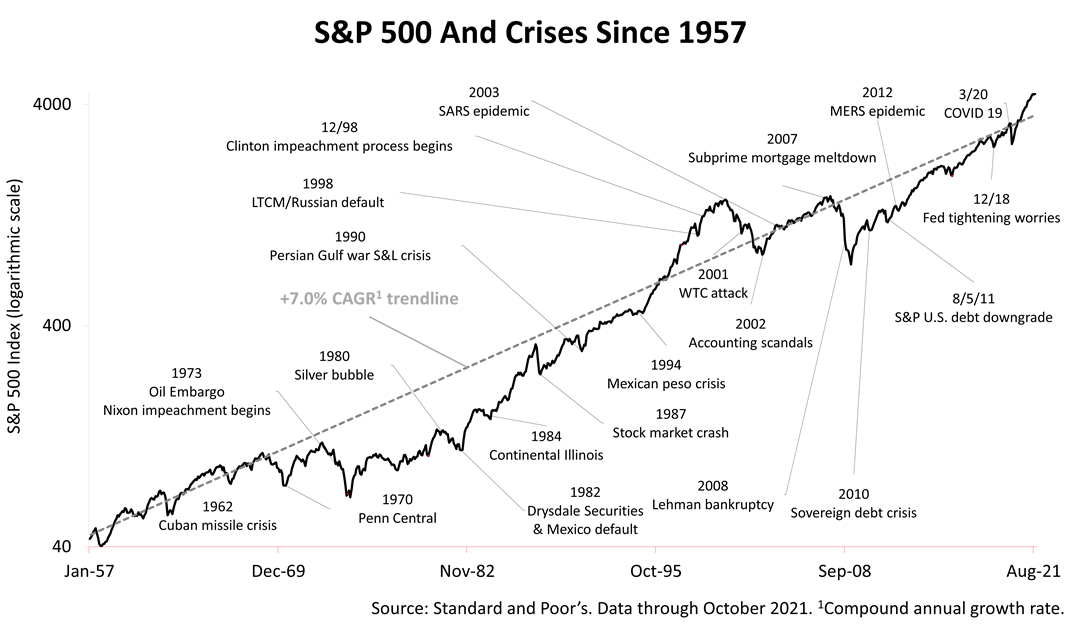

Since 1957, a 64-year span of modern history, 21 financial crises are shown here. Charting them against the performance of the Standard & Poor’s 500 index, the key benchmark of the strength of the United States, puts current investment conditions in perspective. Here’s a key observation to help design a low-expense investment strategy:

Stocks have soared since the March 2020 Covid bear market low but are not deviating above their 7% long term average annual return trendline, like they did in the tech-stock bubble of 2000. This suggests stocks are not at bubble levels, at least not yet.

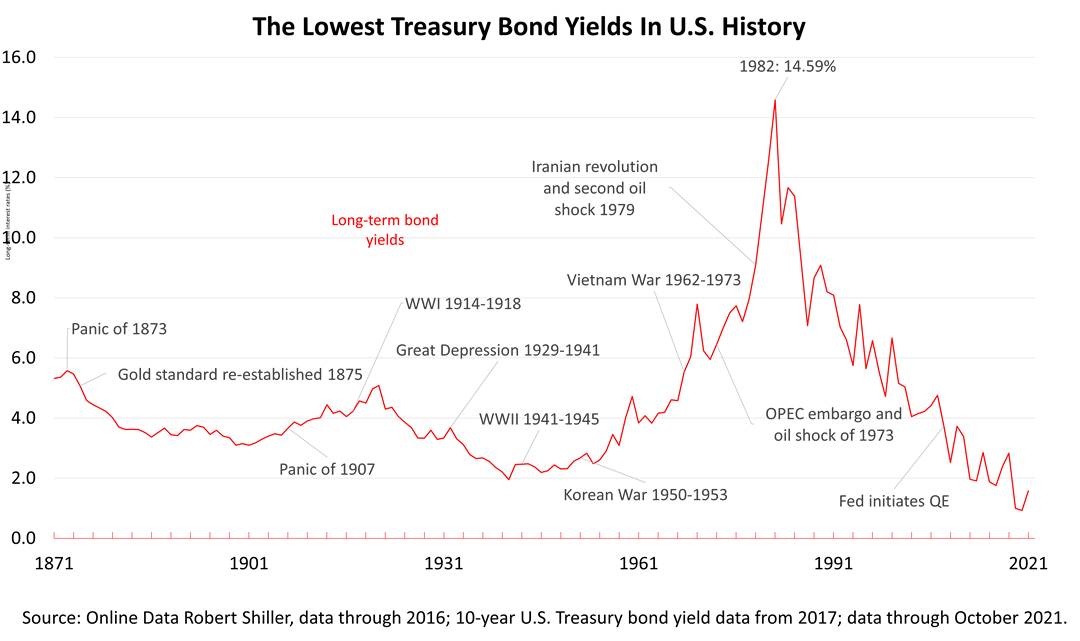

It’s crucial to view stocks in the context of bond yields. Bond yields are lower than ever before in over 200 years of American history.

A change in the way stocks have historically been valued has occurred because bonds are currently priced to provide negative real returns after inflation. It’s unprecedented.

Bonds yields are expected to stay low for the foreseeable future because of demographic and global economic trends. This makes stocks more attractive relative to bonds than in the past. It’s a change in the stock-bond valuation paradigm, and stocks could yet head much higher relative to the 7% trendline as a result.

Things really are different this time.