This Week’s Investment News In Six Charts

It was a big week for federal government data. Here are six charts encapsulating the latest news on economic fundamentals driving investment prices.

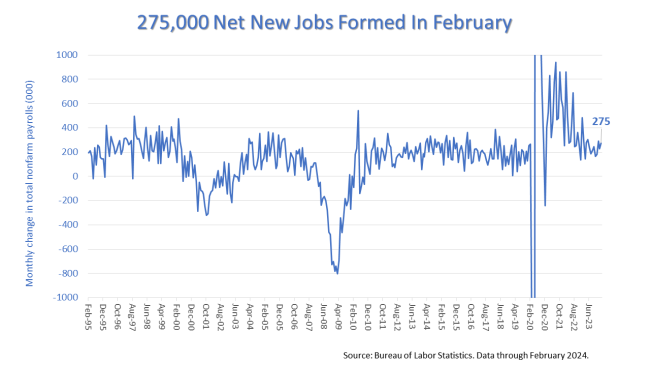

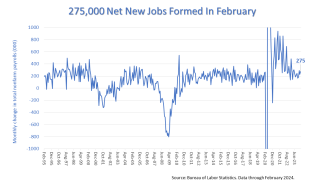

The U.S. economy grew by 275,000 new jobs in February, according to Friday’s report on the monthly job situation from the federal government. That’s more than the approximately 200,000 new jobs averaged during previous economic expansions. It also beat Wall Street analysts expectations.

Currently, the big worry for investors is that the Federal Reserve, which regulates loan rates, will maintain relatively high lending rates. So, in a way, the stronger than expected job creation is not such great news. However, creating 275,000 more new jobs than were lost in February, is comforting.

For every new job created, a new employee is added to the U.S. economy — read that as a new salaried consumer who will probably spend about 95% of their wages, thus growing the national prosperity.

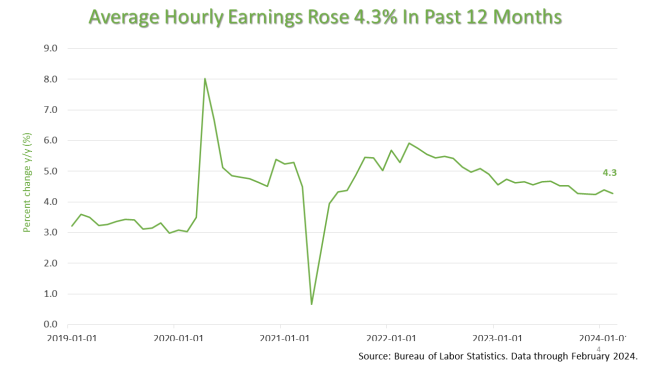

While job creation was surprisingly strong, average hourly wages declined again last month. The average hourly wage was 4.3% higher than a year ago, in the 12 months ended February 29, 2024. With the annual inflation rate at less than 3% currently, real wages after inflation are growing. That’s very good news. To be clear, American workers gained buying power in 2023.

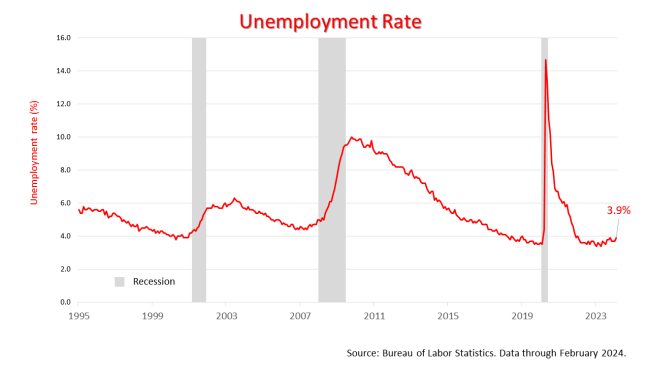

The unemployment rate ticked a tenth of 1% higher, to 3.9%, in February, but it is still near a 50-year low.

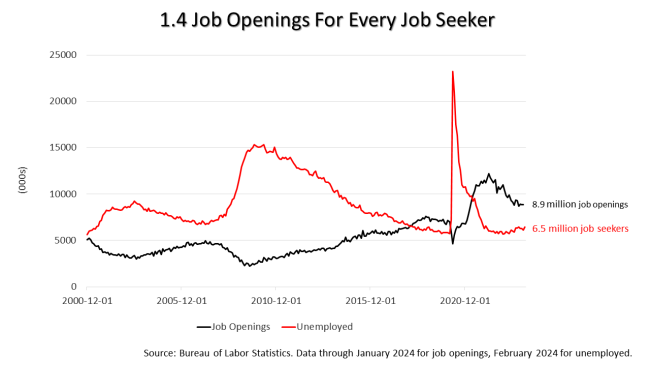

On Wednesday, the federal Job Openings and Labor Turnover Survey (JOLTS) report on job openings, hires, and separations showed 1.4 job openings are waiting to be filled for every unemployed job seeker. This is an unusual condition. Since the pandemic, the job market has been turned upside down, and job seekers have been outnumbered by job openings. That’s not normal, but the pandemic upended normalcy by reducing the number of workers in the economy.

As long the two data points in this chart are inverted, the U.S. will continue to see strong job formation, which leads to more consumers and more spending.

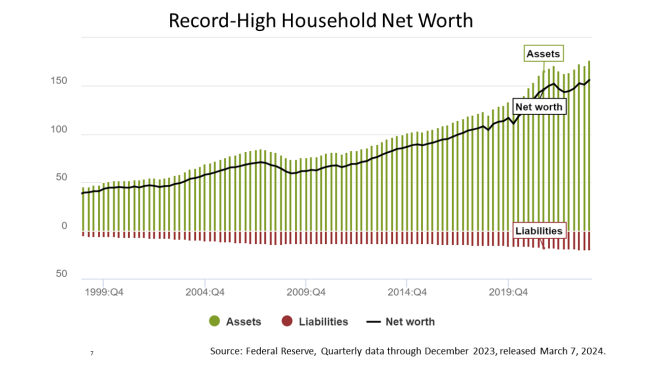

Finally, this chart shows that the average American household’s net worth soared to a record high in 2023. It was driven by gains in the stock market. Stronger household balance sheets inspires increased spending. The “wealth effect” makes people feel they can buy more stuff, and that grows the economy. This is a virtuous cycle, when stock share prices rise and that makes people feel wealthier and inspires them to spend more.. It’s could indicate a bubble is growing if it continues for a long period.

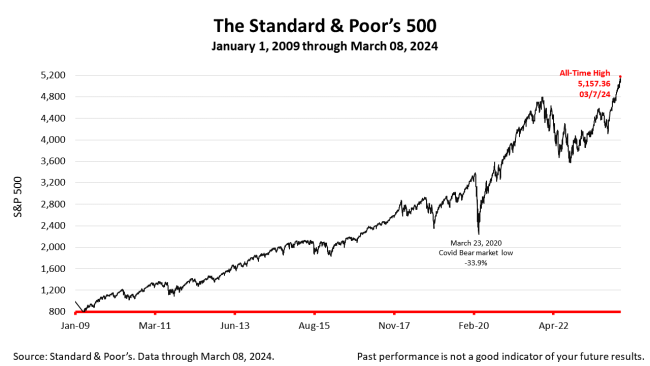

The Standard & Poor’s 500 stock index closed at a new all time high on Thursday, March 7, 2024, before closing lower by 0.65% on Friday at 5123.69. The stock index declined -0.26% from a week ago. The index is up +129.00% from the March 23, 2020, bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.