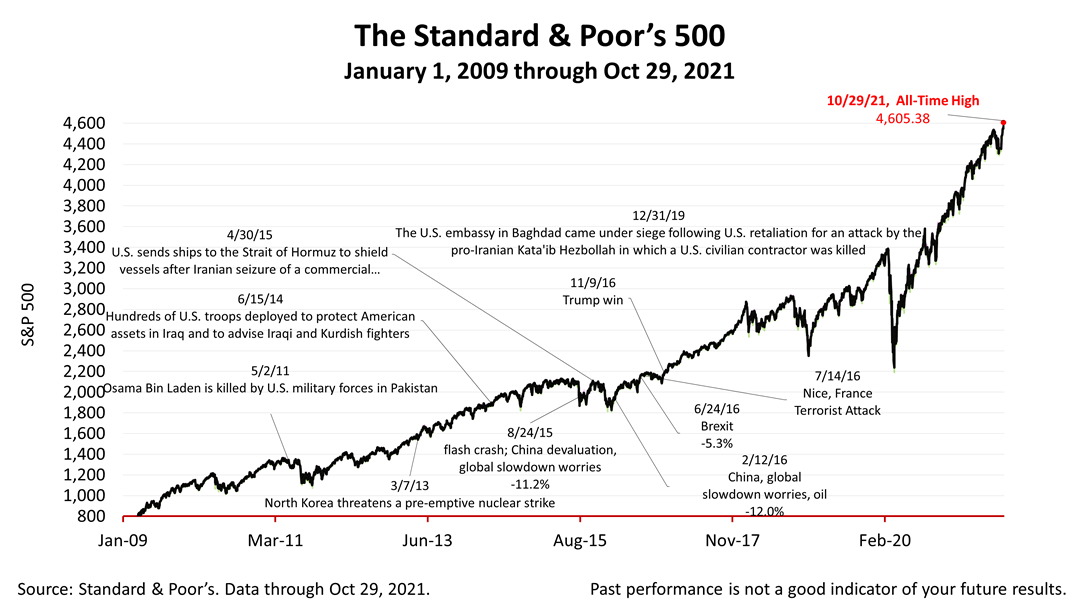

Despite some bad economic news this past week, the Standard & Poor’s 500 stock index closed today at a record high on stronger-than-expected earnings reports.

This past week, a sluggish 2% growth rate was reported for the third quarter by the U.S. Bureau of Economic Analysis. Amazon’s reported lower than expected earnings, and the Federal Reserve raised its estimate of the current inflation rate. Yet investors focused on the good news on corporate earnings and appear to agree with the Fed’s prediction that the elevated inflation rate will revert to 2% by the end of 2022.

With nearly half of the companies in the S&P 500 having reported their third quarter earnings, 82% of them reported profits above expectations, according to a story buried on page B11 of the print edition of The Wall Street Journal Thursday, quoting data from FactSet.

Earnings drive stock prices and better than expected earnings drive stock prices to levels that are better than expected, too.

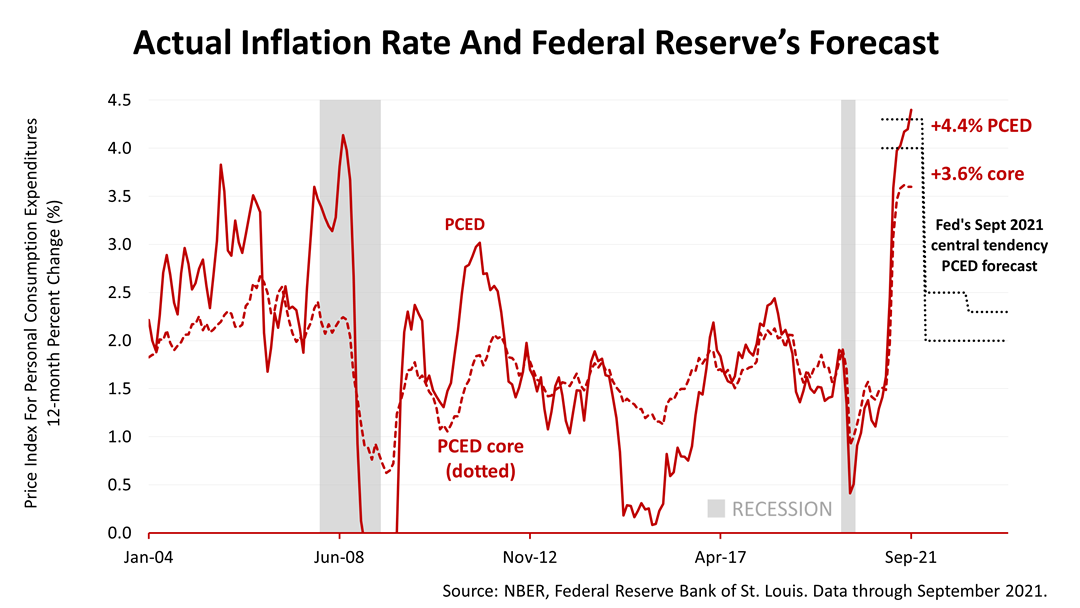

Supply chain problems are cited as the main cause of higher prices that have pushed the inflation rates higher than it’s been in three decades. U.S. central bankers at their most recent meeting stuck to their prediction that inflation, as measured by the Personal Consumption Expenditure Deflator (PCED), will plunge back to about 2%. PCED is slightly different from the Consumer Price Index; it is the inflation index referenced in Fed policy statements. The dotted gray lines reflect the range of inflation forecasts by members of the Federal Open Market Committee, which sets U.S. lending rates.

If the Fed is right, then inflation will revert to its trend rate of 1.5% annually, which it clung to for a decade before Covid. But the Fed in recent months has raised its forecasted inflation rate and extended time wit will take to revert to 2%, while sticking to its assertion that inflation will not become a long-term problem.

So far, stock market investors have been buying into the Fed’s view that high inflation will be transitory.

The Standard & Poor’s 500 stock index closed this Friday at an all-time high of 4,605.38. The index gained +0.19% from Thursday and was up +1.32% from last week. The index is up +69.21% from the March 23, 2020, bear market low.