There are many reasons why professional advice may be best for managing your financial situation. Here’s the No. 7 reason

One of the services our firm offers is portfolio rebalancing. Periodic rebalancing is about as important to investor success as personal advice on tax-efficiency. Rebalancing your portfolio is not a sexy-sounding benefit of working with a professional, but it might affect your portfolio’s terminal value about as much as tax-smart investing advice, which is another important reason to hire an investment professional.

Automated calculators for rebalancing get the math right but getting investors to use them to rebalance once a year requires a commitment of time and an interest in personal finance as well as behavioral change. Working with a qualified professional who knows your financial goals and risk-tolerance came in handy in the period since Covid hit the U.S.

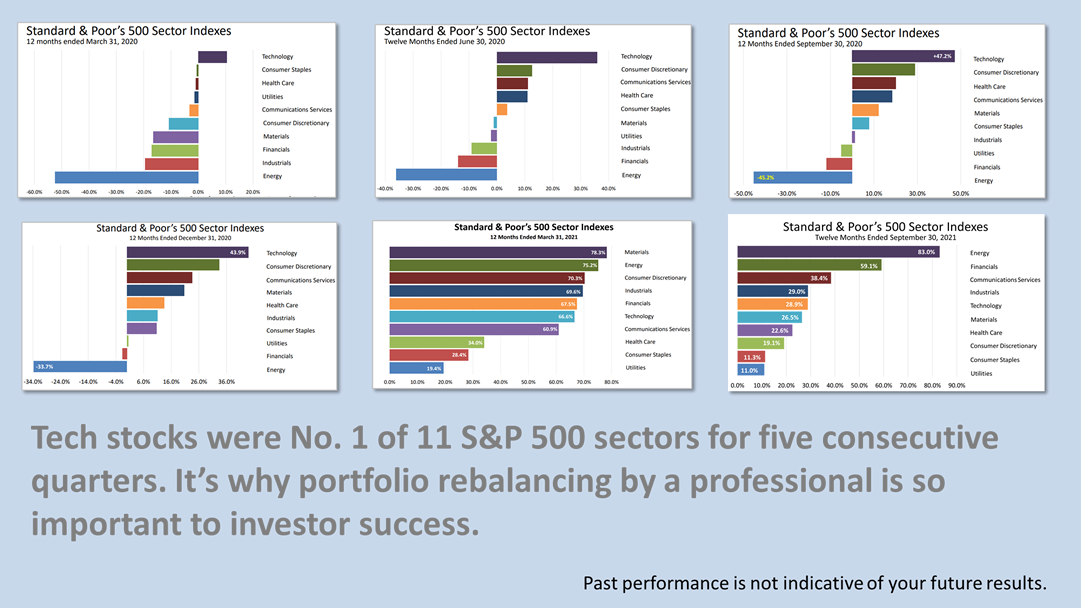

Since the pandemic hit in the first quarter of 2020, technology was the No. 1 performer of 11 S&P 500 industry sectors for five consecutive quarters but for the last two quarters was a middling performer.

The 12-month returns for the past six quarters on stocks classified by industry sectors illustrate why a portfolio rebalanced once a year by a professional is so important to investor success.

During the pandemic, both the Standard & Poor’s tech sector and the overall index were big winners because shopping online was safer health-wise. So was watching Netflix. And Google ads suddenly were attracting more eyeballs. Apple and Microsoft earnings growth was four times earnings growth on the average S&P 500 stock, according to Fritz Meyer, an independent economist. It was totally unexpected, of course.

The tech sector was the only one of the 11 industry sectors that make up the S&P 500 index to show a gain (10%) in the first quarter of 2020, when Covid hit. It was just the start. For the next three quarters, tech sector 12-month returns for stocks came in at an astonishing 37%, 47%, and 44%. It was an historic bull market kicked off by government transfer payments to consumers, and it is still in progress. But tech stocks for the past two quarters have not been dominating. They’ve now returned to the middle of the pack of the 12-month 11-sector index performance.

Successive quarters of outperformance would have allowed your tech stock position to grow unchecked and dominate in your portfolio results. With leadership shifting, a rebalanced portfolio would be better able to benefit from the change in leadership in the past two quarters.

There are many ways to rebalance a portfolio. Rebalancing based on a portfolio’s industry sector weightings is shown for illustration purposes.