The extreme financial effects of the COVID-19 pandemic seemed unprecedented to most investors. Over the past two years, Americans witnessed a sudden stop financial crisis in March 2020, the injection of nearly $10 trillion of monetary and fiscal stimulus within a matter of months, and an unanticipated burst of inflation that caught even the Federal Reserve off guard. The truth, however, is that these events seem anomalous only because many historical parallels have disappeared from our collective memory. In fact, there are no living Americans who recall the two most relevant events — the onset of World War I in July 1914 and the post-World War I/Great Influenza inflation of 1919-1920.

The extreme financial effects of the COVID-19 pandemic seemed unprecedented to most investors. Over the past two years, Americans witnessed a sudden stop financial crisis in March 2020, the injection of nearly $10 trillion of monetary and fiscal stimulus within a matter of months, and an unanticipated burst of inflation that caught even the Federal Reserve off guard. The truth, however, is that these events seem anomalous only because many historical parallels have disappeared from our collective memory. In fact, there are no living Americans who recall the two most relevant events — the onset of World War I in July 1914 and the post-World War I/Great Influenza inflation of 1919-1920.

Famed economist John Kenneth Galbraith once said, “for practical purposes, the financial memory should be assumed to last, at maximum 20 years.” But this principle applies only if you lack the will to self-educate on events that transpired beyond this boundary, or work with a properly schooled professional.

“Those who delve into the more distant past discover that what seems unprecedented in the moment has almost always occurred before — often multiple times,” says financial historian Mark Higgins, CFA, CFP®. “More so than prior financial crises, the COVID-19 pandemic revealed the importance of studying financial history.”

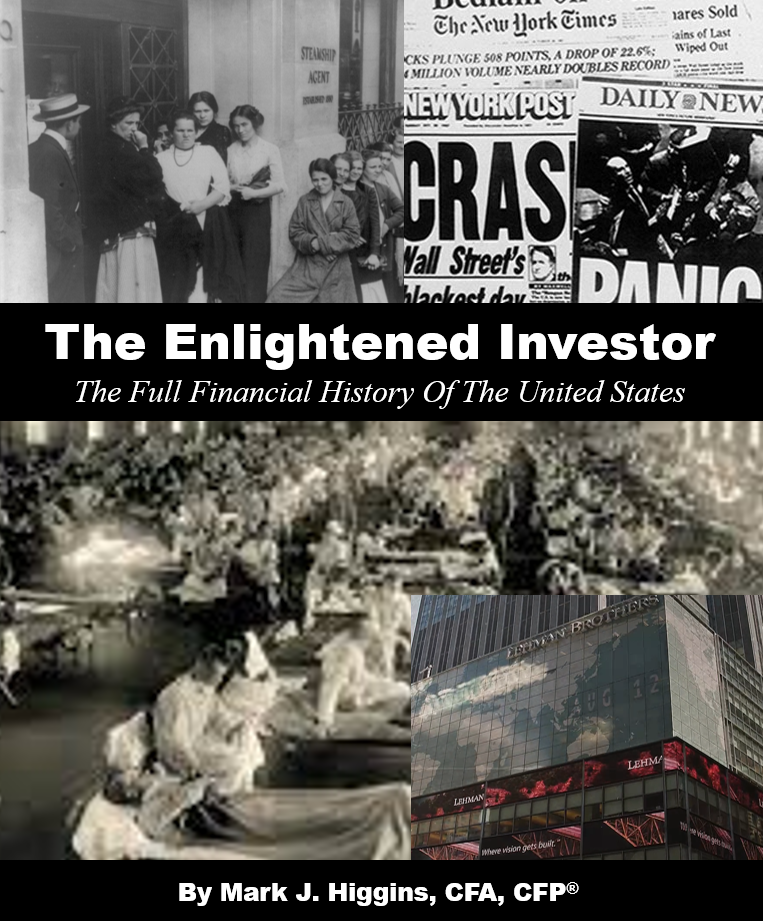

Students of the 1919–1920 inflation were unsurprised by the onset of Post-COVID-19 inflation, according to Mr. Higgins, whose forthcoming history of the U.S. financial system, “The Enlightened Investor,” (Greenleaf Book Group) is expected to arrive on Amazon in spring 2023.

“Investors who recall the policy mistakes of the Federal Reserve in the late 1960s understand why the Fed leadership today is unlikely to repeat these errors,” says Mr. Higgins. “This makes the Federal Reserve’s hawkish turn in 2022 an expected outcome rather than an aberration.”

Those who know about the speculative bubbles that have tormented U.S. markets for more than two centuries are justifiably skeptical of the unproven prospects of cryptocurrencies and NFTs. “Deep knowledge of the past enables envisioning the future with greater clarity,” Mr. Higgins, says a senior investment advisor to multi-billion-dollar institutional federally qualified pension and 401(k) plans. “Investors who immerse themselves in history will likely greet future financial events with recognition rather than surprise, enabling better outcomes.”

If you are interested in learning more about how the period from 1914 to 1921 parallels with current investment conditions and how knowledge of history affects our firm’s investment outlook, please let us know.