Asset Liability Immunization Strategy (ALIS) Insights 1st Quarter 2023 Outlook

Executive Summary:

- Pension discount rates moved higher in 2022, improving funding ratios for a second consecutive year, making a hedging strategy such as ALIS even more attractive.

- Capital markets have exhibited a positive fourth quarter improving the year’s overall return values albeit they still performed negatively for most asset classes on a year-to-date basis.

- The FOMC will continue to increase rates over the next couple of meetings causing the consumer to feel more of the economic pain in an effort to force inflation out of the economy.

State of the Markets

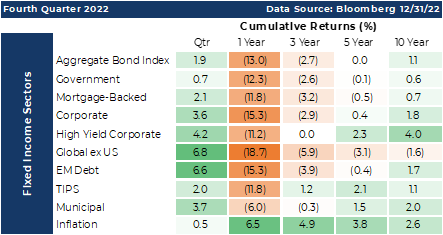

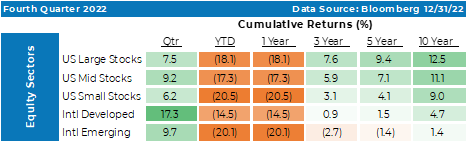

The capital markets provided a year of extreme volatility in 2022, with losses being generated in both risk assets and income producing assets. A rare occurrence indeed. It was the worst year for fixed-income investors in roughly the past 40 years. Investment grade corporate securities fell 15%, more than that of high-yield bonds which marked their year-end performance at minus 11%. At the same time, the S&P 500 fell 18% while the technology-centric NASDAQ declined over 32%. International equities performed slightly better than domestic stocks with International developed stocks producing a negative 14.5% and emerging market stocks a negative 20.1%.

Inflation appears to have peaked, so the market is content to see the Fed take the fed funds rate to nearly 5% later this year through one or possibly two more 25 bps hikes. The drop in inflation expectations across many different measures has resulted in lower yields on longer maturity fixed-income securities. A good example of one of those metrics is the Consumer Price Index which peaked at 9.1% and in the month of January was reported at 6.5%. Economic data remains generally positive; however, some of the employment statistics are beginning to soften, namely nonfarm payrolls and wages.

Reality forced the Fed to tighten last year, and it may force them to ease as soon as the second half of this year. The yield on the 2-year maturity Treasury has declined 60 basis points in the past few months. Despite that fact, the Fed is likely to raise short-term rates a bit further, while longer-term yields have already begun to fall. Our internal analysis suggests in the second half of a Fed tightening cycle, high-quality and longer duration often outperforms other fixed-income areas. We maintain with strong conviction that the Fed is well over halfway through this tightening cycle.

We continue to remain committed to last quarter’s outlook with an overweight to call protection, longer maturities versus shorter maturities, and higher credit quality over lower credit quality because credit spreads are roughly average right now which in the face of an economic slowdown, it would seem the directional bias is toward spread widening in the next year. Liquidity is another bond characteristic to keep in mind. In the corporate bond market, securities that have $1.0B or more per issue, trade much more frequently than smaller issues and often provide narrower bid-asked spreads than smaller issues.

Over the fourth quarter of 2022, many sectors produced positive returns. If we take a closer look at fixed income, we see that sectors which contained more credit risk outperformed those which contained less, breaking a trend that had been present in prior quarters. International securities, as a result of the US Dollar weakness, offered a stronger relative performance to domestic bonds during the quarter.

Equity returns followed suit with the bond market over the last quarter producing positive returns, a continuation of their correlation trend that has persisted over the calendar year. US Dollar weakness was additive to the returns of international equities over the final quarter. On an annual basis the dollar strengthened, causing additional weakness to international assets for a domestic buyer. Long-term returns remained positive for the domestic sector and the international developed sector although emerging markets remained weak.

"This law aims to improve retirement security for American workers and make it easier for small businesses to offer retirement plans to their employees."

Pension Plan Regulatory Update

Late in the fourth quarter, Congress passed the SECURE 2.0 Act which builds on the original SECURE Act that was passed into law in 2019. This law aims to improve retirement security for American workers and make it easier for small businesses to offer retirement plans to their employees. It includes provisions that increase access to retirement savings plans, offers lifetime income options, and extends the age at which individuals must start taking required minimum distributions (RMDs) from their retirement accounts. Its impact on pension plans occurs in a couple of significant provisions. The first is the clarification of the projected interest crediting rate for cash balance plans that use a variable interest crediting rate, providing those plans do not exceed 6% as a reasonable rate of return. This is significant because it limits backloading of benefit accruals to provide larger pay credits for older and longer service workers. The second major effect for pensions is in the termination of variable rate PBGC premium indexing, which has been increasing in recent years. This provision locks the premium at a flat $52 for each $1,000 of unfunded vested benefit. Another aspect of the Act is the enhancement of retiree health benefits in plans that are overfunded where a sponsor can use excess assets to pay retiree health and life insurance benefits. The sunset date for this feature is 2032 with a transfer of no more than 1.75 percent of the plan assets for those plans that are at least 110% funded. Finally, when a plan sponsor offers a single lump sum payment option in leu of lifetime benefits, it must extend a minimum election period of 90 days’ notice and include an explanation of the value of the lifetime benefits. Other important provisions also affect pensions such as the annual funding notice requirement where additional information will now be needed concerning asset and liability statements for the preceding two years, a statement regarding the number of retirees, separated and active participants over the past two years and the average return on assets for the plan year.

Pension Market Update

Defined benefit pensions have seen a dramatic improvement in their funding levels because of the rapid rise in rates over the past year. The improvement is primarily derived from the outsized decrease in liability values, particularly for those plans that were poorly funded as the liability’s denominator effect outweighed that of the numerator, asset valuation. Over 2022, the average large pension plan experienced a double-digit gain in the funding ratio. Consequently, many plans are now in a position to focus on locking in their recent achievements through the diligent use of a strategy that focuses their distinct liability structure, especially when plan sponsors consider the uncertainty from the possibility of slowing economic growth as we move through 2023.

Cash balance plans on average, felt the brunt of the capital markets in 2022 as there was not an asset class that provided a safe harbor, that is unless you held short-dated income producing securities bought with a focus on purchased yield. Traditionally, cash balance assets have been placed in pooled vehicles with a split of 60% equities and 40% fixed income. For simplicity, if we use the S&P 500 as the equity proxy and the Bloomberg Aggregate Bond Index as the fixed income proxy, then the 60/40 portfolio would have produced in 2022, a negative 16.1% return. If we contrast the bond portion of the portfolio between one that held a 1-year Treasury security at the beginning of 2022, holding to maturity until year end, to one that bought the Bloomberg Aggregate Bond Index we see a range in performance of 13.48%. Rates of 1-year Treasuries on 12/31/2021 yielded 0.38%, compared to the index return of a negative 13.1%. With a 60/40 portfolio the difference in weighted return would have measured 5.4% between using the bond index vs 1-year Treasury although we would suggest that a more appropriate allocation for a cash balance plan would entail a 30/70 or perhaps a 20/80 which in both cases would exacerbate the difference in performance in holding a pooled bond allocation vs individual bonds. The current market environment more fully intensifies this situation as 1-year Treasuries are now trading around 4.7% at time of writing. Customization, rather than simplicity for the masses helps to overcome a portion of the inherent interest rate volatility as the bonds eventually amortize to par when holding them individually.

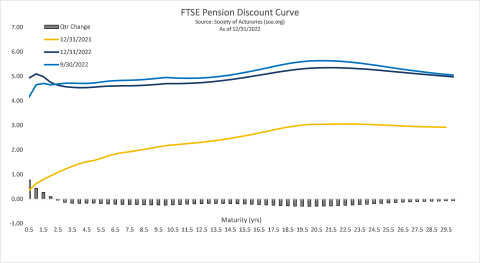

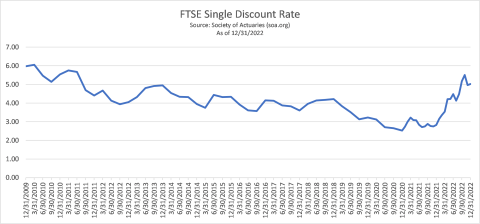

Pension discount rates rose dramatically throughout the year in response to the Fed’s rate actions. Inside of two years, rates moved on average 4.26% higher. While the longer maturities increased by 2.05%. Over the fourth quarter, only short maturities continued to move higher as the remainder of the discount curve reverted downward. It’s prudent to keep in mind the components of a discount rate curve with the first being treasury rates and the second being credit spreads or the compensation that investors receive for the willingness to accept default risk.

Treasury rates, with the exception of the short end, were remarkably stable over the final 3 months of the year although credit spreads tightened. The net effect was the short end was moving upward in response to the Fed Funds Rate while the remainder of the discount curve was changing mainly as a result of credit spread movements. What is clearly evident is that 2022 was yet another year where the rising discount rates contributed largely to the improvement in defined benefit pension plan funding levels. As evidence of this improvement is the annual activity in what is considered to be the final step of de-risking a pension plan, a pension risk transfer transaction. It’s where a plan sponsor engages a specialist to solicit an insurance company to assume or purchase the liabilities and then provide the future required cash flows. 2022 is projected to set a record in the value of transactions which at this point is expected to reach $55B with the next highest year for transactions measured as 2021 at $38B. Another method of understanding discount rate movements it to examine what is called the FTSE single discount rate. It is essentially the entire maturity curve of rates summarized into a single average rate. Over the final quarter it decreased 5bps, resulting in a modest upward progress of values. It started the year at 2.52 and ended at 2.83 which translates into a decrease in liability values for the entirety of 2022.

Economic Outlook

We can be sure of one thing in 2023, the Fed is determined to get the inflation rate much lower than where it is currently. Their main weapon for accomplishing this task is by raising short term interest rates to the point of possibly causing a recession. If history is a guide, we will be in a recession by the time the Fed figures out it raised rates too much. There is a small chance inflation comes down to a level that appeases the Fed without resulting in a recession although we expect a mild slowdown based on the fact there are not many areas of the economy showing significant excesses like we saw prior to the Great Recession.

Some prominent bond fund managers seem to think the Fed needs to start listening to the bond market. Specifically, longer-term bond yields have fallen from their high levels experienced in late-October and the yield curve has inverted (a situation where short-term yields are higher than the yields on longer-term bonds). Curve inversions often precede recessions, but they can give false signals. In recent history, an inversion of the 3-Month Treasury Bill and the 10-Year Treasury Note has been a good “tell” that a recession is imminent. It may be that bond managers will need to hear the Fed. They have often cited that the problem in the 1970’s and early 1980’s was that the Fed at the time became accommodative too soon, and inflation expectations became “baked” into economic expectations, requiring additional tightening to induce an inflation-breaking recession. Our interpretation of the recent Fed Chairman’s comments is that they are mission-focused to wring inflation out of the economy.

"Markets expect the Fed will be in a position to cut rates by the end of the year."

Markets expect the Fed will be in a position to cut rates by the end of the year. According to the CME FedWatch Tool, two-thirds of traders expect that the Fed Funds Rate will be at or below the current rate range (4.25% to 4.50%). That is greatly conflicting the Fed’s outlook where no contributors to the Fed’s Dot Plot forecast to indicate any cuts to rates in 2023. Job growth metrics are strong, and the Current Seasonally Adjusted Unemployment Rate for December was 3.5%. Against the generally accepted definition of full employment being a 5% unemployment rate, there is room for the Fed to tighten further and allow the lagged impact of past tightening actions to be more fully felt in the economy, before easing should be at the tip of the tongue of the market. As Chairman Powell recently stated, speed is less important than the destination. That may suggest that a policy pause, and subsequent minor policy adjustments are the expected path.

The consumer holds our near-term destiny in their hands as the U.S. economy is a consumer-driven and the reaction to the weight of Fed-induced higher borrowing costs will manifest themselves in changing demand patterns. Big ticket items that are often financed have seen a dramatic swing in consumption. The formerly “white hot” used car market has seen a dramatic change. According to the Manheim Used Vehicle Value Index, 2022 saw a decrease in used car values of 14.9%, the largest drop in the 26-year history of the index. Last quarter we touched on the rapid change in the housing market. In December, homebuilder sentiment fell to the lowest level in more than a decade. The result of the past increase in single-family home prices, along with rapidly increasing financing costs has greatly impacted home affordability. If residential real estate values fell 10% to 15%, there would be a risk of a lot of underwater homeowners who are stuck in their homes. Subprime auto loan defaults are up 36% year-over-year through October and as mentioned earlier auto collateral has experienced a dramatic drop in value. It is the substitutions, trade downs, and cessation of purchases, for the small stuff that will telegraph that the Fed is making progress in their fight against inflation. According to the New York Fed, through the third quarter of 2022, due to increased credit card balances and mortgage balances, households increased debt at the fastest pace in 15 years. If real wage growth flatlines, or becomes negative on a real basis, it would appear the consumer will be a critical part of the Fed’s plan.

Banks are generally well-capitalized, so we don’t anticipate meaningful bank failures in the next recession, if their appetite to lend is cut off, it can contribute meaningfully to a credit crunch. Given the debt binge that consumers and world governments have been on since the Great Recession, and all the way through the pandemic experience, if credit freezes, large problems may arise. Since 2007, the G7 nations have seen their public debt as a percent of GDP move from 81% to 128% in 2022. Bailouts may be coming back into vogue, because discipline and responsibility seems to be out of fashion.

"The people that were helped by the stimulus may have been harmed more than any other group."

During the recent inflationary episode, many workers saw wage gains that looked positive, but that were negative on an inflation-adjusted basis. We expect that is the primary motivator for the Fed. The people that were helped by the stimulus may have been harmed more than any other group. Of note, the Fed’s assumptions change due to disappointing productivity gains and slow improvement in labor force participation. The next revolution in productivity may come from the customers themselves, paying at the individual level for sources of utility that are specific to them, along with capital investments in automation and applications for artificial intelligence. Short rates will rise farther, and longer-term bond yields have farther to fall as an economic slowdown, and all the new uncertainties that go with that, become the reality.

The Fed must deflate the recent inflationary episode. They have recently sharpened their messaging to say what they have to do may be unpopular and that their focus is once again on their dual mandate of full employment and price stability. Chairman Powell has said the speed of this journey is not a goal he expects, and speed may actually produce a result that is counter to their real goal, but the destination (full employment and average inflation of 2%) is the prize. That journey means millions of unfilled jobs will vanish, millions of people may lose their current job, and GDP will probably shrink in the near future. We expect the Fed will use the word “pause” in their post-meeting statements this year (and they may throw in a “data dependent” for good measure). So now we wait and see.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.