With purchasing manager survey data bolstering a bullish outlook and the Federal Reserve revealing a hike in interest rates is still far off, stocks closed at a record high for the third straight week.

The indexes of both monthly surveys of corporate purchasing managers at large businesses fell, but they were coming off record highs. With these indexes administered by the Institute of Supply Management, a reading greater than 50 indicates business expansion, and less than 50 indicates that business is contracting.

The monthly manufacturing sector survey has been conducted for decades and the reliability of the index has been tested over a long time. While the service sector survey index data only goes back to 2008, it uses the same methodology as the manufacturing sector survey. The service sector of the U.S. economy accounts for 89% of the U.S. economy and 91% of employees, making it the more important of the two indexes.

The other influential data released this past week were the minutes of the interest rate policymaking committee of the Federal Reserve Bank. Here are the most important 83 words of the 8,774-word minutes from the two-day meeting of the nation’s central bankers:

“All members reaffirmed that, in accordance with the Committee’s goals to achieve maximum employment and inflation at the rate of 2% over the longer run and with inflation having run persistently below this longer run goal, they would aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well anchored at 2%. Members expected to maintain an accommodative stance of monetary policy until those outcomes were achieved.”

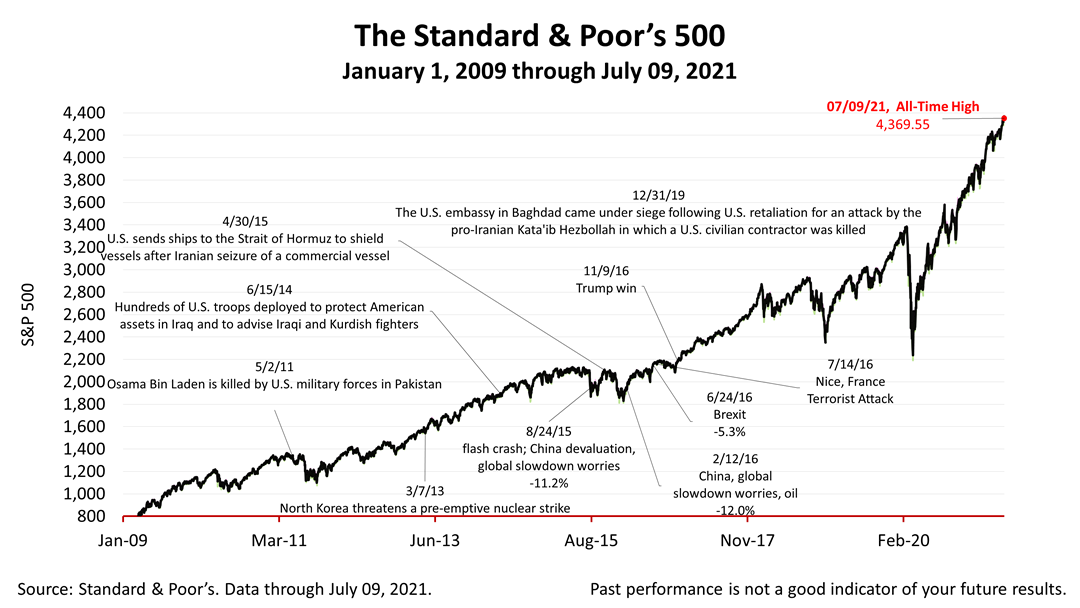

The Standard & Poor’s 500 stock index closed today at an all time high of 4,369.55, gaining +1.13% for the day. The index gained just +0.39% from last Friday’s close. Since the March 23, 2020, bear market low, the value of the S&P 500 is up +64.54%.