Federal Reserve Projects Strong Growth

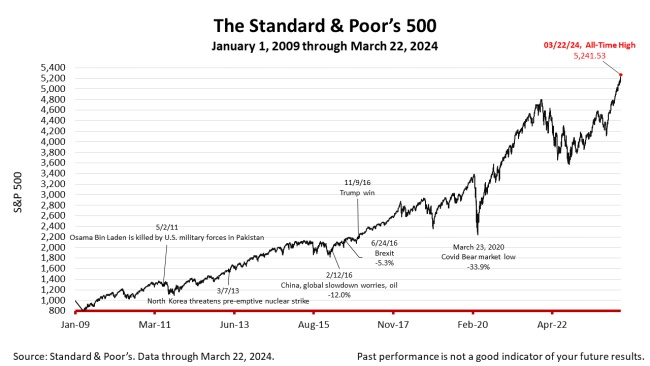

The Standard & Poor’s 500 index soared 2.3% last week and is on track to close the first quarter of 2024 with a gain of more than 10% — more than four times the average annual gain since 1926.

The S&P 500 has been rising sharply since mid-January and last week’s 2.3% gain followed the conclusion of a meeting of members of the Federal Open Market Committee (FOMC).

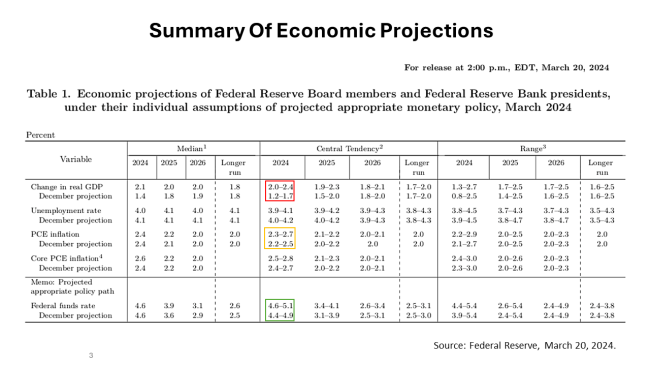

Released at 2 p.m. Wednesday, March 20, this table contains the latest projections of the seven-member Federal Reserve Board and the 12 Presidents of the Federal Reserve Bank’s district branches.

The table is released once a quarter and contains key data points for estimating economic growth, inflation, and the direction of interest rates.

The green box shows the Fed revised its expectations for lending rates. The Fed now expects the Fed funds rate — the rate at which it lends to the nation’s largest banks — will stay higher for longer than its last projection, made only three months earlier.

The Fed is projecting it will maintain higher rates for longer because the economy is growing at a stronger than expected pace. The red box shows the Fed three months ago expected the U.S. economy would grow between 1.2% and 1.7% in 2024. The new projection is for a Gross Domestic Product (GDP) of 2.0% to 2.4%.

To be clear, monetary policymakers in the past three months decided to postpone lowering lending rates because the economy is growing faster than expected. And not a little faster, but a lot faster than policymakers forecasted in December.

Importantly, the Fed does not expect the better-than-expected growth in 2024 to spark inflation. The orange box highlights that the Fed projects inflation will rise 2.3% to 2.7%. Three months ago, the Fed projected an inflation rate of 2.2% to 2.5%, but it raised its projection by just two-tenths of 1%, a mild revision compared to hiking estimated growth for 2024 by seven-tenths of 1% to 2.4%.

Although rates may stay higher for longer, lending rates for mortgages, consumer and business loans, are expected to decline in 2024. The current Fed funds rate is 5.25% to 5.5%, but in 2024 it is projected to decline to the 4.6% to 5.1% range. The green box shows policymakers expected the Fed funds rate to range from 4.6% to 5.1%, which is a half-point higher than the current Fed funds rate. The 50-basis point decline in rates in 2024 is expected to come in two 25 basis-point rate cuts.

The Standard & Poor’s 500 stock index closed Friday at 5234.18, down -0.14% from Thursday, and up +2.29% from a week ago. The index is up +133.94% from the March 23, 2020, bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.