron’s effects on a long-term investor’s portfolio.

Bubble talk from speculators misleads individual investors about the financial economic situation. Please do not to let the headlines divert you from your strategic plan or long-term investment policy.

Which brings us to Reason Number Five clients trust our firm’s advice: We believe every investor should have a strategic investment policy to guide their portfolio through moments like this, when the unexpected happens.