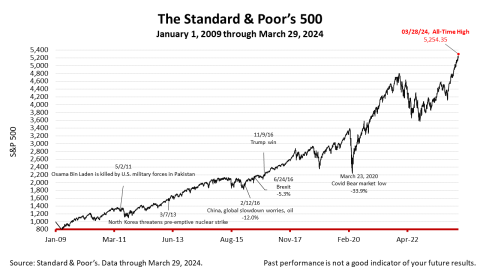

Stocks Closed At A Record High

The Standard & Poor’s 500 stock index closed Friday at a new all–time high, ending the first quarter of the year with a gain of 10%. That’s as much as large-company stocks averaged annually since 1926.

Amid widespread skepticism about the future, the U.S. financial economy is poised to continue to surprise retirement investors as well as Wall Street analysts.

The strong performance in the stock market, a measure of progress of the world’s leading democracy and largest economy, comes as investors expect the Federal Reserve to cut interest rates at the end of the second quarter and raise them once more late this year.

Optimism is also fueled by the growing use of artificial intelligence, which is expected to boost productivity.

The Standard & Poor’s 500 closed at 5254.35, up +0.11% from Thursday and +0.39% from a week ago. The index is up +134.84% from the March 23, 2020 Covid bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.