Asset Liability Immunization Strategy (ALIS) Insights 1st Quarter 2024 Outlook

Executive Summary:

- In the 4th Quarter of 2023, the markets faced renewed international conflicts, domestic political issues, and growing federal debt, which by the end of the quarter, was offset by strong economic data, including a surprising drop in the unemployment rate which led market expectations to price in six rate cuts over the coming year, in contrast to the Fed’s guidance of three cuts.

- Capital markets responded positively in the final quarter of 2023 due to increased anticipation of Fed rate cuts.

- Looking ahead to 2024, real yields are expected to remain high due to declining inflation and a restrictive Fed policy, including Quantitative Tightening and maintaining high Fed Funds Rates. The path for rates in the new year may involve a late second-quarter rate cut and increased expectations of recession later in the year.

State of the Markets

The renewed conflict in the Middle East combined with domestic political challenges and growing federal debt weighed on the markets at the start of Q4 2023. Despite this, domestic economic releases were strong over the quarter, and unemployment unexpectedly ticked lower to a rate of 3.7%. Signs of moderating inflation along with a robust labor market made the probability of an economic soft-landing a near certainty. As a result, the market has priced in roughly six rate cuts, totaling 150 basis points over the coming year, while the Fed’s own guidance suggests only three rate cuts in 2024, starting as soon as this March.

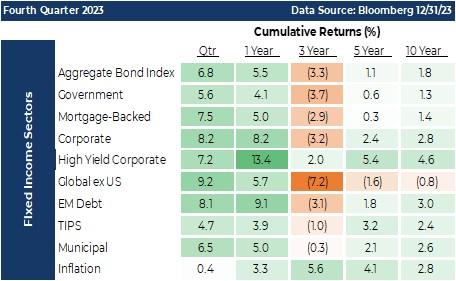

Increased anticipation for Fed rate cuts resulted in very strong returns for most markets in November and December as yields declined and fears of recession diminished. The bond market sentiment, which started the quarter very negative, ended the year on a positive note. Through the end of the fourth quarter, taxable bond indexes experienced appreciation for the year of between 4.1% and 13.4%, and 10-Year Treasury yields started the fourth quarter at 4.57% and ended at 3.88%. Risk sectors of the bond market outperformed more conservative sectors over the quarter and year.

The equity markets responded to the same anticipation for Fed rate cuts that the bond market evidenced by producing strongly positive quarterly returns over all major sectors except energy. The S&P 500, as an example, rose nearly 12% in the quarter achieving a YTD return of more than 26% with the strongest sector performance belonging to the Real Estate and Information Technology sectors. This was a deviation from the annualized sector returns where Communication Services and Consumer Discretionary sectors outperformed the Real Estate sector by several factors. We suspect the anticipated soft-landing and signs of moderating inflation helped to spur the outlook for the Real Estate sector. Over the period, growth stocks continued to outpace value stocks and sustain the trend that has been in place for some time as the technology sector continues to assert its secular influence over the equity markets. International developed stocks and international emerging market stocks followed the same path, booking positive gains over the quarter and annual timeframes.

Pension Market Update

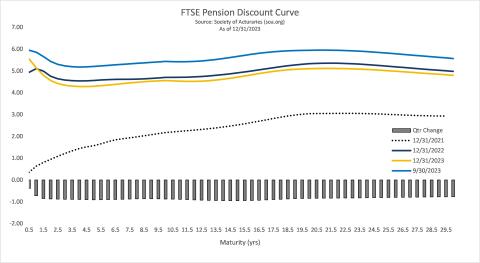

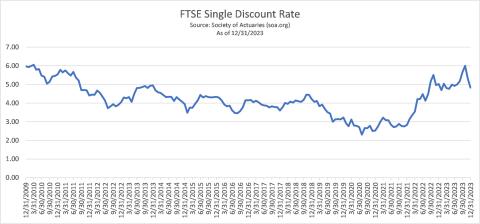

Interest rate movements over calendar year 2023 declined on average by -0.18% across the entire yield curve which is significant when we consider the impact on the increase valuation of liabilities. For example, our average pension plan has an effective duration of 12.6 yrs. and so in simplistic terms the decline in rates over the year increased our average plan’s liability value by 2.3%. A more dramatic effect was evident when we considered that most of that rate movement occurred in the 4th quarter when the market began to anticipate future rate cuts. The average rate movement along the curve in the fourth quarter measured -0.86% and increased our average plan’s liability values by 10.8%. This is of particular interest when we hear advisors and plan sponsors consider the attributes of de-risking. Often in the decision to reallocate, the allure of potential positive returns from risk assets outweighs the impact of falling rates, but the 4th quarter provided some valuable insights. Pension indices produced mixed results in the final quarter as several key factors drove the outcome of either improving or declining funding ratios. Those factors included the assumed allocation to risk markets, the level of funding, and the distribution of interest rate sensitivity in both the fixed assets and the liabilities. Nevertheless, positive returns by risk assets do not always provide improved funding results and the 4th quarter of 2023 was no exception as most pension tracking indices showed improvement but many did not.

In contrast, cash balance pension plans continued to evidence positive performance in 2023 as most major assets classes provided returns above that of the typical Interest Crediting Rate (ICR). We continue to advocate for plans to embrace individual short-intermediate bonds as their purchased yields can provide positive returns, especially when held to maturity.

As seen by the enclosed graphs, discount rates uniformly experienced declines in 2023. This is in stark contrast to the movement experienced since the middle of the Covid crisis where discount rates were trending upward while at the same time reducing the value of liabilities and modestly pushing up funding levels. As we have noted in the economic outlook section of this document, our forecast is for further rate declines resulting in a more normally sloped yield curve. With that forecast in mind, we continue to believe that now is the time for de-risking action to be taken.

The most notable pension news over the quarter was that IBM is launching a hybrid (cash balance) defined benefit pension plan for its workforce which will substitute the firm's 401(k) contributions with a tax-deferred benefit amounting to 5% of eligible salary, with no contribution required from the employee. The rationale for the change may have resulted from a large stranded surplus in the previously closed legacy defined benefit plan which was rumored to be around $3.6bn. That surplus has restricted uses although it can be utilized to fund another type of defined benefit such as a newly formed cash balance plan. By creating the new plan, IBM can now access the pension surplus to replace its prior 401(K) match and reduce its employee benefit costs. IBM was among the initial major companies to transition to a defined contribution retirement plan over 15 years ago, and the move back to a defined benefit retirement plan is occurring concurrently with an understanding that current risk management strategies have lessened the potential risks posed by defined benefit plans to corporate financial statements. This is a reversal of a multi-decade trend of terminating defined benefit plans which may indicate a tipping point in the industry towards hybrid pension plans.

Economic Outlook

In 2024, real yields are expected to remain high due to declining inflation and a restrictive Fed policy involving Quantitative Tightening and maintaining the Fed Funds Rate at multi-decade highs. Fed officials are cautious because cutting rates during a similar period of negative real Fed Funds Rates in 1976 led to inflation and a severe recession. Real yields currently hover around 2%, below the historical average of 3%. Recent banking system challenges have led the Fed to use rate policy for altering financial conditions and its balance sheet to support financial stability. As the Fed normalizes its balance sheet through QT, it will put upward pressure on nominal rates as cashflows and maturities from the Fed's portfolio are not reinvested, suggesting a longer-term trend toward higher rates, both real and nominal.

In prior quarters we have mentioned that we thought the market was going to be incorrect about the timing and amount of Fed cuts in 2024, we also think the market is looking at the reason for Fed action from a vantage point that suffers from availability bias, where recent events heavily influence a near-term outlook. Although the service side of the economy has grown over time, it is interesting to note the psyche and health of the consumer is often thought of as near the bottom of the Fed’s triggers while global growth, business health, and orderly credit environments are the most frequent reasons for Fed action.

Previous Fed actions have been influenced by global tensions, tighter bank lending standards, low spreads on lower quality corporate debt, reduced individual savings, and increasing debt levels relative to the economy's size. The strength of the employment environment has historically determined whether a soft landing or mild recession would occur, but technology has altered the relationship between job openings and unemployment. The services sector is unexpectedly nearing contraction, which may lead to a negative feedback loop of economic pessimism translating into dampened business expectations, leading to job market deterioration, starting in the first quarter, and potentially escalating later in the year.

"A recession could trigger broader credit contraction..."

The economy faces many potential challenges related to liquidity, credit access, and corporate bond spreads as the Fed continues QT. A recession could trigger broader credit contraction, affecting access to capital and the cost of issuing debt in the corporate bond market. Despite a restrictive Fed and softening economic conditions, a normalization of the yield curve's shape and future U.S. deficits, rising debt, underfunded entitlement programs, and increased debt financing costs may exert long-term upward pressure on interest rates.

Many reliable recession indicators are flashing red, with manufacturing slowing and the service sector nearing neutrality. A loss of support from the service economy could lead to negative consumer sentiment and a downward job market spiral. Persistent sources of inflation remain, and the Fed faces challenges in controlling inflation's final stages. In a presidential election year, the Fed must balance easing with inflation control without appearing to influence the election. The likely path for rates includes a late second-quarter rate cut, driven by job market conditions, weakening growth, and real rates. Late in 2024, an increased expectation of a recession may lead to rates falling further, possibly resulting in a more typical upward-sloping yield curve, especially in the short part of the curve where rates will drop more than long-term Treasuries. If the election results in a divided government, we could envision a prolonged recession followed by a slower progression to addressing fiscal challenges. In this context, historical precedents may guide presidential candidates' choices between stimulus and austerity.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.