Investment News For The Week Ended Friday, January 26

The financial fake-out of 2023 extended into 2024 and is poised to continue pleasantly surprising investors.

In a week filled with better-than-expected news, Bureau of Economic Analysis inflation data released Friday added weight to evidence that the Federal Reserve’s 12 interest rate hikes between March 2022 and July 2023 quashed a post-pandemic inflation crisis without choking growth and triggering a recession. Defying the Fed’s record for making bad monetary policy decisions and causing every recession in modern U.S. history — except for the short-lived but severe downturn after the Covid-19 outbreak in March 2020, the outlook remains bright.

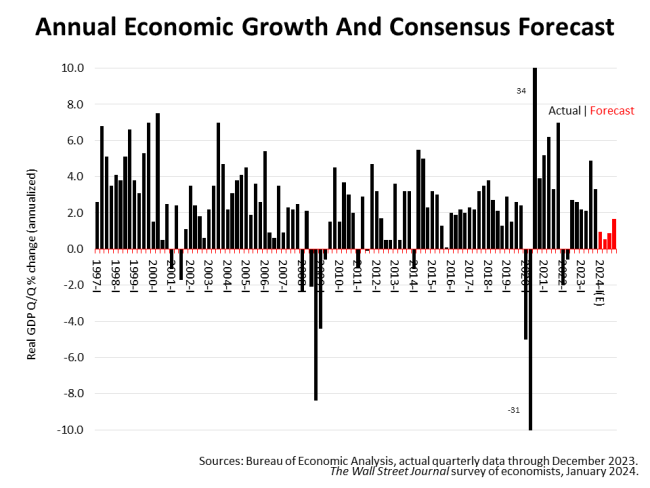

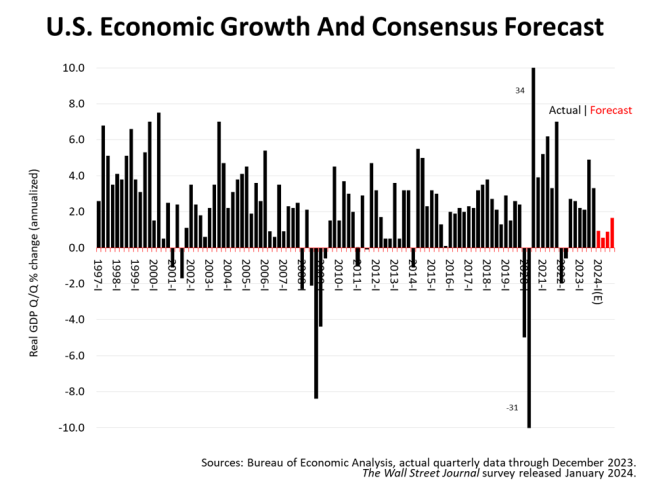

The economy grew in the fourth quarter of 2023 at a 3.3% annualized rate. That’s double the 1.65% consensus estimate of 60 leading economists surveyed by The Wall Street Journal in early January.

In addition to showing no signs of recession, recent data now make a “soft landing” seem pessimistic. No landing is on the horizon for 2024.

The 60 economists surveyed in January see a slowdown ahead, but no recession.

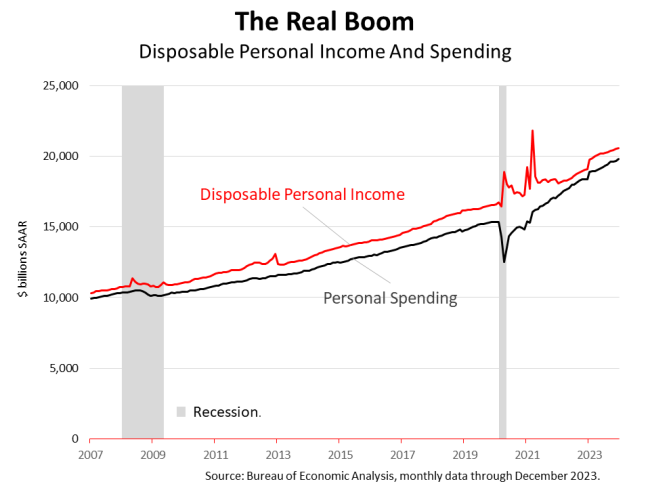

Disposable personal income (DPI) soared 7.9% in the 12 months ended December 2023. With an inflation rate of less than 3%, consumer purchasing power increased by nearly 5%, according to Friday morning’s data release. Gross domestic product data is subject to revisions at the end of February and March, but America’s consumer-oriented economy is growing at an unexpectedly high rate after adjusting for inflation.

Meanwhile, the Federal Reserve of Atlanta’s real-time algorithmic-driven growth forecast predicts a U.S. growth rate of 3%, much higher than the forecast for .94% GDP in the first quarter of the year predicted by economists in the early-January survey by The Journal.

On Friday, Standard & Poor’s 500 stock index set a new all-time record-high closing price before closing fractionally lower, at 4890.97 on Friday, down -0.07% from Thursday, and up + 1.06% from a week ago. The index is up +118.60% from the March 23, 2020 bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.