The Conference Board Backs Off Its Recession Forecast

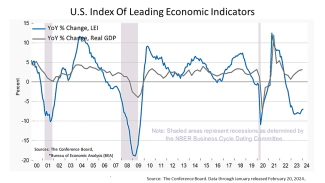

The Conference Board (TCB), the big business think tank that maintains the U.S. Index of Leading Economic Indicators (LEI), backed off its prediction for a recession in 2024.

The LEI has been a highly reliable forward-looking indicator of a recession for many decades. Two years ago, after the LEI collapsed, TCB’s economics team predicted a recession would begin within months. However, the downturn never materialized. Nonetheless, TCB continued to predict a recession was ahead — until this past week.

“While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its 10 components were positive contributors over the past six-month period (ending in January 2024),” according to Justyna Zabinska-La Monica, a TCB business cycle expert. “As a result, the leading index currently does not signal recession ahead. While no longer forecasting a recession in 2024, we do expect real GDP growth to slow to near zero percent over Q2 and Q3.”

Why did the LEI signal a recession incorrectly? Economist Fritz Meyer, a principal contributor to our weekly investment updates, says the LEI is too heavily influenced by manufacturing data, which accounts for only 11% of U.S. economic activity. A recession in manufacturing did occur in 2023 but the service sector, which accounts for 89% of U.S. economic activity, is much more influential. TCB’s LEI is comprised of 10 components listed below, but three of them are based on data from the manufacturing sector.

1.average weekly hours worked, manufacturing

2.average weekly initial unemployment claims

3.manufacturers’ new orders of consumer goods and materials

4.Institute of Supply Management index of new orders

5.manufacturers’ new orders of nondefense capital goods

6.building permits for new private housing units

7.stock prices measured by the Standard & Poor’s 500 index

8.Leading Credit Index

9.interest rate spread of 10-year Treasury Notes versus fed fund

10.index of consumer expectations

With the LEI in recent months no longer declining, Fritz Meyer, an independent economist, said TCB may be interpreting the LEI’s collapse differently because TCB’s forecast has been wrong for so long.

TCB’s forecast for a near zero growth in the second and third quarter of 2024 remains overly pessimistic, says Mr. Meyer, noting that the predictive algorithms designed by economists at the Federal Reserve Bank of Atlanta and New York, are forecasting a growth rate of nearly 3% in Q1 2024.

Economic strength drives corporate earnings and earnings drive stock prices. Thus, TCB’s reversal of its recession forecast is good news for investors.

The Standard & Poor’s 500 stock index closed Friday at 5088.80, a new record high. A rally in stocks has been underway, driven by better-than-expected sales and earnings reported by Nvidia, which makes semi-conductor chips used in computers running artificial intelligence (AI) applications. Growth of AI could unleash a spike in productivity in the U.S., the world leader in AI. The S&P 500, an indicator of the progress of the U.S. economy, rose +0.03% from Thursday and +1.66% from a week ago. The index is up +127.44% from the March 23, 2020 bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.