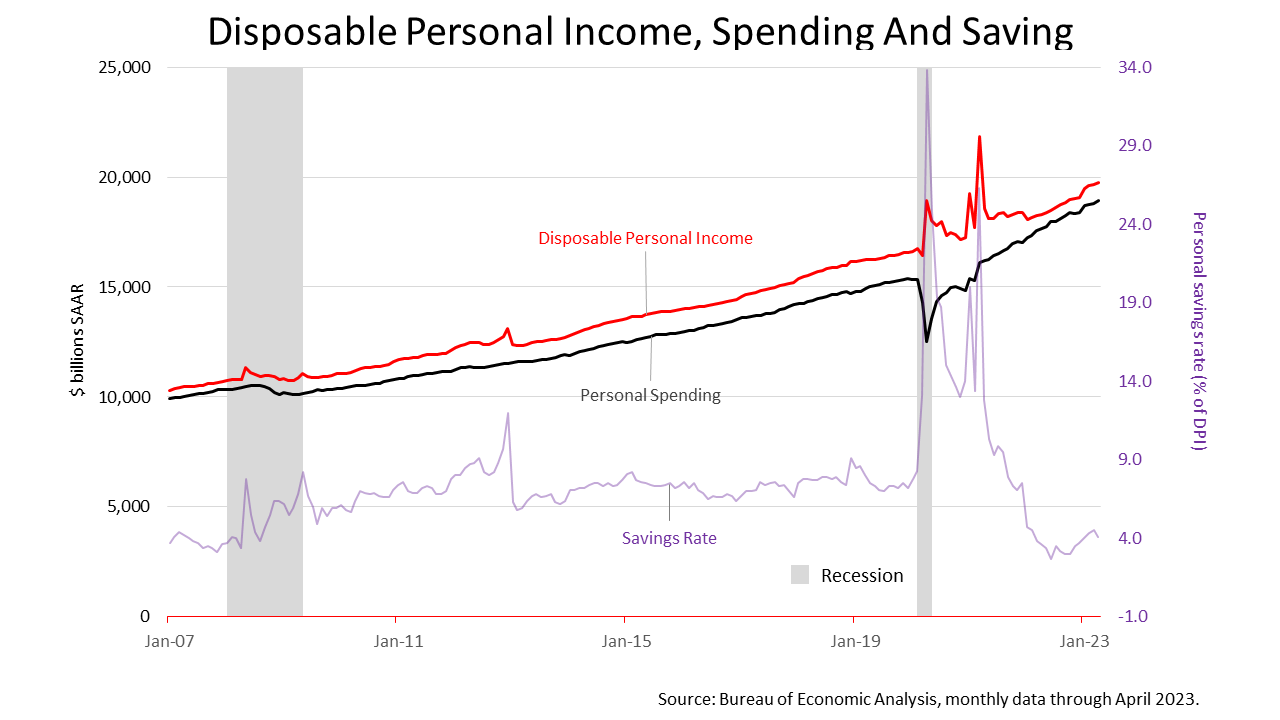

Personal consumption expenditures (PCE) sharply increased by 0.8% in April, while disposable income (DPI) rose 0.4%, as consumers continued to tap excess cash in savings accounts that were built up from government stimulus payments made in 2020 and 2021 following the pandemic.

The chart above shows the savings rate in April ticked down to 4.1%, less than the pre-pandemic rate. Meanwhile, in the 12 months through the end of April, DPI rose a sharp 7.9%, fueling a sharp rise in consumer spending of 7.3%. Even after inflation, Friday’s income and spending figures from the Bureau of Economic Analysis are strong and dispel concerns of recession.

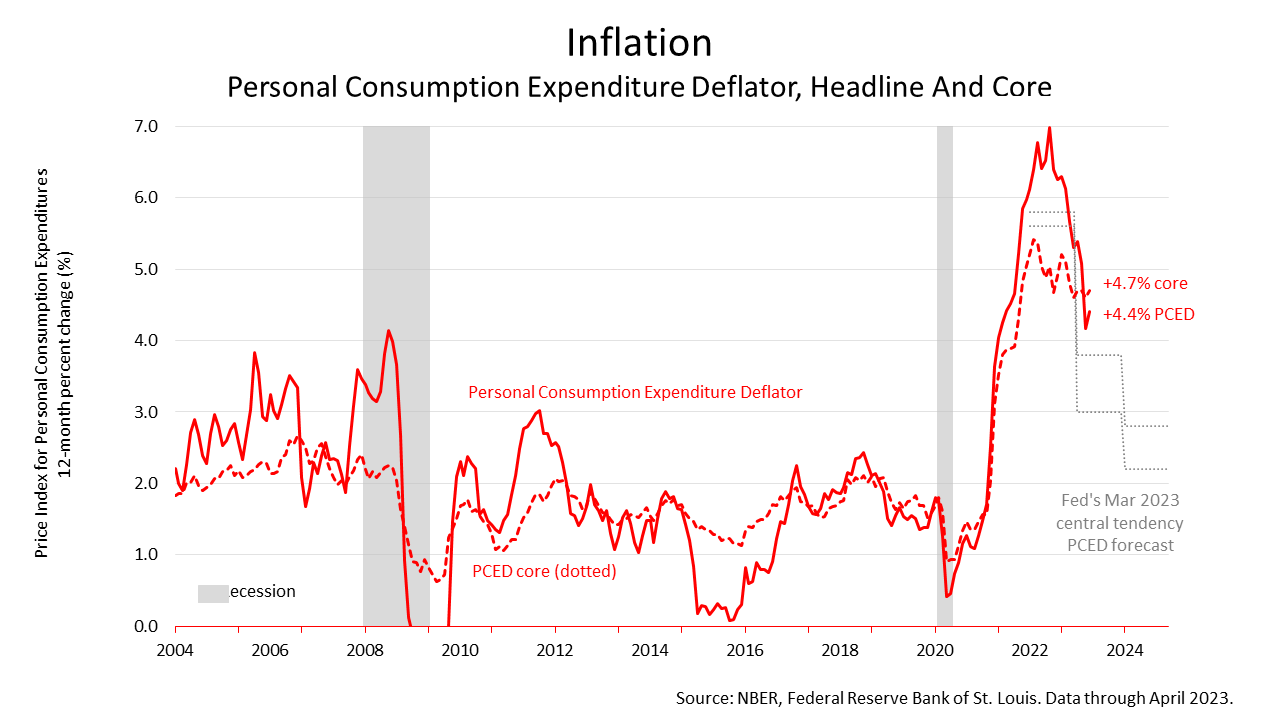

Inflation peaked as 2023 began after the worst period of inflation in four decades. The annual inflation rate peaked at 7% after pandemic stimulus payments by the federal government and a spike in gasoline prices was caused by American sanctions placed on Russia for invading Ukraine.

In March 2022, U.S. central bankers realized inflation psychology infiltrated consumer psychology and was not transitory, and the Federal Reserve began the most aggressive monetary tightening campaigns since enactment of the Federal Reserve Act of 1913. Since then, rates were raised 10 times.

Fed watchers expect a pause in rate hikes to wait and see signs of whether raising its lending rate by 1000% in the past 13 months was enough to eradicate inflation psychology from the American consumer’s mindset. That’s a matter of fine-tuning.

Great progress has been made on lowering inflation without causing a recession. However, the effects of rate hikes are delayed by several months and allowing strength in the economy to flourish while tightening the cost of a loan to buy a home, car or business, is hard. Mistakes in monetary policy caused every recession in post-War U.S, history expect for the Covid-19 recession.

So, it was good news Friday morning that the Personal Consumption Expenditure Deflator (PCED), the Fed’s benchmark of inflation, ticked upward in April.

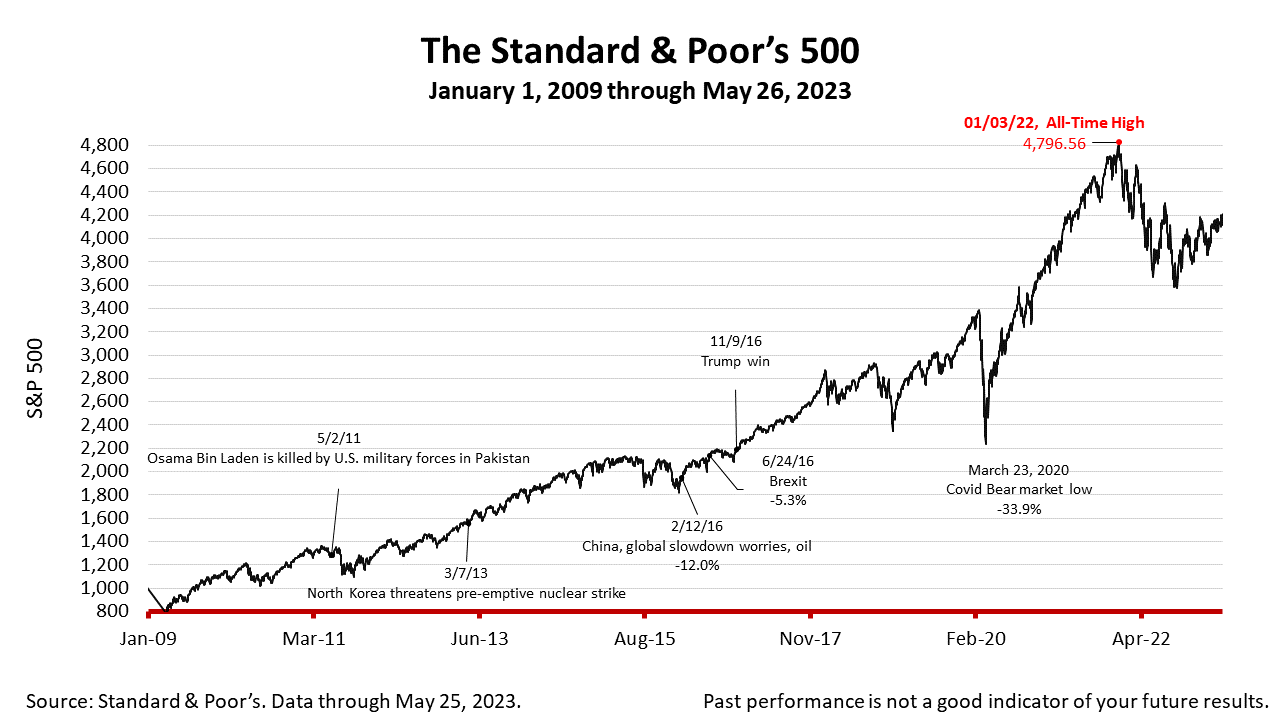

The Standard & Poor’s 500 stock index closed Friday at 4205.45, up +1.30% from Thursday, and up +0.32% from a week ago. The index is up +87.96 from the March 23, 2020, bear-market low and down -12.32 from its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.