On this date two years ago, the NBA suspended its 2019-2020 season, Tom Hanks and his wife, Rita Wilson, announced they had tested positive for Covid 19, and the World Health Organization officially declared a pandemic had started.

Since then, nearly one million deaths from the virus have been reported in the United States. Worldwide, six million deaths have been reported. Since then, the Covid-19 health threat to Americans has been reduced. In the years ahead, the virus is expected to pose a threat about as bad as the winter flu.

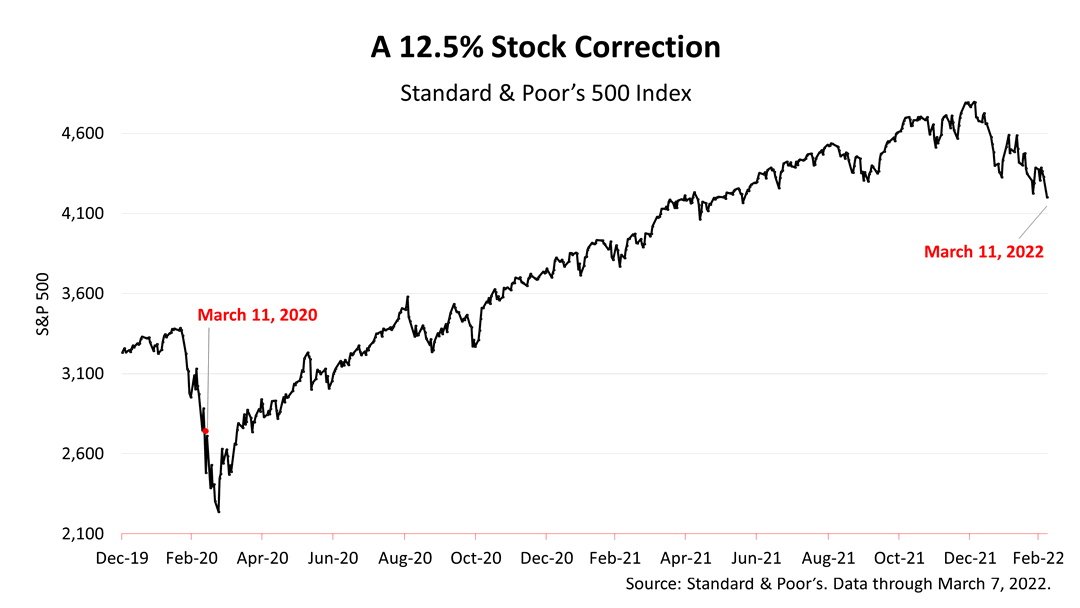

The human toll, the grief and suffering, caused by the pandemic are unimaginable. The effects of the pandemic in financial terms are an entirely different matter, however, as is shown in this chart.

The Standard & Poor’s 500 index, a benchmark of the largest 500 publicly traded U.S. companies, has appreciated by more than 60% since the Covid bear market low, although it has been in correction mode in recent weeks.

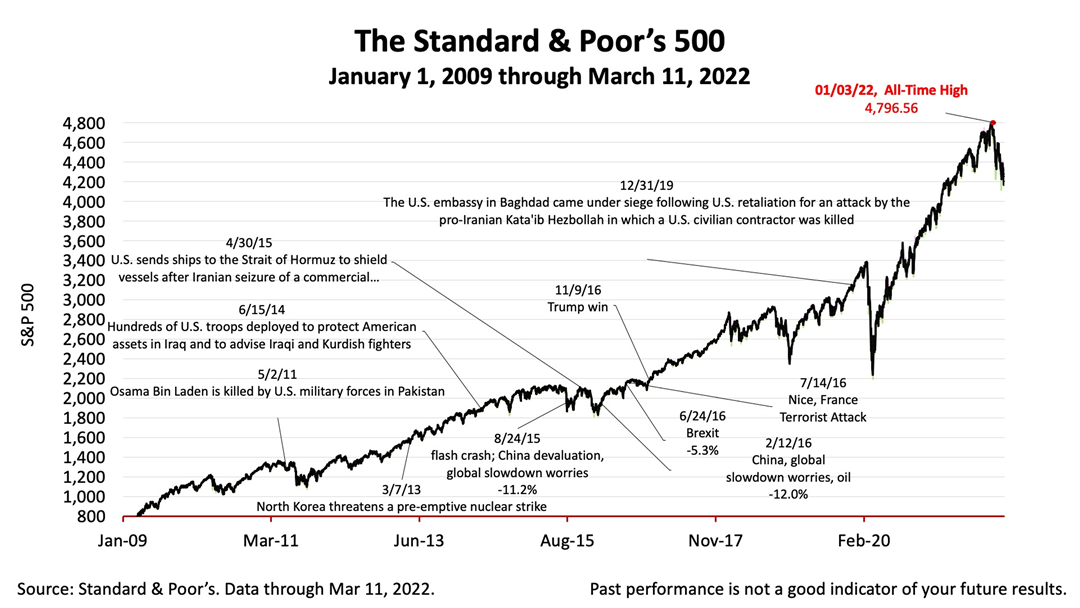

No one can predict the stock market but we do know that stock prices are driven by earnings growth, and earnings growth is driven by economic growth. The uncertainty posed by Russia and the worst bout of inflation in 40 years is expected to continue, but the economy is expected to grow by nearly 3% in 2022, and no recession is on the horizon.

Recessions trigger bear markets and that’s not what’s happening now, according to the latest fundamental economic data releases, including the:

- Index of U.S. Leading Economic Indicators

- yield curve

- Federal Reserve monetary policy statement

- record high retail sales

- record low consumer financial obligations ratio

- record high household net worth

- job growth

The Standard & Poor’s 500 stock index closed this Friday at 4,204.31. The index lost -1.30% from Thursday and -2.91% from last week. The index is up +61.07% from the March 23, 2020, bear market low.