The Great Fake Out Of 2023 Is Poised To Extend Into 2024

All year long, the economy and stock prices have fooled experts and consumers, outperforming expectations month after month.

In November, a surprise rally has powered a 9% gain in the Standard & Poor’s 500 stock index, defying expectations yet again. Now, the great fake out of 2023 is poised to extend into 2024. Here’s what’s happening:

Consumer sentiment collapsed during the pandemic. The University of Michigan Consumer Sentiment Index never fully recovered to its pre-pandemic norm of 95. Sentiment rebounded in 2021 but collapsed again in 2022 and has settled not much above a record low lately. In addition, 80% of likely voters in six swing states say the economy is fair or poor, according to a November 22, 2023 New York Times/Sienna College poll, and only 2% say it’s excellent. Sentiment is bleak.

Which makes no sense for two reasons important reasons:

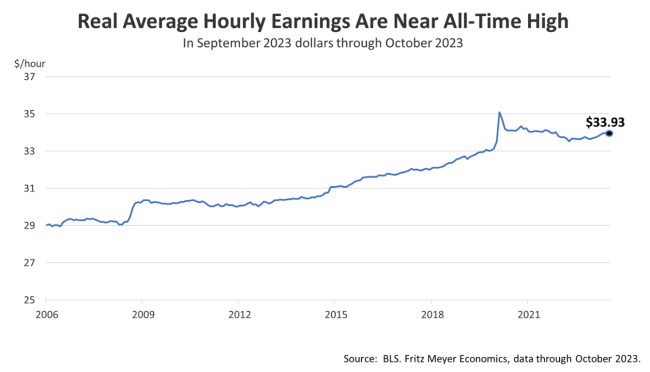

- Real wages are near an all-time high. While consumer sentiment is far lower than its historical norm, average hourly earnings adjusted for inflation are not far from an all-time high. To be clear, after adjusting for inflation U.S. workers are earning $33.93 an hour, which is not far from an all-time high.

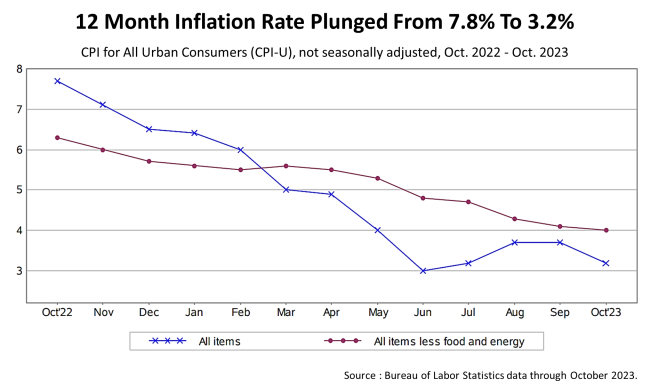

- The inflation rate plunged from 7.8% to 3.2% in the 12 months ended October 2023. The Consumer Price Index, an inflation benchmark, sank. Inflation is under control.

In addition to inflation coming under control, the economy is expected to grow by 2.2% in the fourth quarter of 2023, according to Federal Reserve Bank algorithms designed by district branches in Atlanta and New York. That’s much higher than is expected by economists and contradicts extremely negative consumer sentiment.

The effect of the money illusion on the mass financial psyche of Americans is poised to persist in early 2024. Consumers and investors are unlikely to wake up tomorrow and realize they’re making a mental mistake by focusing on nominal prices, shrouding their outlook based on an inflation crisis that has passed.

The bottom line: The economy and stock market are well poised to continue to defy expectations.