The Best People Were Wrong

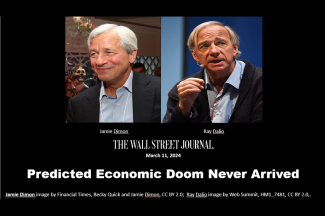

Jamie Dimon, CEO of JP Morgan Chase, the largest U.S. bank, warned that a “hurricane” was about to hit the U.S. economy in June 2022, and Ray Dalio, founder of the world’s largest hedge fund, predicted a “debt crisis” and a ”perfect storm” of economic pain.

Veteran financial reporter Gregory Zuckerman in The Wall Street Journal on March 11, pointed out that the smartest guys in the room can’t predict the future. Bond king Jeffrey Gundlach predicted last March that a recession would come “in a few months, and famed economist David Rosenberg has predicted a recession would begin for the past two years.

To readers of our weekly financial updates, this is not news. We’ve said repeatedly that no one can reliably predict the economy, much less stock prices. Wise investors plan to stay invested in a diversified portfolio through economic cycles.

If the best people cannot predict the future, can you? A buy-and-hold strategy only sounds simple. It’s not. It requires discounting gurus' predictions and the same behavioral discipline to stay fit and slim, not drink too much, and believe in the strength of the United States economy — despite great turmoil.

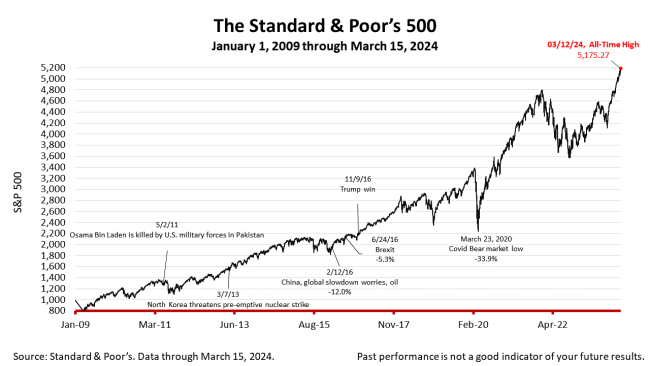

The Standard & Poor’s 500 stock index closed Friday at 5117.09, down -0.65% from Thursday and -0.13% lower than a week earlier. The stock index is up +128.71% from the March 23, 2020 bear market low and 6.68% higher than its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.