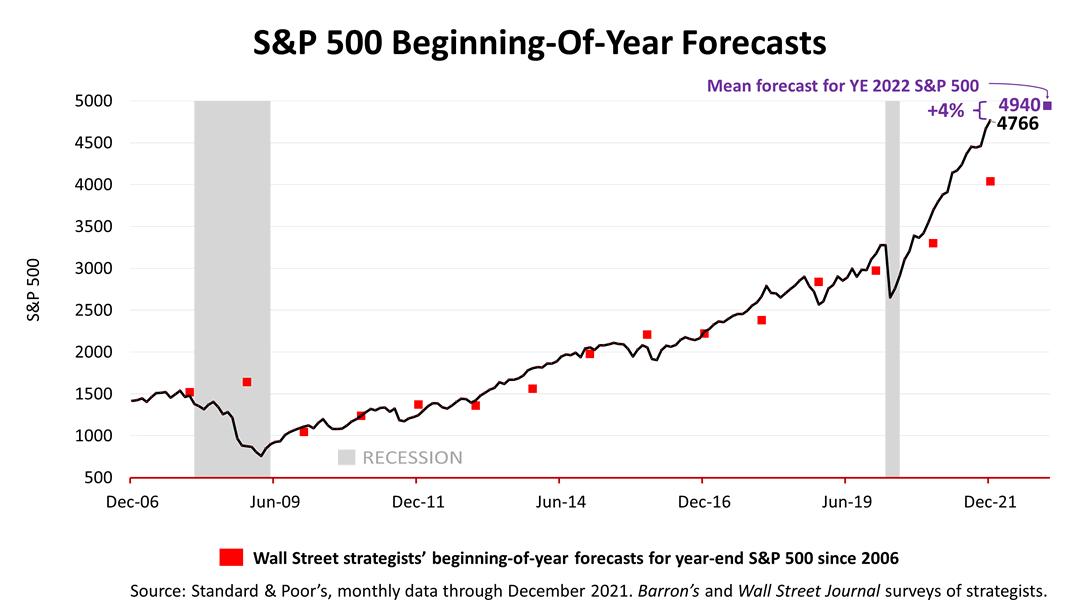

Wall Street’s forecast for 2022 is for a 4% gain in the Standard & Poor’s 500 stock index. But what does that really mean? Should you care? The answer is “not so much.” Wealth management is not predicated on predicting the stock market’s performance over the next year.

No one can reliably predict stock prices year after year and Wall Street’s no exception, according to this chart by independent economist Fritz Meyer. If the consensus forecasts by top strategists on Wall Street had been accurate since 2006, the red dots would all fall on the black line representing the S&P 500.

Illustrating how wildly wrong Wall Street’s best experts can be, in December 2020, the consensus forecast of the 10 strategists was for the S&P 500 to close 2021 at 4040. However, the S&P 500 closed 2021 at 4766, exceeding Wall Steet’s consensus forecast by more than 20 percentage points! The actual gain was three times Wall Street’s expectations!

We don’t wish to perpetuate the myth that investing successfully is predicated on predicting the stock market’s one-year performance. Building wealth involves tax management of your investments, adhering to a discipline, and a plan optimized for the rest of your life, that takes care of your family.

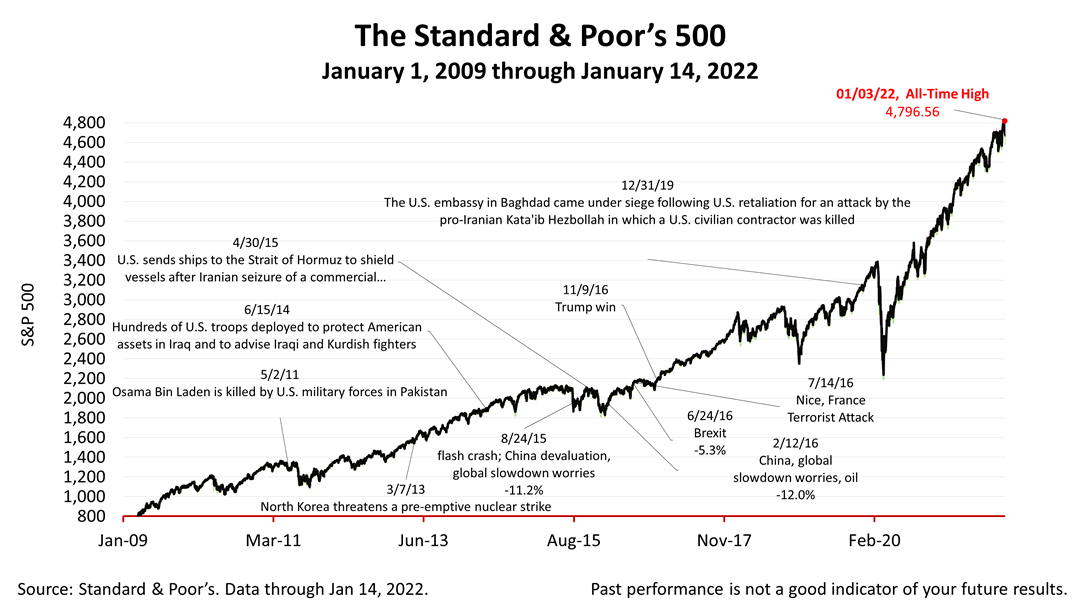

The S&P 500 stock index closed Friday at 4,662.85, about 3% lower than its January 3 record-high. A key measure of the confidence in the future of the United States, the S&P 500 price was essentially flat for the day. Gaining a scant +0.08% from Thursday, the index lost three-tenths of 1% from a week earlier. Since the March 23, 2020, pandemic bear market low, the S&P 500 is up +70.3%.